Last Update 09 Dec 25

Fair value Decreased 0.21%LYV: Strong Secondary Ticketing Reforms Will Support Future Profit Momentum

Analysts have nudged their average price target on Live Nation Entertainment slightly lower by about $1 to the high $170s, reflecting modestly higher long term growth expectations, but also regulatory overhang and secondary ticketing uncertainties that temper near term valuation multiples.

Analyst Commentary

Street research around Live Nation continues to frame the stock as a structurally attractive growth story, but with a valuation ceiling in the near term given regulatory and secondary ticketing uncertainties. Recent price target moves cluster in a relatively tight band in the low to high $170s, with a few more optimistic targets reaching $190 where analysts are willing to look through near term headwinds into 2026 and beyond.

Bullish Takeaways

- Bullish analysts emphasize that demand indicators remain robust, pointing to strong onsite spending and a 37 percent increase in event deferred revenue as evidence that the live events pipeline supports continued double digit growth.

- Several recent target changes, including raises to around $190, reflect confidence that Live Nation can expand profitability over multiple years, supporting a premium valuation multiple versus slower growing entertainment peers.

- Analysts see the impact of secondary ticketing changes as less severe than what was initially priced into the shares, suggesting potential upside if policy outcomes prove more benign than feared.

- Longer term oriented views argue that deferring realization of higher targets into 2026 still leaves room for multiple expansion as the regulatory backdrop clarifies and earnings power is better reflected in forecasts.

Bearish Takeaways

- Bearish analysts and more cautious views point to ongoing Federal Trade Commission complaints and broader Washington scrutiny as a material overhang that can cap near term multiples regardless of operational performance.

- The persistence of a regulatory cloud, including the risk of additional FTC lawsuits, raises uncertainty around ticketing practices and business model flexibility, which could weigh on valuation even if headline demand remains resilient.

- Incremental price target reductions of a few dollars reflect reduced near term confidence in how quickly the stock can rerate, as investors await more clarity on enforcement timelines and potential remedies.

- Some research suggests that while growth and profitability should remain strong, the timing of when this is fully recognized in the share price is being pushed out, increasing the risk of periods of underperformance relative to fundamentals.

What's in the News

- U.K. ministers are drafting legislation to outlaw reselling event tickets above face value, cap service fees, and ban reselling more tickets than originally bought, with the goal of clamping down on large scale bot driven touting that could reshape secondary ticket economics for Live Nation and peers (Financial Times).

- Ticketmaster will ban users from operating multiple accounts, shut down its TradeDesk platform, and require a unique taxpayer ID for each resale account, while deploying AI and identity verification tools to detect fake or duplicate accounts following pressure from an FTC lawsuit (Billboard).

- The U.S. Federal Trade Commission is conducting an advanced stage probe into Ticketmaster’s compliance with laws targeting automated ticket resales, with a decision on potential enforcement action expected within weeks (Bloomberg).

Valuation Changes

- Fair Value has edged down slightly from $169.40 to about $169.05 per share, implying a marginally lower intrinsic value estimate.

- Discount Rate has fallen slightly from roughly 9.97 percent to about 9.93 percent, modestly reducing the implied cost of capital.

- Revenue Growth has risen very slightly from about 8.33 percent to roughly 8.34 percent, indicating a minimally stronger long term growth outlook.

- Net Profit Margin has eased down slightly from around 3.56 percent to about 3.55 percent, reflecting a marginal reduction in expected profitability.

- Future P/E has increased very slightly from about 47.55x to roughly 47.58x, suggesting a nearly unchanged but marginally higher forward valuation multiple.

Key Takeaways

- International expansion and vertical integration are strengthening revenue growth, operational efficiency, and margin improvement through new markets, venues, and value chain capture.

- Technology adoption and heightened digital engagement are enhancing ticket sales, yield management, and high-margin advertising and sponsorship opportunities.

- Regulatory pressures, reputational issues, and disruptive competition could undermine profitability and market share, while aggressive expansion efforts heighten operational and financial risks.

Catalysts

About Live Nation Entertainment- Operates as a live entertainment company worldwide.

- Live Nation is in the early stages of expanding its presence across high-growth international markets such as Latin America (notably Mexico and Brazil) and APAC (notably Japan), leveraging surging demand for live events among younger, increasingly affluent urban populations globally. This is poised to materially drive revenue growth through increased ticket sales, new venues, and event launches.

- The experience economy is fueling robust, sustained consumer demand for concerts and festivals worldwide, as evidenced by record ticket sales, growing international fan attendance, and strong sell-through rates; this dynamic underpins continued top-line expansion and higher on-site spending per event, supporting both revenue and margin growth.

- Increased adoption of advanced ticketing technologies (dynamic pricing, platform upgrades, and AI-driven operational efficiency) enables improved yield management and cost structure for Ticketmaster, which should support ongoing net margin improvement and better earnings conversion.

- Continued focus on vertical integration, especially in global venue development and operation, allows Live Nation to capture a greater share of the event value chain, facilitates operational efficiency, and enhances ancillary revenues (e.g., sponsorships, food and beverage, VIP packages)-directly benefiting net margins and overall earnings.

- Rising engagement through digital and social media channels accelerates event discovery and ticket sales velocity, while also boosting the value of Live Nation's advertising and sponsorship platform, which is expected to drive high-margin top-line growth and help diversify future revenue streams.

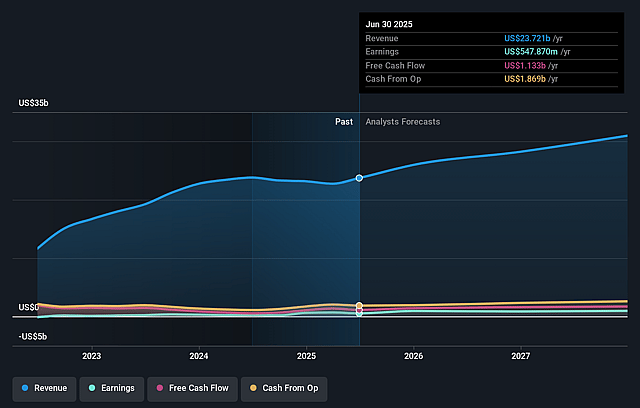

Live Nation Entertainment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Live Nation Entertainment's revenue will grow by 10.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 2.9% in 3 years time.

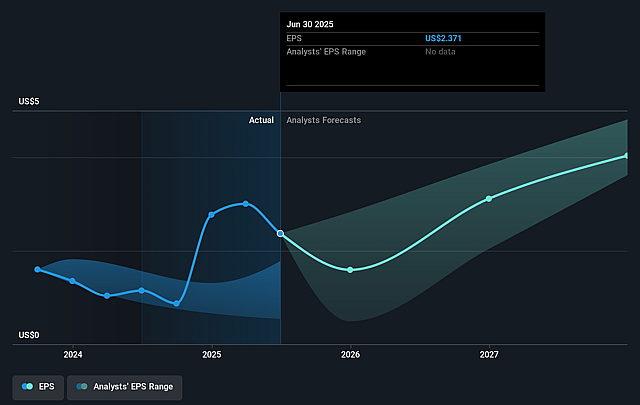

- Analysts expect earnings to reach $939.0 million (and earnings per share of $4.5) by about September 2028, up from $547.9 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $775.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 56.9x on those 2028 earnings, down from 72.1x today. This future PE is greater than the current PE for the US Entertainment industry at 39.3x.

- Analysts expect the number of shares outstanding to grow by 0.59% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.68%, as per the Simply Wall St company report.

Live Nation Entertainment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing regulatory and antitrust risks, particularly related to Ticketmaster's market dominance, remain ever-present, including the possibility of increased public scrutiny, government action, or forced divestiture that could constrain the company's pricing power and future earnings.

- Persistent reputational challenges around ticketing transparency, high fees, and consumer dissatisfaction may erode customer trust over time, which could limit growth in ticketing revenue and compress net margins if not adequately addressed.

- The ticketing segment's slower growth and performance divergence from the concert business highlights a risk of structural stagnation, especially as international expansion into lower-margin markets may dilute average revenue per ticket and weigh on overall profitability.

- Growing artist and venue resistance to exclusive deals, coupled with the rise of alternative and potentially blockchain-based ticketing platforms, threatens Live Nation's proprietary pipeline and could erode its long-term ticketing market share and revenue streams.

- Expansion into new international regions and aggressive venue development introduces execution risks, such as potential overinvestment, misjudgment of local market demand, or operating inefficiencies, which could ultimately depress return on invested capital and drag on earnings if not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $171.5 for Live Nation Entertainment based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $195.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $32.0 billion, earnings will come to $939.0 million, and it would be trading on a PE ratio of 56.9x, assuming you use a discount rate of 9.7%.

- Given the current share price of $170.3, the analyst price target of $171.5 is 0.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Live Nation Entertainment?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.