Key Takeaways

- TechTarget is leveraging AI, cloud, and data trends to boost demand for specialized content, lead generation, and high-margin, intent-driven marketing solutions.

- Operational efficiency, strategic international growth, and proprietary data investments are improving client retention, upselling, and supporting sustainable market share gains.

- Shifting digital landscapes, client insourcing, margin pressures, industry consolidation, and privacy changes all threaten TechTarget's revenue growth, pricing power, and data advantage.

Catalysts

About TechTarget- Provides purchase intent-driven marketing and advertising campaigns in North America, the United Kingdom, and internationally.

- TechTarget is increasingly positioning itself to capture rising demand driven by the accelerating adoption of AI, cloud computing, and cybersecurity across industries; this demand for specialized B2B content and high-quality lead gen is expected to lift both revenue and long-term margins as these technology trends intensify.

- The company is strengthening its operational execution by integrating and rationalizing its product portfolio (unifying brands under Omdia, cross-selling capabilities), simplifying go-to-market structures, and focusing on large enterprise customers-these operational improvements should increase revenue efficiency, improve client retention, and boost margins through upselling and larger contract wins.

- International market expansion, with 40% of the addressable market outside the U.S., and deeper penetration in large enterprise IT and vertical technology sectors provide significant headroom for future revenue growth and improved earnings diversification.

- TechTarget is capitalizing on robust demand for intent-driven, first-party data and original, authoritative content as B2B marketers shift away from cookie-based targeting-this positions the company to capture higher direct spend, improving both revenue and net margins.

- Continued investment in AI and proprietary data (including leveraging richer datasets via Informa PLC partnerships) is expected to strengthen the company's competitive moat and market share, supporting sustainable long-term EBITDA and earnings growth.

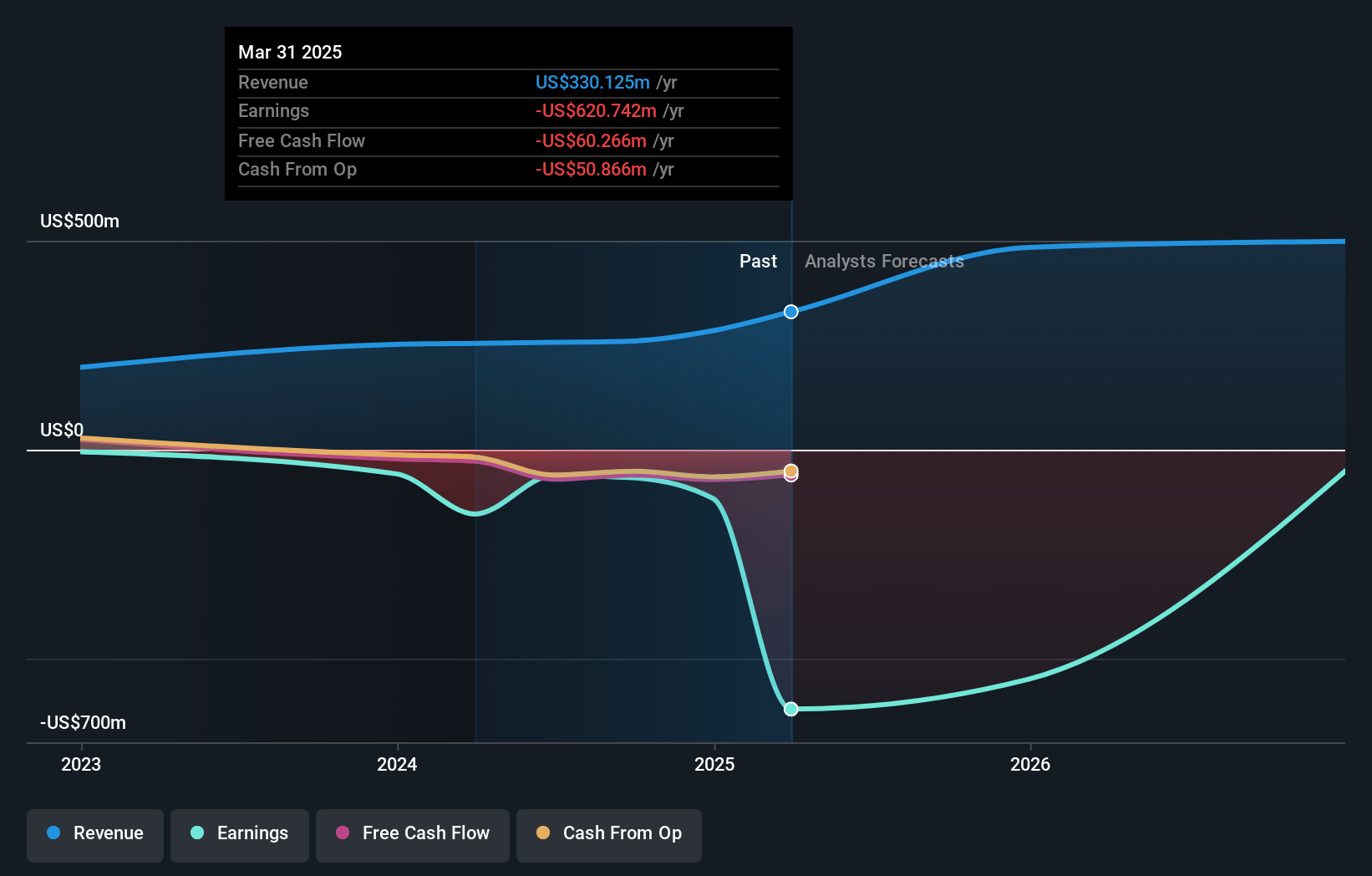

TechTarget Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming TechTarget's revenue will grow by 29.7% annually over the next 3 years.

- Analysts are not forecasting that TechTarget will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate TechTarget's profit margin will increase from -188.0% to the average US Media industry of 9.1% in 3 years.

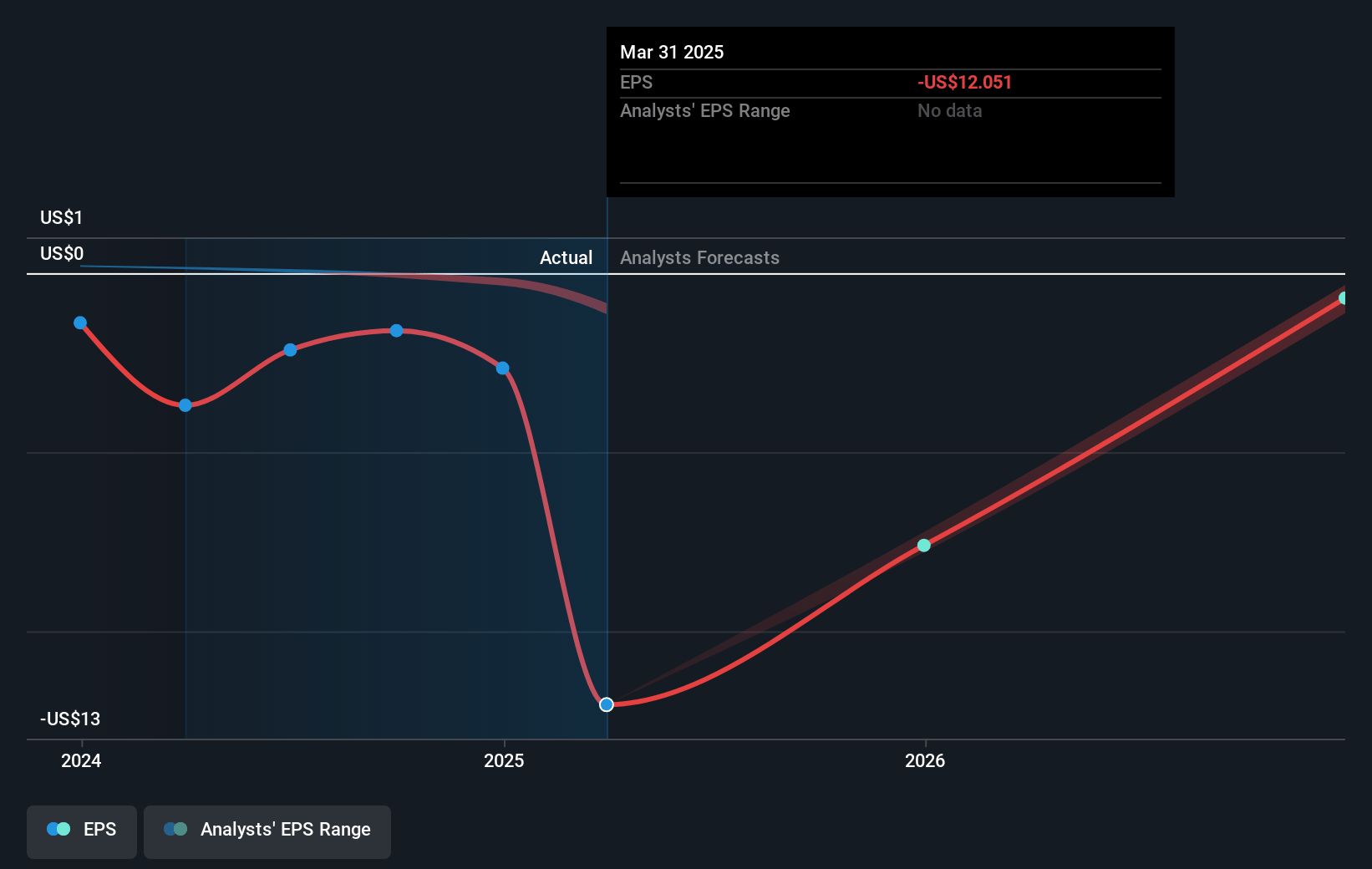

- If TechTarget's profit margin were to converge on the industry average, you could expect earnings to reach $65.6 million (and earnings per share of $0.75) by about July 2028, up from $-620.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.0x on those 2028 earnings, up from -0.8x today. This future PE is greater than the current PE for the US Media industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.92%, as per the Simply Wall St company report.

TechTarget Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift in how information is discovered and consumed-from traditional search to AI-enabled platforms-creates uncertainty around TechTarget's future audience acquisition and engagement strategies, potentially reducing web traffic and undermining advertiser demand, which could negatively impact revenue growth.

- Rising adoption of generative AI by B2B marketers and enterprises increases the risk that clients will build or insource their own lead generation and intent data capabilities, reducing dependence on third-party providers like TechTarget and potentially leading to higher customer churn and diminished revenues.

- Continuous investment required in proprietary data, AI infrastructure, new product development, and integration from recent M&A activity may pressure operating margins and net income, particularly if topline growth remains flat or negative, as indicated by a 6% YoY revenue decline in Q1 and guidance for flat revenues this year.

- Ongoing industry consolidation and the concentration of TechTarget's addressable market within the top 200 customers heightens the risk of budget reallocation among large software vendors and increased competitive leverage by bigger marketing platforms, which may lead to deteriorating pricing power, reduced ARPU, and eventual revenue contraction.

- Uncertainty regarding the impact of evolving privacy regulations and walled garden platforms poses a long-term risk to TechTarget's access to high-quality, first-party data for its intent products, potentially eroding differentiation, decreasing lead quality, and impacting both revenue and margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.333 for TechTarget based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $719.7 million, earnings will come to $65.6 million, and it would be trading on a PE ratio of 20.0x, assuming you use a discount rate of 6.9%.

- Given the current share price of $7.34, the analyst price target of $12.33 is 40.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.