Narratives are currently in beta

Key Takeaways

- Strategic focus on ASCENIV is projected to significantly improve margins and drive substantial revenue growth via a $1 billion opportunity.

- Efficiency enhancements through AI, donor programs, and regulatory approval aim to boost earnings and production capabilities significantly.

- Reliance on consistent plasma supply and regulatory approval uncertainties pose potential risks to revenue growth, earnings projections, and strategic partnership expansion.

Catalysts

About ADMA Biologics- A biopharmaceutical company, engages in developing, manufacturing, and marketing specialty plasma-derived biologics for the treatment of immune deficiencies and infectious diseases in the United States and internationally.

- ADMA Biologics anticipates significant margin expansion driven by a revenue shift towards ASCENIV, which is seen as a potential $1 billion revenue opportunity. This is expected to enhance net margins as ASCENIV's contribution increases.

- The company is implementing plasma donor retention programs and partnering with third-party plasma collectors to improve plasma supply for ASCENIV, supporting sustained revenue growth and increased earnings.

- ADMA's yield enhancement production project is expected to receive regulatory approval in 2025, opening the path for substantial increases in revenue and earnings through more efficient production processes.

- ADMAlytics, the company's AI and machine learning platform, is optimizing production efficiency and commercial planning, which is projected to improve net earnings by reducing costs and increasing output.

- The potential pediatric label expansion for ASCENIV, expected by the first half of 2026, could further boost revenue by expanding the product's market and utilization.

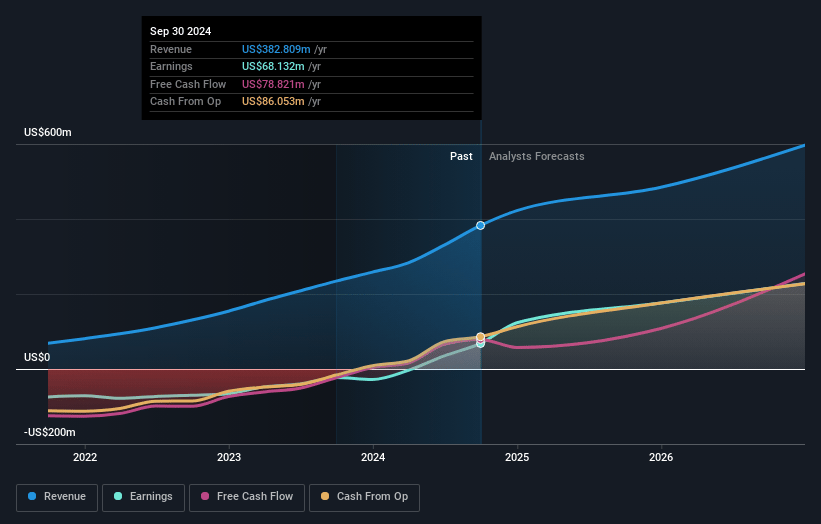

ADMA Biologics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ADMA Biologics's revenue will grow by 21.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.8% today to 39.1% in 3 years time.

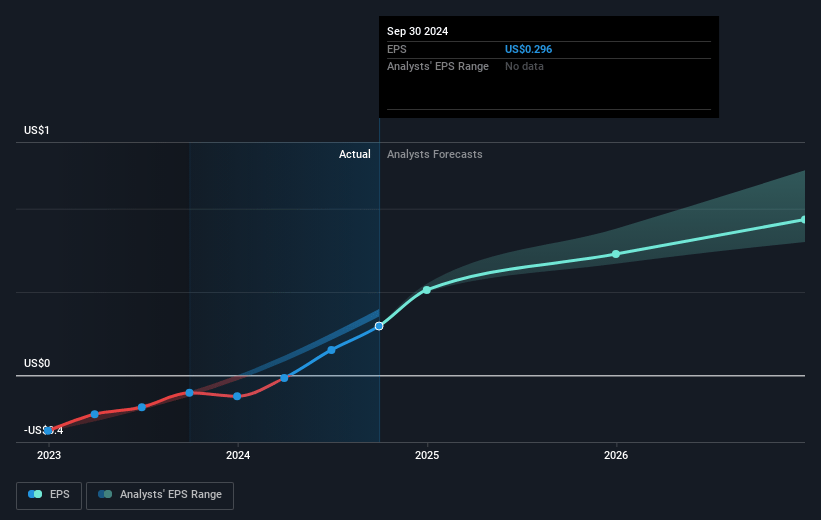

- Analysts expect earnings to reach $271.3 million (and earnings per share of $1.1) by about November 2027, up from $68.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $301.4 million in earnings, and the most bearish expecting $187.4 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.4x on those 2027 earnings, down from 71.6x today. This future PE is greater than the current PE for the US Biotechs industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 1.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.15%, as per the Simply Wall St company report.

ADMA Biologics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company’s substantial reliance on high-titer plasma collections presents a challenge, as the ability to maintain and increase the supply of plasma is a critical factor for revenue growth and ASCENIV production, which impacts both revenue and profit margins.

- There is potential uncertainty regarding the timing and success of regulatory approvals and commercial sales beginning in the latter half of 2025, particularly related to the yield enhancement initiative, which could affect earnings growth projections.

- The execution risk associated with the transition to a new independent audit firm, KPMG, could impose unforeseen financial or operational challenges during audits, potentially impacting financial statement accuracy and investor confidence, which may affect earnings reporting.

- External economic and regulatory environment changes, such as administration shifts and FDA staffing, could potentially influence operations or market dynamics in the plasma pharmaceuticals sector, posing a risk to revenue and profitability continuity.

- Any failure in the expansion and execution of strategic partnerships with third-party plasma collectors could restrict supply chain improvements, directly impacting production capabilities and revenue from ASCENIV.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $23.45 for ADMA Biologics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $17.23.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $693.6 million, earnings will come to $271.3 million, and it would be trading on a PE ratio of 25.4x, assuming you use a discount rate of 6.2%.

- Given the current share price of $20.63, the analyst's price target of $23.45 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$20.93

FV

1.2% overvalued intrinsic discount26.00%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

4users have followed this narrative

4 days ago author updated this narrative