Key Takeaways

- Anticipated game releases and mobile successes are expected to significantly boost revenue and consumer spending.

- Strategic focus on core and mobile businesses may enhance operational efficiency and margins.

- Challenges in developing new IP, market consolidation, and declines in key games signal potential future revenue and competition pressures for Take-Two.

Catalysts

About Take-Two Interactive Software- Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

- The upcoming release of Grand Theft Auto VI in Fall 2025, along with other highly anticipated titles like Borderlands 4 and Mafia: The Old Country, is expected to drive significant revenue growth in fiscal 2026 and beyond.

- The expansion and anticipated success of mobile titles such as Match Factory!, alongside strong growth in Toon Blast, are set to bolster both revenue and net bookings, contributing to the company's growing mobile segment.

- The innovative features and high reviews of NBA 2K25, along with increased consumer engagement and spending, are expected to sustain and grow recurrent consumer spending, positively impacting earnings.

- The strategic decision to sell the private division label to focus resources on core and mobile businesses is anticipated to improve operational efficiency and potentially enhance net margins.

- The increasing engagement and performance of existing franchises like Grand Theft Auto and Red Dead Redemption, alongside new updates and expansions for these titles, are expected to maintain high levels of consumer spending and drive sustained revenue growth.

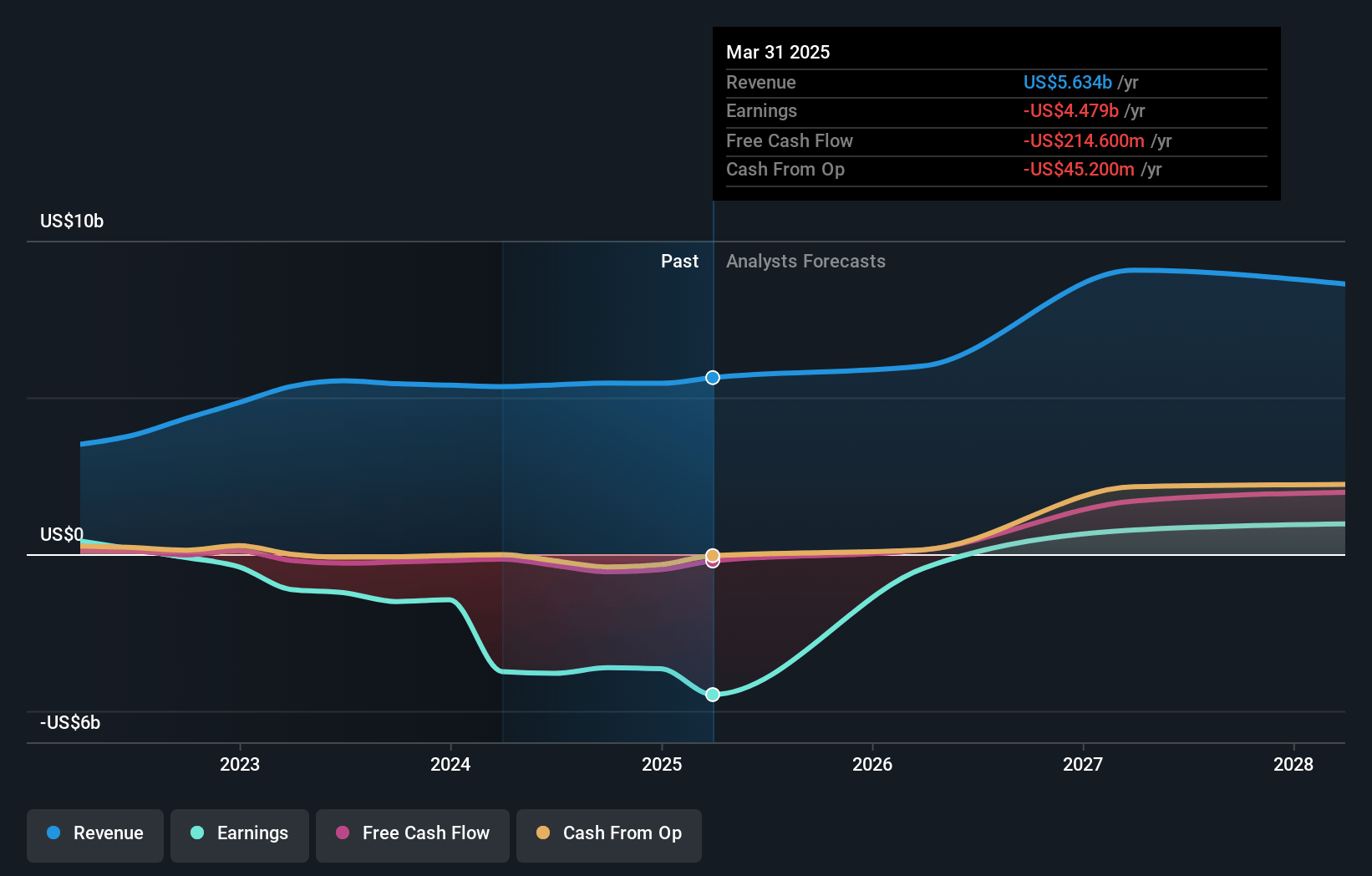

Take-Two Interactive Software Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Take-Two Interactive Software's revenue will grow by 14.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -66.4% today to 9.8% in 3 years time.

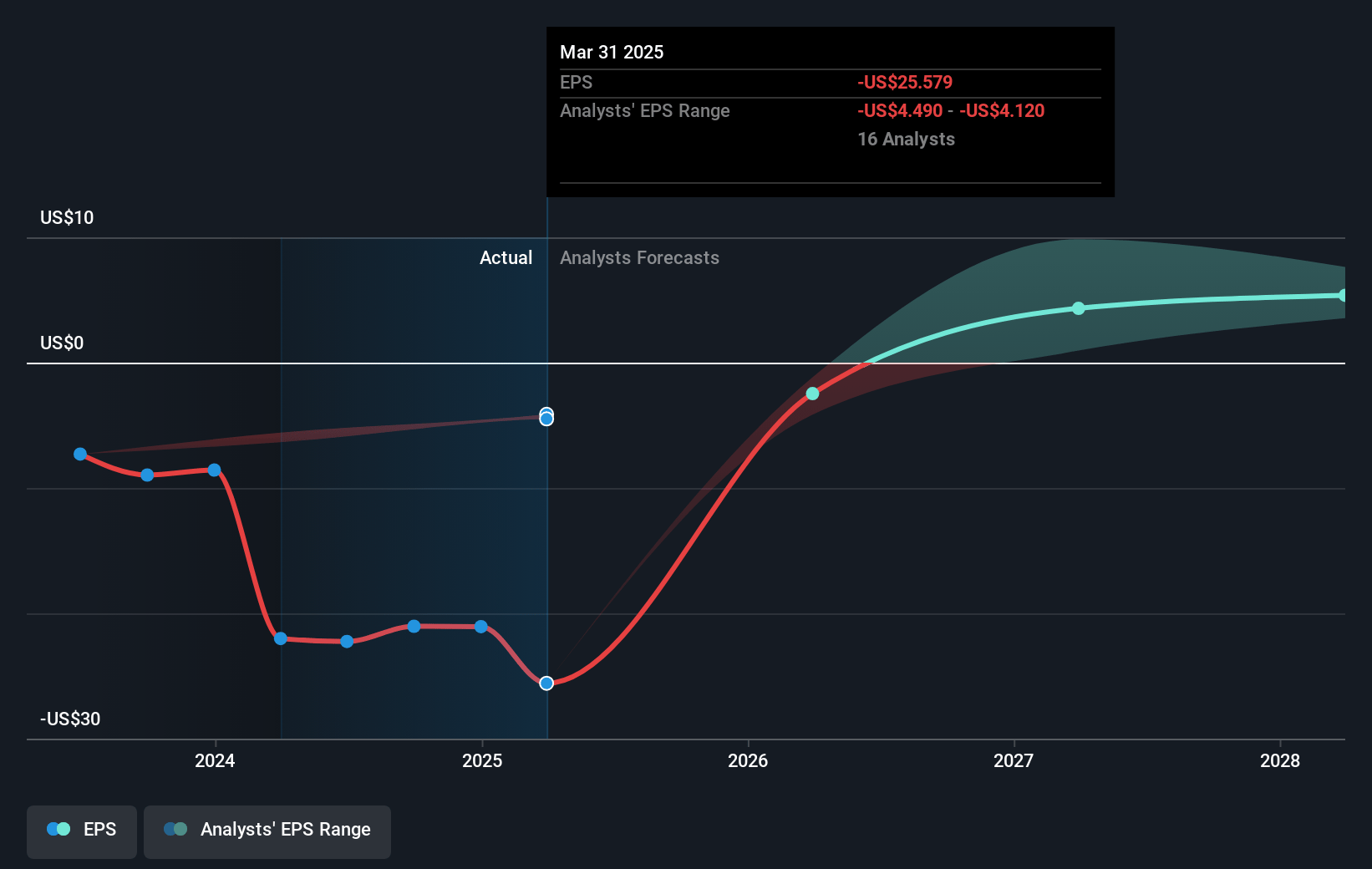

- Analysts expect earnings to reach $807.4 million (and earnings per share of $4.1) by about January 2028, up from $-3.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $988.1 million in earnings, and the most bearish expecting $416.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 61.2x on those 2028 earnings, up from -9.1x today. This future PE is greater than the current PE for the US Entertainment industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 3.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.65%, as per the Simply Wall St company report.

Take-Two Interactive Software Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Take-Two's decision to sell its private division label, which included rights to unreleased titles, suggests challenges in developing new, notable intellectual property. This could impact future revenue growth if new IP fails to emerge as significant drivers.

- The gaming industry is becoming more consolidated, with a shift towards larger publishers and fewer titles capturing market share. This could result in increased competition and potential revenue and earnings pressure for Take-Two if it fails to maintain its hit-driven portfolio.

- The persistence of declining revenue from Gen 8 consoles, despite strong growth in Gen 9, may impact overall net margins negatively if the transition to newer generation platforms is not adequately paced or managed.

- Expected decline in revenue from Grand Theft Auto Online despite efforts to maintain engagement indicates potential challenges in sustaining recurrent consumer spending, impacting future revenue streams.

- Broad-based risks related to the mobile games sector, specifically from declines in hyper-casual games and Empires & Puzzles, could lead to reduced revenue growth if new mobile games do not perform as well as expected or if market shifts deflate current growth drivers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $201.11 for Take-Two Interactive Software based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $240.0, and the most bearish reporting a price target of just $130.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.3 billion, earnings will come to $807.4 million, and it would be trading on a PE ratio of 61.2x, assuming you use a discount rate of 7.7%.

- Given the current share price of $187.14, the analyst's price target of $201.11 is 6.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives