Narratives are currently in beta

Key Takeaways

- Shopee's user engagement growth and monetization efforts are expected to increase future revenue and profitability through improved ad take rates and partnerships.

- SeaMoney's and Garena's strategies are likely to boost revenue and net margins through credit product expansion and leveraging local trends, respectively.

- Competitive pressures and regulatory challenges, alongside reliance on key products, could strain Sea's growth, revenue, and profitability across e-commerce, financial, and entertainment sectors.

Catalysts

About Sea- Engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally.

- Shopee is seeing strong growth in user engagement and monetization, with average monthly active buyers up over 20% and ad take rate improvements, which is expected to boost future revenue and profitability.

- SeaMoney's expansion into off-Shopee loans, particularly for large ticket purchases, and increasing use of credit products across broader markets is likely to drive further growth in revenue and net margins for the digital financial services segment.

- The collaboration between Shopee and YouTube allowing for direct purchases is expected to enhance user engagement and sales, positively impacting revenue growth.

- Garena's strategy to leverage local trends and events for Free Fire, and new game launches like Need for Speed Mobile, aims to sustain user engagement and bookings growth, potentially increasing earnings from the digital entertainment segment.

- Expanded logistics capabilities and improvements in SPX Express delivery times and cost efficiency could further enhance Shopee’s profitability by reducing cost per order and improving service quality.

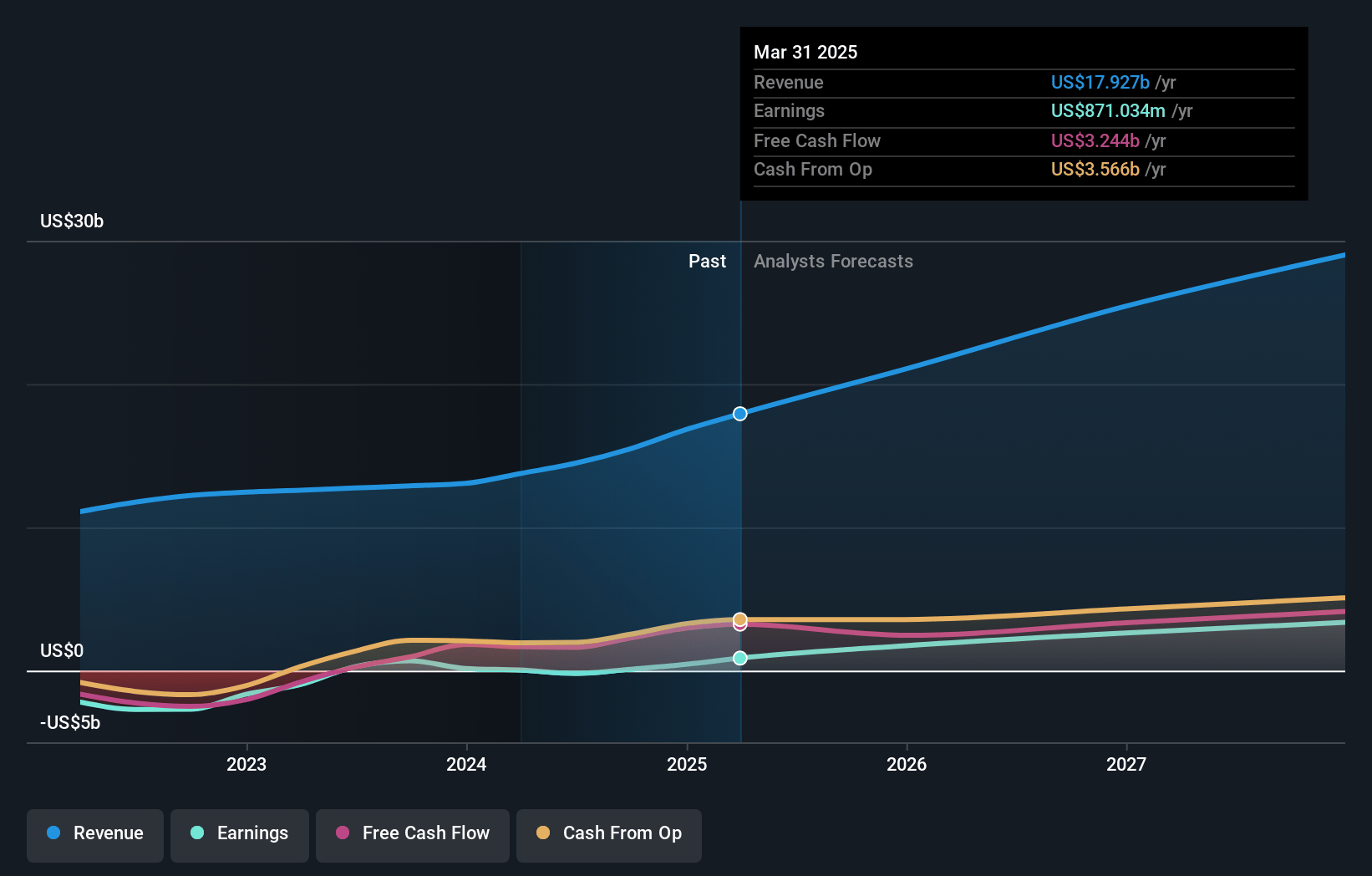

Sea Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sea's revenue will grow by 16.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.4% today to 8.9% in 3 years time.

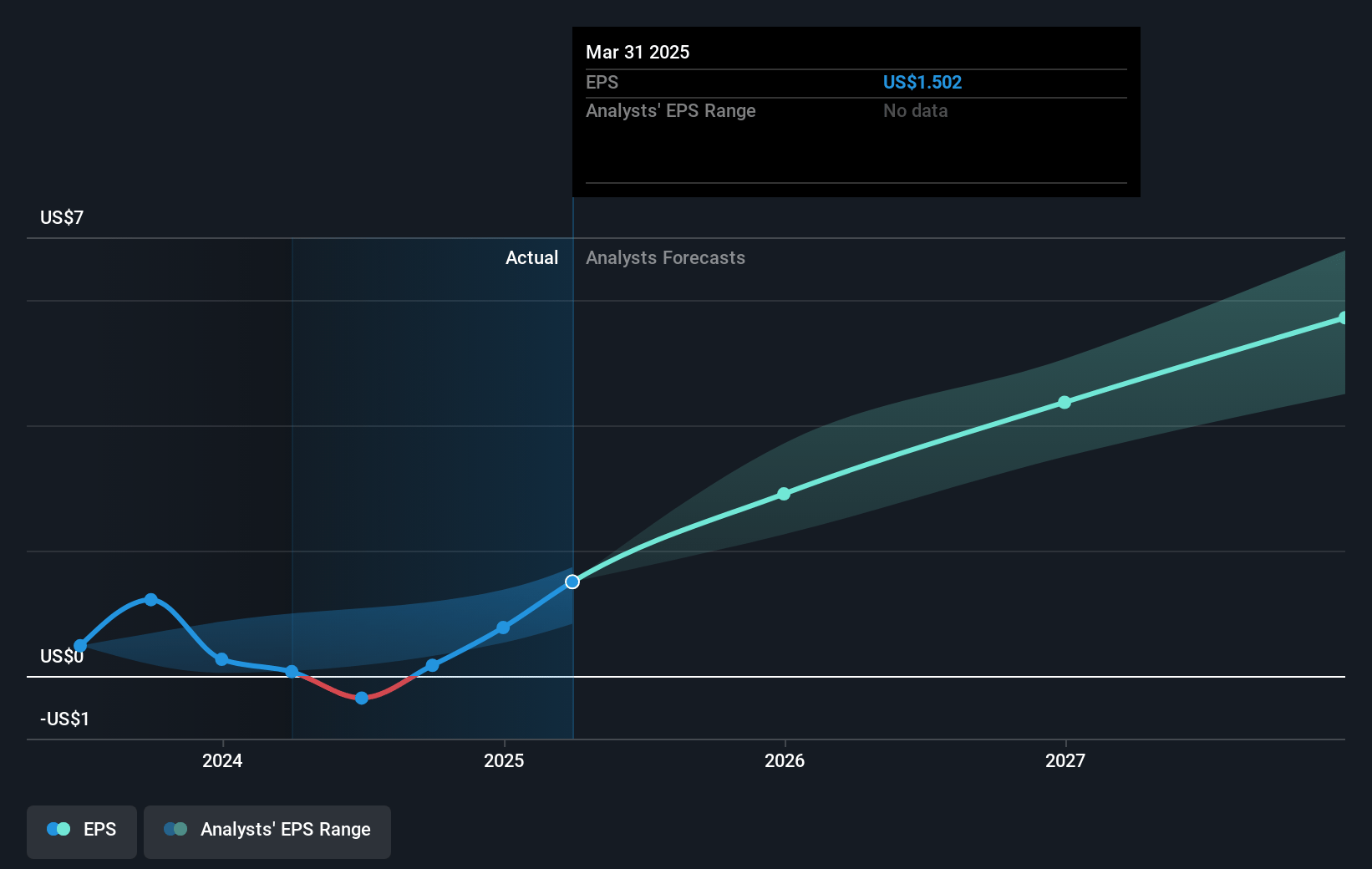

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $3.32) by about November 2027, up from $-200.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.6 billion in earnings, and the most bearish expecting $854.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.2x on those 2027 earnings, up from -308.0x today. This future PE is greater than the current PE for the US Entertainment industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.42%, as per the Simply Wall St company report.

Sea Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite achieving positive adjusted EBITDA, the e-commerce market remains highly competitive. An increase in competitive pressure, especially from cross-border competitors, could impact revenue growth and margins as Sea may need to increase spending on sales and marketing to maintain its market position.

- Potential changes in the interest rate environment could affect consumer spending and credit demand, particularly affecting the digital financial services arm. A reduction in consumer appetite for credit could result in slower growth in the company's loan book, impacting revenue and net income.

- The heavy reliance on Free Fire for its digital entertainment segment could pose a risk if the game experiences declining popularity or user engagement. A decrease in active users or revenue from in-game purchases could negatively affect overall earnings.

- The profitability of the logistics operations, particularly SPX Express, is contingent on continuing cost reductions and operational efficiencies. Any unforeseen increases in logistics costs could adversely impact net margins in the e-commerce segment.

- Increasing regulatory scrutiny in the financial services sector, especially in emerging markets, could impose additional compliance costs or restrict growth opportunities, thereby impacting the company's earnings and profitability in its digital financial services division.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $102.47 for Sea based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $150.0, and the most bearish reporting a price target of just $29.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $22.7 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 38.2x, assuming you use a discount rate of 7.4%.

- Given the current share price of $107.65, the analyst's price target of $102.47 is 5.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives