Narratives are currently in beta

Key Takeaways

- The focus on enterprise growth amidst macroeconomic unpredictability could limit revenue diversification and expansion due to smaller SMB contributions.

- Dependence on new AI offerings for revenue stability introduces potential volatility in margins if growth expectations aren't met.

- Successful strategies, expanded offerings, and a share repurchase program drive potential revenue growth, improved margins, and enhanced shareholder value at ZoomInfo Technologies.

Catalysts

About ZoomInfo Technologies- Provides go-to-market intelligence and engagement platform for sales and marketing teams in the United States and internationally.

- The shift to disqualifying riskier small businesses could impact short-term revenue growth as it reduces the number of new sales opportunities, potentially dampening growth optics for the next few quarters.

- Continued reliance on the enterprise segment for growth, whereas unpredictable macroeconomic conditions and smaller SMB share might strain revenue diversification and expansion efforts in the near future.

- Incremental conservatism in revenue projections and headwinds from lower-quality customers suggest downward pressure on future earnings, especially if the aggressive move to upmarket doesn't yield rapid results.

- High dependency on Copilot’s adoption and success for revenue retention and expansion could introduce volatility in net margins if newer AI-driven offerings don't scale as anticipated.

- Assuming further share repurchases occurring to boost levered free cash flow per share rather than revenue growth, which could imply challenges in organically driving EPS and profit up without financial engineering.

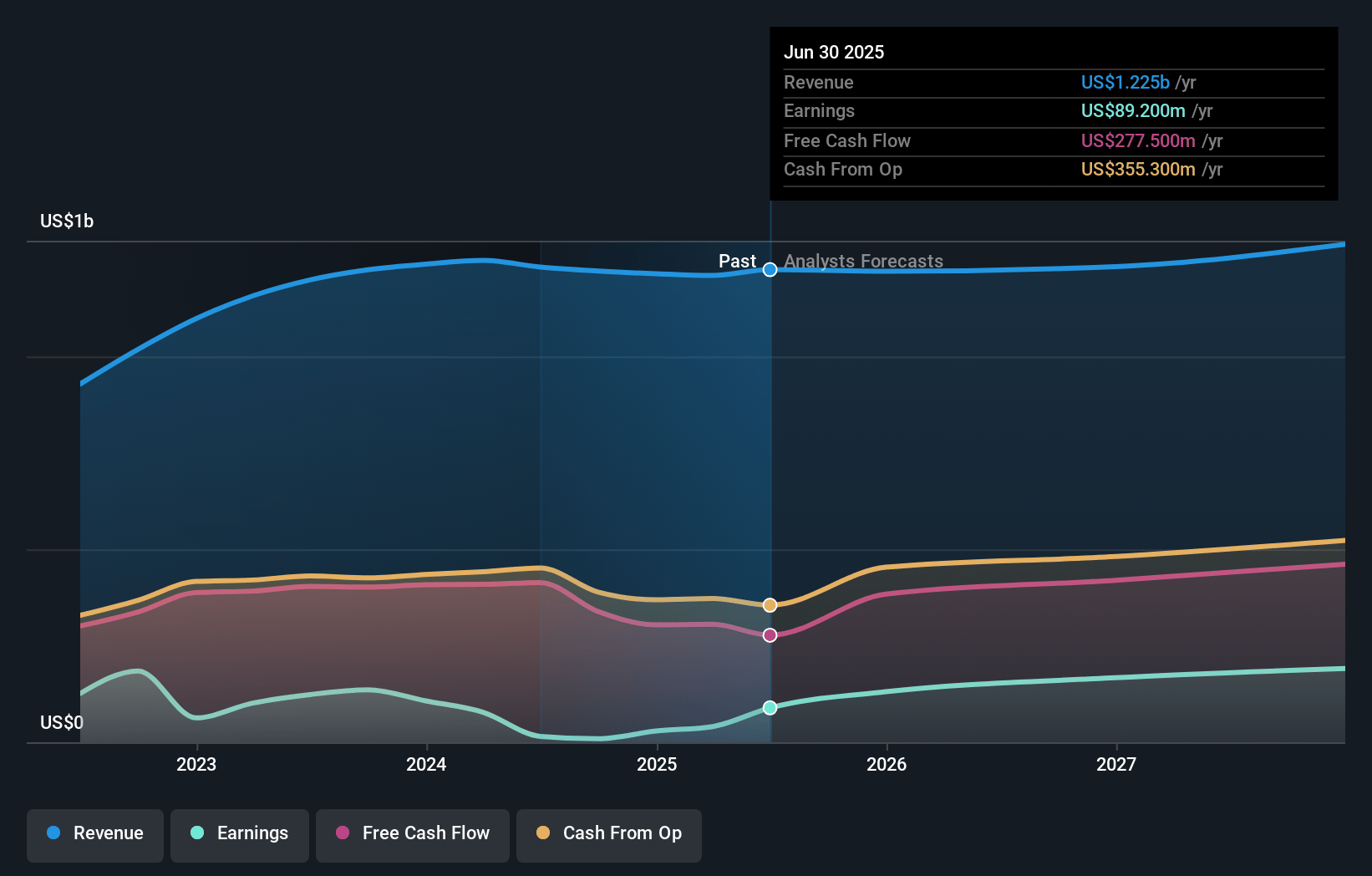

ZoomInfo Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ZoomInfo Technologies's revenue will grow by 1.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.3% today to 13.0% in 3 years time.

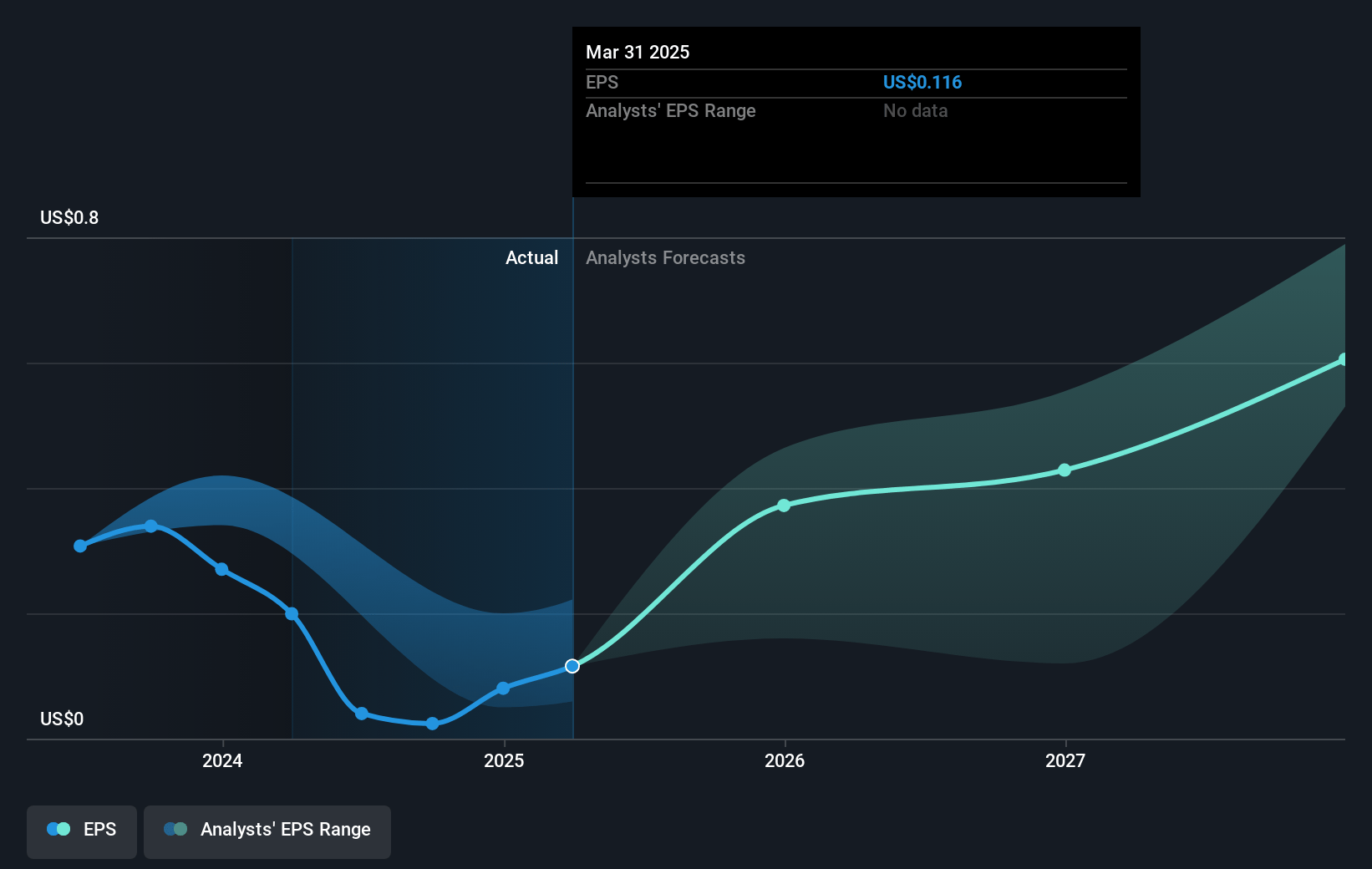

- Analysts expect earnings to reach $166.5 million (and earnings per share of $0.49) by about November 2027, up from $15.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $254.2 million in earnings, and the most bearish expecting $90.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.8x on those 2027 earnings, down from 310.3x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 24.1x.

- Analysts expect the number of shares outstanding to decline by 2.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

ZoomInfo Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ZoomInfo's strategy to reduce volatility from future write-offs has been successful through the implementation of a new risk model and emphasizing upfront prepayments, which can enhance long-term revenue durability.

- Strong enterprise growth with increasing numbers of $100,000 and $1 million-plus customer cohorts indicates potential revenue growth and improved net margins due to higher-value contracts.

- The performance of ZoomInfo Copilot exceeded expectations, leading to better customer engagement and potential revenue growth as it improves customer retention and expansion opportunities.

- An aggressive share repurchase program has reduced total shares outstanding by approximately 17%, which can improve earnings per share (EPS), thus enhancing shareholder value.

- Expanded product offerings and integrations, including growth in the data-as-a-service sector and the adoption of AI solutions such as ZoomInfo Copilot, indicate potential for increased revenue and improved margins through product differentiation and increased customer reliance on their solutions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.39 for ZoomInfo Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.3 billion, earnings will come to $166.5 million, and it would be trading on a PE ratio of 28.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of $13.08, the analyst's price target of $11.39 is 14.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives