Key Takeaways

- Strong demand for live events and New York City tourism recovery drive increased ticket sales and higher spending, boosting revenue growth.

- Strategic initiatives in pricing, marketing, and partnerships enhance ticket sales, sponsorship revenues, and potentially increase net margins and future earnings.

- Decreased event bookings and potential loss of tax exemptions, coupled with rising expenses and varying tourism, may challenge MSG Entertainment’s revenue and net margins.

Catalysts

About Madison Square Garden Entertainment- Through its subsidiaries, engages in live entertainment business.

- The strong demand for live events and the ongoing recovery of New York City tourism are driving increased ticket sales and higher per capita spending on food, beverage, and merchandise, positively impacting revenue growth.

- The successful implementation of new immersive elements and strategic pricing for the Christmas Spectacular has led to record ticket sales and the potential for further pricing optimization, enhancing revenue and net margins.

- The expected growth in special events, such as high-profile productions and sports events at The Garden, suggests an increase in arena license fees and other leasing revenues, contributing to future earnings.

- New and renewed marketing partnerships with major brands like Lenovo, Motorola, and Verizon indicate an increase in sponsorship revenues and potentially higher net margins from premium hospitality services.

- The ongoing capital return strategy, including stock buybacks, reflects management's confidence in future cash flow generation and is likely to support earnings per share growth.

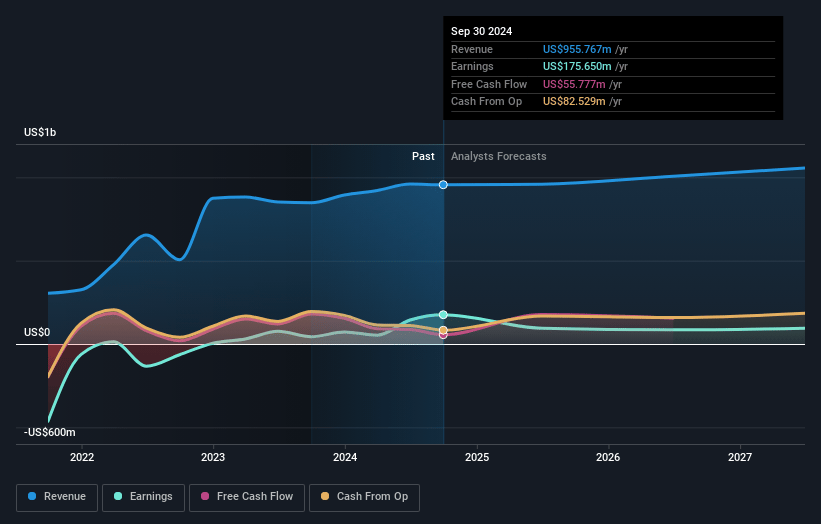

Madison Square Garden Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Madison Square Garden Entertainment's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.1% today to 8.2% in 3 years time.

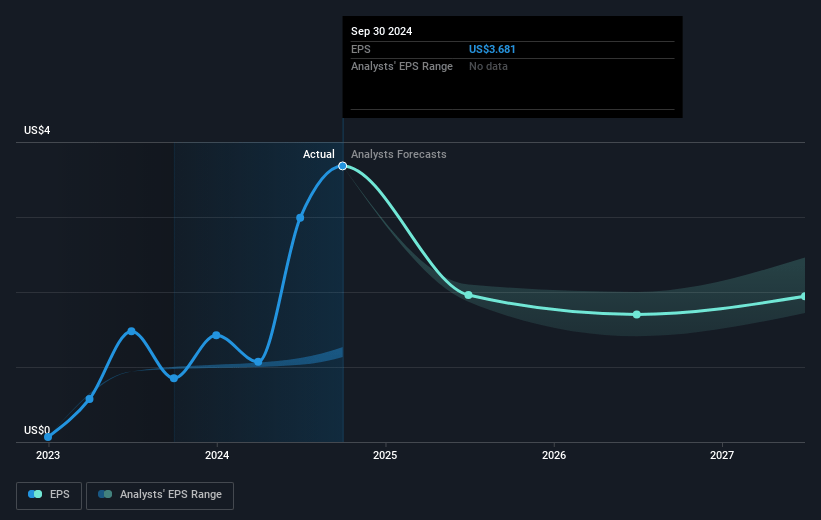

- Analysts expect earnings to reach $88.9 million (and earnings per share of $2.02) by about April 2028, down from $126.3 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $114.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 32.3x on those 2028 earnings, up from 11.4x today. This future PE is greater than the current PE for the US Entertainment industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 0.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.4%, as per the Simply Wall St company report.

Madison Square Garden Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The MSG Entertainment business experienced a decrease in the number of events, notably concerts, which resulted in reduced revenues from entertainment offerings. This could negatively affect future revenue growth if booking levels do not recover.

- Weaker concert bookings at The Garden could impact future revenues, as the typical booking window poses challenges for predicting and securing events long-term. This could also affect net margins if fixed venue costs are not offset by event revenues.

- There is a pending risk of losing the property tax exemption for The Garden, which could result in significant financial burdens and affect net margins negatively.

- Higher selling, general, and administrative expenses, including costs related to executive management transitions, may put pressure on net margins if not matched by proportional revenue increases.

- While consumer demand appears strong, potential fluctuations in tourism to New York or consumer spending dynamics could impact ticket sales and per capita spending on food, beverage, and merchandise, thus affecting total earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.375 for Madison Square Garden Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $88.9 million, and it would be trading on a PE ratio of 32.3x, assuming you use a discount rate of 10.4%.

- Given the current share price of $30.07, the analyst price target of $45.38 is 33.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.