Last Update08 Aug 25Fair value Increased 9.56%

Despite a slight reduction in revenue growth forecasts, Ziff Davis’s consensus price target has increased from $41.33 to $44.29, supported by a notably lower forward P/E ratio that enhances relative valuation appeal.

What's in the News

- Ziff Davis reaffirmed fiscal 2025 earnings guidance, expecting revenue of $1,442 million to $1,502 million.

- Ziff Davis was added to the Russell 2000 Dynamic Index.

Valuation Changes

Summary of Valuation Changes for Ziff Davis

- The Consensus Analyst Price Target has risen from $41.33 to $44.29.

- The Consensus Revenue Growth forecasts for Ziff Davis has fallen from 4.0% per annum to 3.6% per annum.

- The Future P/E for Ziff Davis has fallen from 8.73x to 8.14x.

Key Takeaways

- Focus on digital content, SaaS, and high-margin verticals is driving recurring revenue growth and strengthening margins through proprietary brands and data assets.

- Strategic M&A, disciplined capital return, and advanced ad tech are accelerating diversification, platform scaling, and enhancing long-term shareholder value.

- Heavy dependence on acquisitions and industry shifts threaten organic growth, advertising revenue, and overall profitability amidst evolving digital and AI-driven media landscapes.

Catalysts

About Ziff Davis- Operates as a digital media and internet company in the United States and internationally.

- Ziff Davis is benefiting from the growing demand for digital content, cloud-based solutions, and recurring subscription services, as demonstrated by double-digit organic growth across Health & Wellness, Connectivity, and strong SaaS uptake, which supports sustained revenue and margin expansion from recurring business models.

- The company is capitalizing on a significant shift toward data-driven, performance-oriented digital advertising and e-commerce, as evidenced by its AI-enhanced moment of influence targeting platform and large, privacy-protected first-party data assets, likely to drive higher digital ad yields and improved advertiser spend, boosting ad revenue growth.

- Strategic focus on premium, high-margin verticals (health, gaming, cybersecurity) and the monetization of proprietary brands-such as CNET, Everyday Health, IGN, and Lose It!-is delivering both pricing power and margin resilience, positioning the company for further net margin and EBITDA expansion.

- Ziff Davis's disciplined M&A approach, with ongoing tuck-in acquisitions funded by a strong balance sheet, is actively diversifying revenues and accelerating growth across verticals, directly contributing to future earnings and margin growth through operational synergies and platform scaling.

- Sustained and substantial share repurchases-nearly 10% of outstanding shares in the past year-combined with organic and inorganic growth, enhance EPS accretion and shareholder value, highlighting management's confidence in undervaluation and future earnings growth.

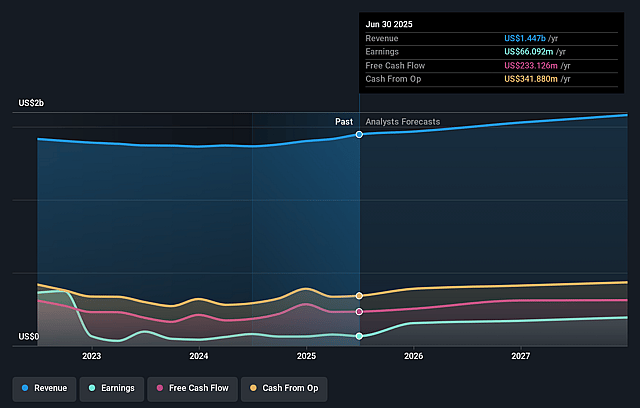

Ziff Davis Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ziff Davis's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 14.6% in 3 years time.

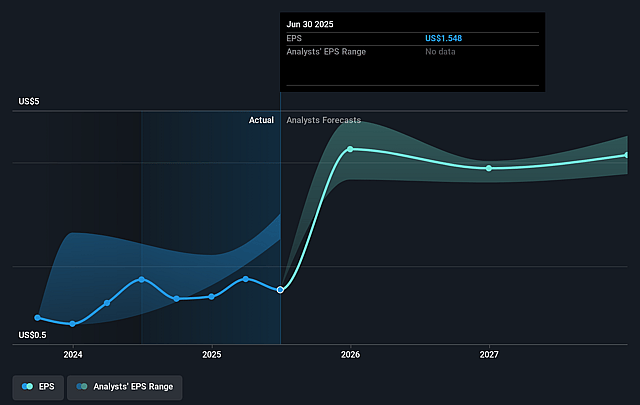

- Analysts expect earnings to reach $235.9 million (and earnings per share of $4.14) by about August 2028, up from $66.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, down from 22.7x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 13.6x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.71%, as per the Simply Wall St company report.

Ziff Davis Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on inorganic (acquisition-driven) growth, as roughly half of Ziff Davis's intended double-digit revenue growth is expected to come from M&A, creating ongoing risk of integration challenges, overpayment, and potential pressure on net margins and earnings if acquisition synergies fall short.

- Exposure to long-term digital advertising headwinds, including increasing adoption of privacy regulations, the global proliferation of ad-blocking technologies, and a continued shift of advertising budgets to walled gardens and social platforms-challenges that could structurally reduce advertising effectiveness and ultimately compress Ziff Davis's advertising-related revenue and margins.

- The risk posed by accelerated AI and large-language-model-driven content aggregation (such as zero-click search and AI-powered overviews), which disrupts traditional web traffic and threatens the value of premium owned-and-operated content properties-potentially undermining Ziff Davis's traffic, user engagement, and revenue base over time.

- Weakness and stagnation in certain core segments and brands, specifically Tech & Shopping's Offers brand (placed into "managed decline") and B2B technology, as well as lumpy or slowing performance in Cybersecurity & Martech, pointing to dependence on continual acquisition to prevent revenue plateaus and raising questions about the sustainability of organic growth, revenue, and net margins.

- Ongoing industry-wide challenges from declining desktop web traffic in favor of closed mobile/app environments and intensifying digital media consolidation by major tech firms, which can diminish Ziff Davis's audience reach, erode its negotiating power with advertisers, and put long-term pressure on both revenue generation and earnings capacity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.286 for Ziff Davis based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.6 billion, earnings will come to $235.9 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 9.7%.

- Given the current share price of $36.58, the analyst price target of $45.29 is 19.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.