Catalysts

About Lions Gate Entertainment

Lions Gate Entertainment is a global content company that produces, distributes and monetizes film, television and related entertainment franchises across multiple platforms.

What are the underlying business or industry changes driving this perspective?

- Rapid expansion of a high value, franchise driven theatrical slate, including Michael, Hunger Games Sunrise on the Reaping and the two part Resurrection series, is positioned to capture strong global box office and downstream licensing demand, supporting sustained revenue growth and higher earnings power.

- Record and steadily growing one billion dollar plus annual library revenue, increasingly driven by television titles and supported by rising demand from streamers, FAST channels and international buyers, is turning Lionsgate's retained rights strategy into a durable, high margin cash engine that can structurally lift net margins.

- Meaningful ramp in scripted TV deliveries, with key renewals like Ghosts, The Rookie and power related series along with new shows such as Robinhood and Spartacus House of Ashur, is rebuilding backlog and visibility, driving a multiyear step up in segment revenue and more stable, recurring earnings.

- Asset light monetization of marquee IP across stage, live experiences and gaming, from Hunger Games and John Wick live attractions to new AAA game opportunities around John Wick and Saw, is opening new, capital efficient revenue streams that can expand overall return on invested capital and boost operating margins.

- Disciplined use of AI and data driven marketing, combined with structurally lower production and P&A costs versus peers, is enhancing productivity and campaign effectiveness, enabling comparable or better box office and licensing outcomes with 30 to 50 percent less spend. This may translate into outsized improvements in segment profit and consolidated earnings.

Assumptions

This narrative explores a more optimistic perspective on Lions Gate Entertainment compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

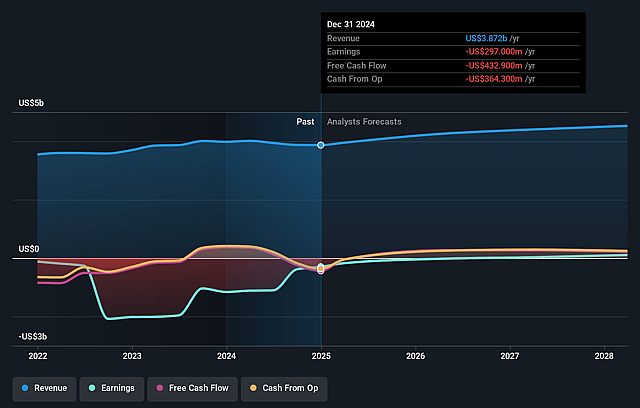

- The bullish analysts are assuming Lions Gate Entertainment's revenue will grow by 6.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -7.7% today to 3.6% in 3 years time.

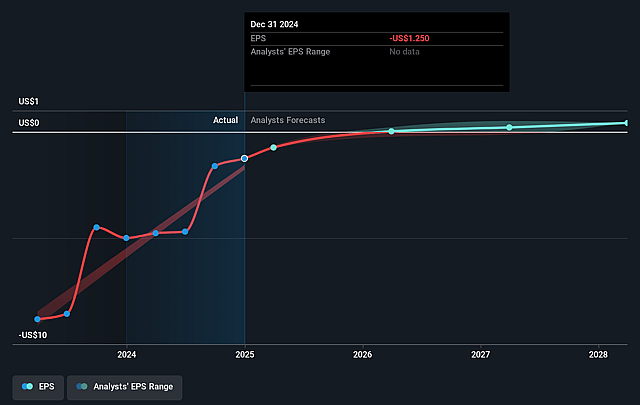

- The bullish analysts expect earnings to reach $170.8 million (and earnings per share of $0.68) by about December 2028, up from $-297.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.0x on those 2028 earnings, up from -7.0x today. This future PE is greater than the current PE for the US Entertainment industry at 20.3x.

- The bullish analysts expect the number of shares outstanding to grow by 1.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The increasingly fragmented and competitive attention landscape, where audiences are harder to find and engage across proliferating digital and social platforms, may mean even heavily marketed films and series underperform relative to expectations. This would pressure theatrical and licensing revenue and limit the anticipated uplift in earnings.

- The strategy of concentrating the slate behind a growing number of large IP driven tentpoles such as Michael, Hunger Games and Resurrection increases exposure to a few high stakes releases in an unpredictable box office environment. Underperformance of one or more of these titles could materially weaken revenue visibility, compress net margins and delay the inflection in earnings.

- Reliance on long term scripted TV investment and deficit financing to retain rights assumes a healthy buyer ecosystem. Extended industry M&A cycles, buyer consolidation and cautious commissioning can suppress new series orders and renewals, slow backlog conversion into revenue and limit the library driven improvement in net margins and earnings.

- Library monetization tailwinds from franchises such as John Wick, Twilight and Hunger Games and the build out of self directed and FAST channels may not be sustainable if consumer viewing shifts, platform strategies or licensing economics deteriorate over time. This would reduce high margin library revenue growth and constrain overall margin expansion.

- The company is operating with elevated leverage of around 6.4 times and significant ongoing content and P&A spend. Any delay in the back end loaded revenue ramp, weaker than expected cash flow from the fiscal 2026 to 2028 slate or a slower build in ancillary monetization would hinder deleveraging, increase financing risk and weigh on future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Lions Gate Entertainment is $15.0, which represents up to two standard deviations above the consensus price target of $11.08. This valuation is based on what can be assumed as the expectations of Lions Gate Entertainment's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $7.5.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be $4.7 billion, earnings will come to $170.8 million, and it would be trading on a PE ratio of 31.0x, assuming you use a discount rate of 11.4%.

- Given the current share price of $8.59, the analyst price target of $15.0 is 42.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Lions Gate Entertainment?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.