Narratives are currently in beta

Key Takeaways

- Strategic customer relationships and platform enhancements are expected to drive top line growth, attracting high-profile brands.

- International expansion and subscription focus should enhance operational efficiency, positively affecting revenue and net margins.

- Dependence on partner ecosystem and FX-neutral growth, amid macro-economic risks and competition, threatens VTEX's profitability and revenue stability.

Catalysts

About VTEX- Provides software-as-a-service digital commerce platform for enterprise brands and retailers.

- VTEX's product innovation, expanded platform capabilities, and strategic customer relationships are likely to drive top line growth and profitability as they continue to attract high-profile brands and retailers. This is expected to impact revenue positively.

- The successful rollouts and partnerships with significant retail brands, including Fast Shop in Brazil and international expansions of big customers like Colgate and Samsung, suggest strong sales momentum. This should enhance revenue and earnings.

- VTEX's expansion in the U.S. and Europe markets, coupled with the consistent addition of new customers, positions it well for international revenue growth, which should positively influence overall revenue and net margins.

- The ongoing focus on subscription revenue growth and reduction of direct service roles indicate improvements in operational efficiency, contributing to higher net margins and better cash flow management.

- Enhancements in platform offerings, including the VTEX Ad Network and post-purchase capabilities from strategic acquisitions like Weni, are expected to boost customer engagement and overall revenue, creating long-term growth potential.

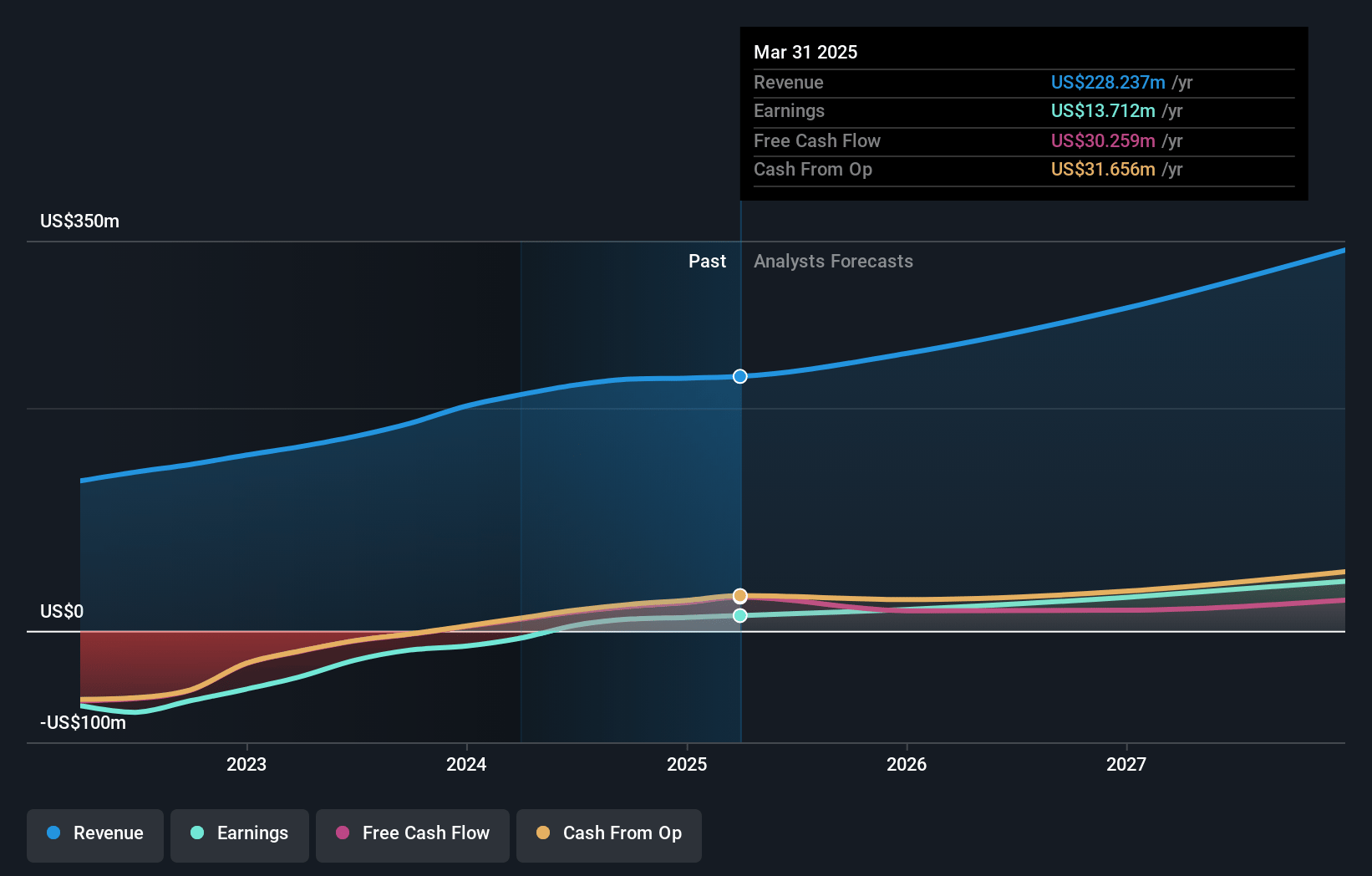

VTEX Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming VTEX's revenue will grow by 13.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.0% today to 20.7% in 3 years time.

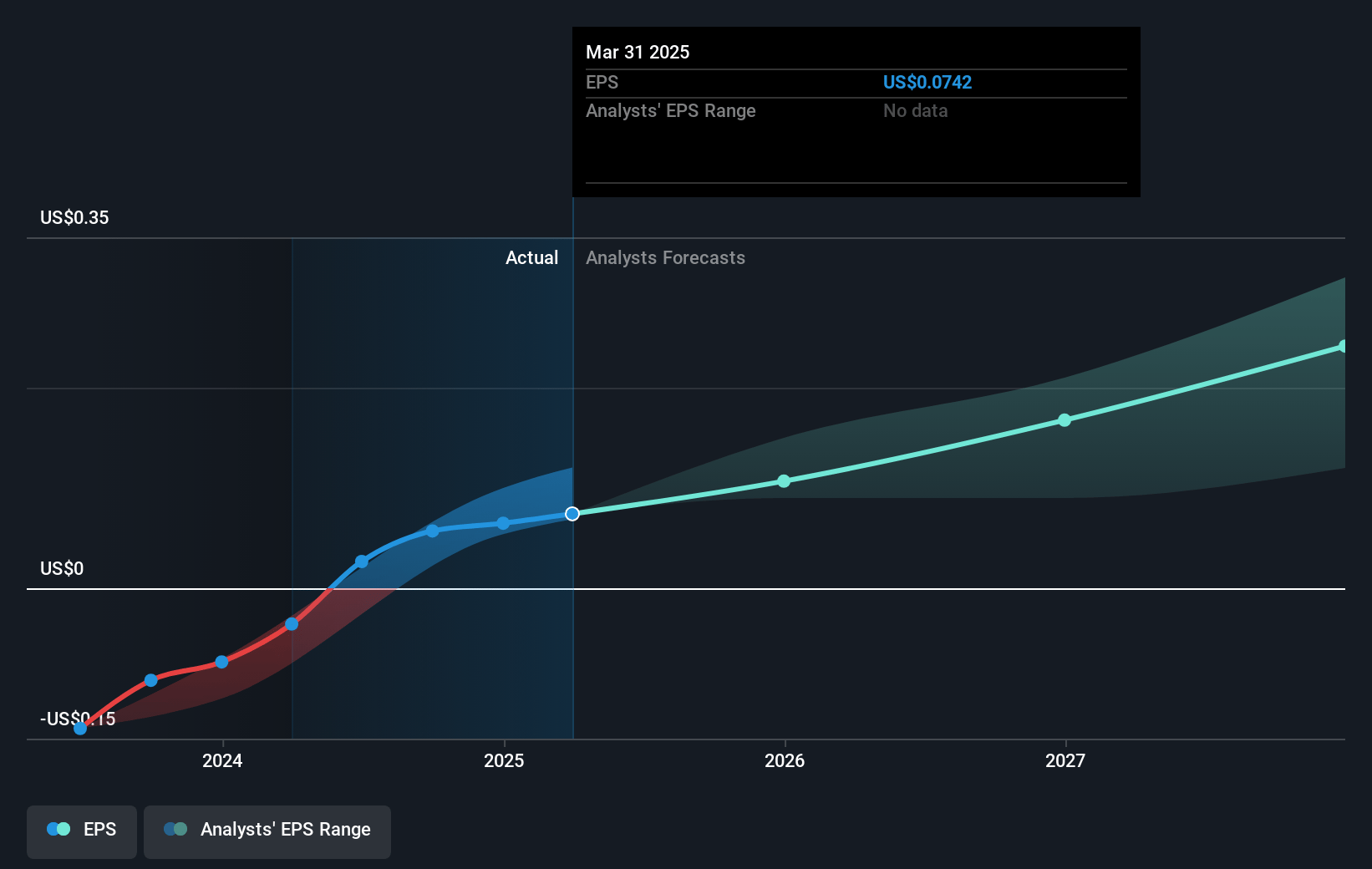

- Analysts expect earnings to reach $68.1 million (and earnings per share of $0.3) by about January 2028, up from $9.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.6x on those 2028 earnings, down from 138.8x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 24.7x.

- Analysts expect the number of shares outstanding to grow by 6.85% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.62%, as per the Simply Wall St company report.

VTEX Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Macro-economic uncertainties are mentioned, suggesting that any prolonged global or regional economic instability could impact revenue growth and profitability margins.

- The aggressive market competition, which was discussed, might pressure VTEX's ability to maintain its subscription revenue and gross margins over time.

- The FX-neutral growth figures reveal a dependency on currency fluctuations that could impact net earnings, particularly considering the economic situation in Argentina, which has been mentioned as a headwind affecting revenue.

- Although VTEX has expanded its ecosystem, a reduction in direct services, often sold at a loss, could impact revenue growth, complicating the financial conversations in a more competitive environment.

- There is a reliance on the maturity and effectiveness of the partner ecosystem to drive growth and revenue, which poses a risk if partners fail to meet expectations or market conditions change.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.39 for VTEX based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $6.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $328.7 million, earnings will come to $68.1 million, and it would be trading on a PE ratio of 38.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of $6.73, the analyst's price target of $9.39 is 28.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives