Key Takeaways

- Successful pricing strategies and AI-powered offerings are driving higher customer retention and subscription growth while improving gross margins and recurring revenue performance.

- Focus on enterprise expansion and organizational integration positions the company to win larger, multi-year contracts and capitalize on long-term digital transformation trends.

- Competitive pressures, regulatory challenges, and macroeconomic headwinds threaten Vimeo’s pricing power, user growth, and profitability, while structural costs restrict its ability to improve margins.

Catalysts

About Vimeo- Provides video software solutions in the United States and internationally.

- Vimeo’s self-service business has returned to bookings growth for the first time in three years, driven by successful pricing adjustments paired with enhanced offerings, resulting in lower churn and setting the stage for sustained subscription revenue growth and improved gross margins as customer retention continues to rise.

- The company’s Enterprise segment is experiencing significant expansion, with quarterly revenue now more than double what it was two years ago and a focus on larger, multi-division contracts that enhance average revenue per user and long-term customer value, providing a strong catalyst for top-line revenue growth and increased net margins as operational leverage improves.

- Strategic investment in generative AI tools—such as video translations and soon-to-launch agentic video capabilities—creates opportunities for new monetizable features delivered on a consumption basis, supporting higher average revenue per user across both self-serve and enterprise channels and likely contributing to recurring revenue growth and better gross margin performance over time.

- Vimeo’s focus on deeper and wider organizational integration—helping enterprise clients consolidate multiple video tools onto one SaaS-based platform—addresses the growing demand across industries for unified, digital communication solutions, positioning the company to capture greater market share and extract increasingly lucrative, multi-year enterprise contracts that benefit both revenue and earnings.

- The proliferation of online video consumption and accelerating adoption of remote work are structurally expanding the total addressable market for cloud-based video platforms, which, coupled with Vimeo’s investment in innovative features and scalable SaaS infrastructure, positions the company for outsized long-term revenue and earnings growth as digital transformation continues throughout the global economy.

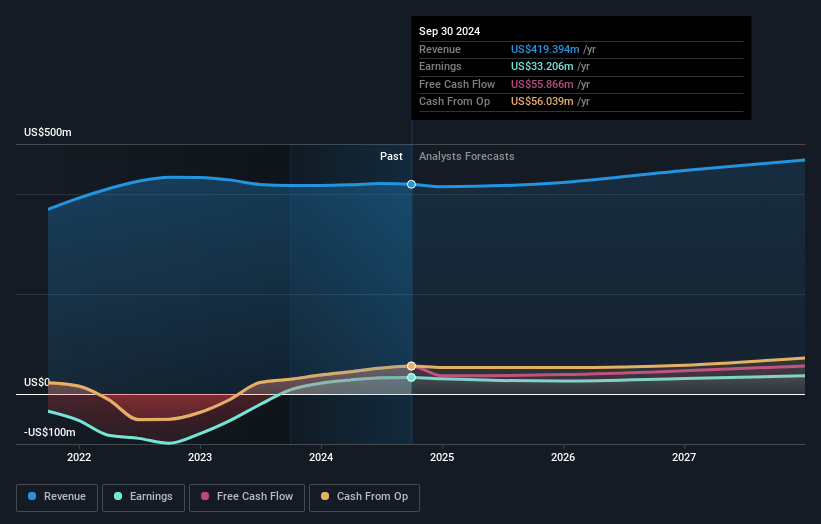

Vimeo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Vimeo compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Vimeo's revenue will grow by 8.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 5.1% in 3 years time.

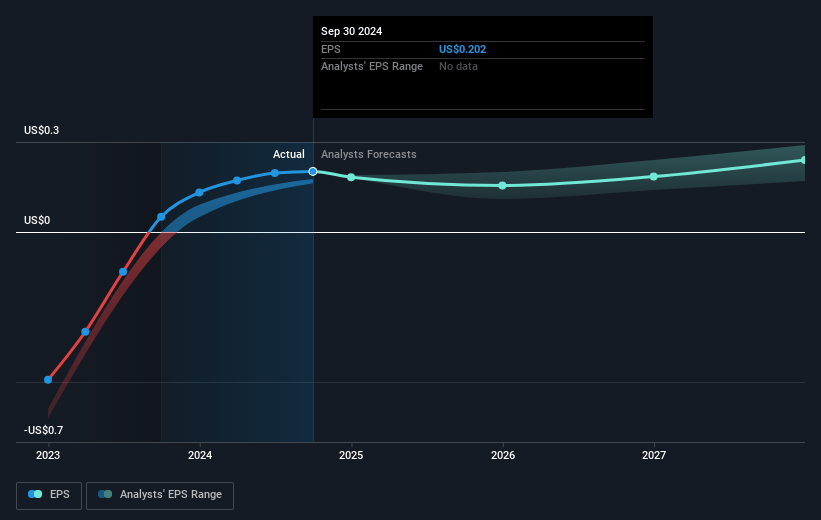

- The bullish analysts expect earnings to reach $26.8 million (and earnings per share of $0.15) by about July 2028, up from $16.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 59.8x on those 2028 earnings, up from 41.9x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.4x.

- Analysts expect the number of shares outstanding to decline by 0.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.59%, as per the Simply Wall St company report.

Vimeo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising competition from emerging content formats such as short-form video, VR/AR, and live interactive experiences could reduce user engagement and undermine Vimeo’s ability to attract and retain both business and individual customers, which would negatively impact revenue growth and limit market share.

- The continued proliferation of free or low-cost video solutions like YouTube, Canva, and TikTok is likely to sustain downward pressure on Vimeo’s pricing power and margins, making it difficult for the company to differentiate its premium offerings and maintain healthy net earnings over time.

- Intensifying data privacy regulations present a risk of increased compliance and operational costs for Vimeo’s platform, potentially constraining its ability to monetize customer analytics and dampening overall net margins.

- Persistent macroeconomic uncertainty and ongoing declines in discretionary spending by small and medium businesses on software tools may slow Vimeo’s new customer acquisition and hamper the growth of its core self-service and enterprise segments, limiting topline revenue expansion.

- High fixed costs related to video infrastructure and research and development, combined with historically low operating leverage, could hinder Vimeo’s ability to drive significant improvements in profitability and limit gains in net earnings even if revenue grows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Vimeo is $8.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Vimeo's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $530.7 million, earnings will come to $26.8 million, and it would be trading on a PE ratio of 59.8x, assuming you use a discount rate of 7.6%.

- Given the current share price of $4.23, the bullish analyst price target of $8.0 is 47.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.