Key Takeaways

- Interpublic Group is enhancing revenue by integrating data and scaling media buying, improving campaign efficiency and client offerings.

- Strategic M&A and expense reductions aim to expand high-demand capabilities and improve profitability through operational efficiency.

- Economic uncertainties, account losses, and goodwill impairments could hinder Interpublic's revenue growth and financial performance across key markets.

Catalysts

About Interpublic Group of Companies- Provides advertising and marketing services worldwide.

- Interpublic Group is launching Interact, a framework that integrates data across the campaign life cycle, enhancing connectivity and efficiency, which may boost revenue through improved client results and offerings.

- The company is scaling its practice in principal media buying, which could drive revenue growth as clients opt into this bundled solution that offers value beyond traditional media buying strategies.

- Strategic internal combinations and potential dispositions are being considered to streamline the portfolio and focus on high-growth areas, which could improve net margins by enhancing operational efficiency.

- Interpublic is targeting M&A to acquire specialized data assets and technology platforms in retail media, which could expand their capabilities and drive revenue growth by accessing high-demand sectors.

- The company is focusing on reducing expenses through structural actions, such as unified back-office functions and optimized use of real estate, potentially improving net margins and overall profitability.

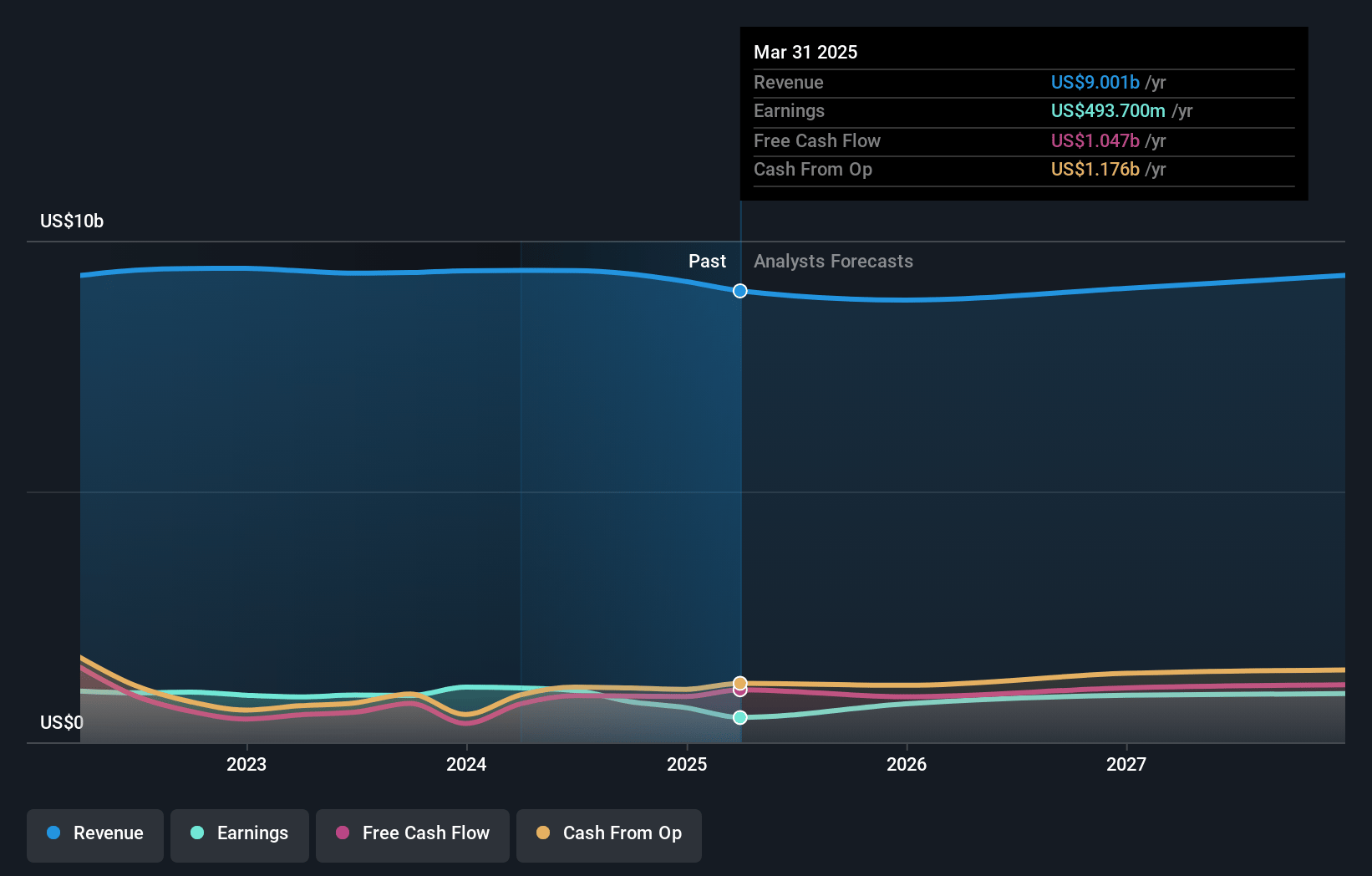

Interpublic Group of Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Interpublic Group of Companies's revenue will grow by 1.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 11.0% in 3 years time.

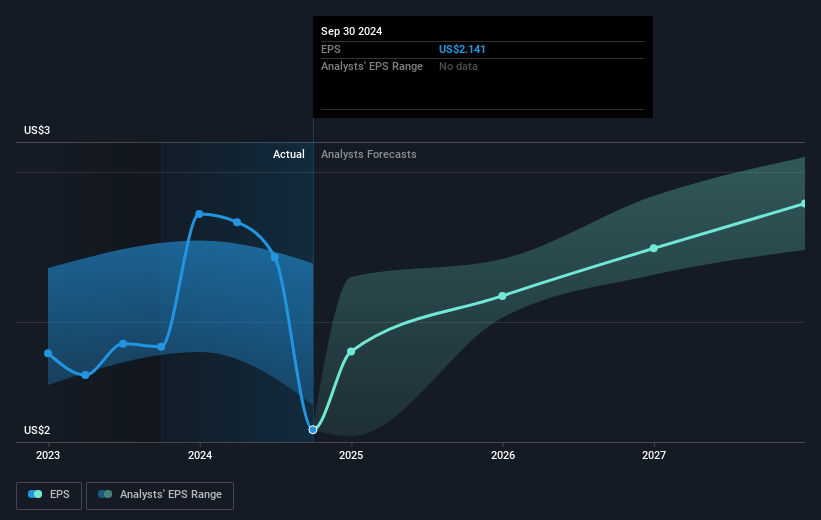

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $2.86) by about January 2028, up from $808.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, up from 13.3x today. This future PE is greater than the current PE for the US Media industry at 13.4x.

- Analysts expect the number of shares outstanding to decline by 0.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Interpublic Group of Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The flat organic revenue growth and 2.9% decrease in net revenue indicate potential challenges in maintaining or increasing revenues, which might hinder future financial performance.

- Account losses in significant sectors like auto and transportation, tech, and telecom could continue to impact revenue negatively, creating headwinds for growth.

- Economic and political uncertainties, particularly in the U.S. and major international markets, pose risks to discretionary project spending, which might affect revenue projections.

- Decreases in performance in key international markets like Asia Pacific and the UK could signal ongoing regional challenges that might impact overall revenue growth.

- The noncash goodwill impairment of $232 million related to Digital Specialist agencies suggests potential future financial strain and impacts on net margins if similar write-downs occur.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.32 for Interpublic Group of Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $39.0, and the most bearish reporting a price target of just $29.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.7 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $28.85, the analyst's price target of $35.32 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives