Narratives are currently in beta

Key Takeaways

- Strategic expansion into emerging markets and advancements in technology position IMAX for revenue growth and competitive advantage.

- Diversification into live events and alternative content opens new revenue streams, enhancing earnings and net margins with better asset utilization.

- Economic uncertainty and possible superhero fatigue could harm revenue, while capital demands and reliance on partnerships add risks to earnings and profitability.

Catalysts

About IMAX- Operates as a technology platform for entertainment and events worldwide.

- The anticipated rebound in moviegoing post-Hollywood strikes, paired with a phenomenal slate in 2025 and 2026, suggests a strong pipeline of content which could significantly increase future revenue and earnings.

- A notable surge in exhibitor demand with system sales and installations markedly exceeding 2023 levels indicates potential for upward momentum in both revenue and net margins due to increased capacity utilization.

- The company's strategic expansion into emerging markets, such as Saudi Arabia and continued progress in China, is set to drive future revenue growth, leveraging increasing consumer demand and geopolitical economic recovery measures.

- Advancements in IMAX technology, including new innovations being utilized by top filmmakers, are poised to enhance the company's competitive edge, positively impacting both revenue and net margins by attracting more premium viewership and content.

- Strategic diversification into live events and alternative content, such as eSports and concert films, offers new revenue streams and improved network utilization, suggesting potential for increased earnings and stronger net margins due to higher asset utilization without significant CapEx.

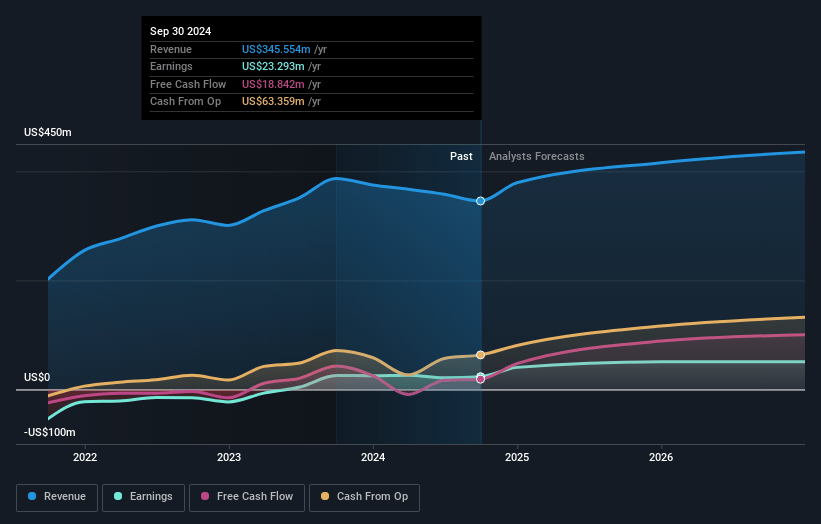

IMAX Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming IMAX's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.7% today to 11.8% in 3 years time.

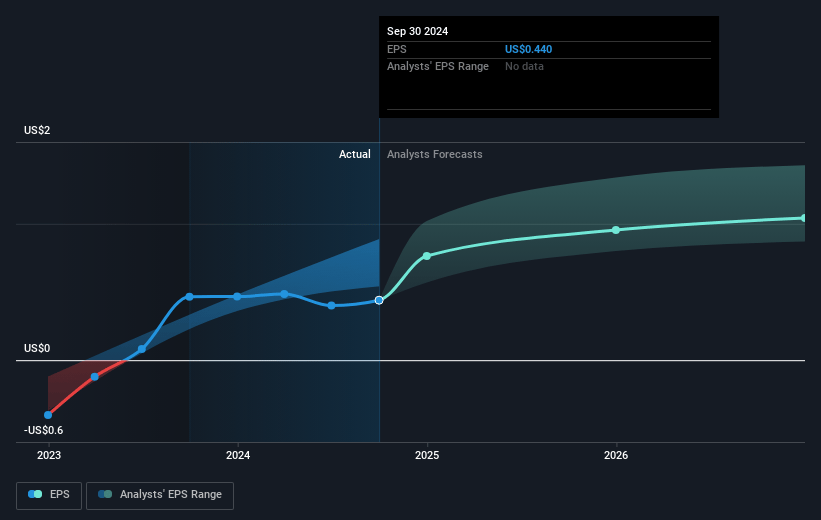

- Analysts expect earnings to reach $51.2 million (and earnings per share of $1.34) by about December 2027, up from $23.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.4x on those 2027 earnings, down from 57.2x today. This future PE is greater than the current PE for the US Entertainment industry at 18.0x.

- Analysts expect the number of shares outstanding to decline by 10.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.84%, as per the Simply Wall St company report.

IMAX Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The potential for prolonged economic uncertainty in key markets like China could negatively impact consumer spending on movies, affecting revenue and profitability.

- Risks of superhero fatigue with audiences might impact box office performance for key blockbuster titles, impacting revenue projections related to these releases.

- The reliance on large film slates for projected growth, which if delayed or underperform, could adversely affect expected revenue and net margins.

- The high level of capital expenditure for system installations might pressure short-term cash flow and net profitability, especially if these investments do not lead to the anticipated box office growth.

- Dependence on successful partnerships for content diversification and technological innovation could introduce execution risk, potentially impacting earnings if not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.27 for IMAX based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $33.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $432.1 million, earnings will come to $51.2 million, and it would be trading on a PE ratio of 25.4x, assuming you use a discount rate of 7.8%.

- Given the current share price of $25.3, the analyst's price target of $27.27 is 7.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives