Last Update07 May 25Fair value Decreased 5.30%

Key Takeaways

- Broader offerings and tech integration with automakers are expanding the subscriber base and stabilizing revenues through diversified pricing and partnerships.

- Exclusive content, innovation in AI, and strong customer loyalty are driving differentiation, reducing churn, and supporting sustainable revenue and margin growth.

- Ongoing shifts to digital streaming, aging core audiences, rising costs, and intense competition threaten revenue growth, margins, and subscriber retention.

Catalysts

About Sirius XM Holdings- Operates as an audio entertainment company in North America.

- The rapid increase in connected vehicles and integration of mobile-friendly features, such as SiriusXM 360L and app-based listening, is expanding the potential subscriber base to nearly 100 million vehicles. This wider addressable audience, combined with the company’s deepening partnerships with OEMs, supports long-term subscriber growth and higher recurring revenues.

- SiriusXM’s shift toward diversified subscription offerings, such as the launch of the targeted ad-supported subscription tier and customized in-car pricing, broadens appeal to price-sensitive users while maintaining premium packages for loyal customers. This is expected to drive ARPU expansion, reduce churn, and further stabilize net margins.

- The company continues to leverage its highly engaged, loyal, and aging core audience of car owners and commuters, evidenced by record customer satisfaction and low churn even after recent price increases. This insulates cash flows from short-term shifts in media consumption habits and creates durable earnings streams.

- Exclusive content deals, the integration of podcasting assets, and innovative ad tech solutions—including cross-channel monetization over audio, video, and social—support differentiation relative to competitors and unlock higher advertising and subscriber revenues over the long term.

- Strategic investment in AI-driven content curation and voice-activated interfaces on both in-car systems and app platforms positions SiriusXM to capture further share as consumer adoption of seamless, subscription-based audio continues to grow, driving sustained revenue growth and enhanced profitability as personalization lowers churn and lengthens subscriber lifetimes.

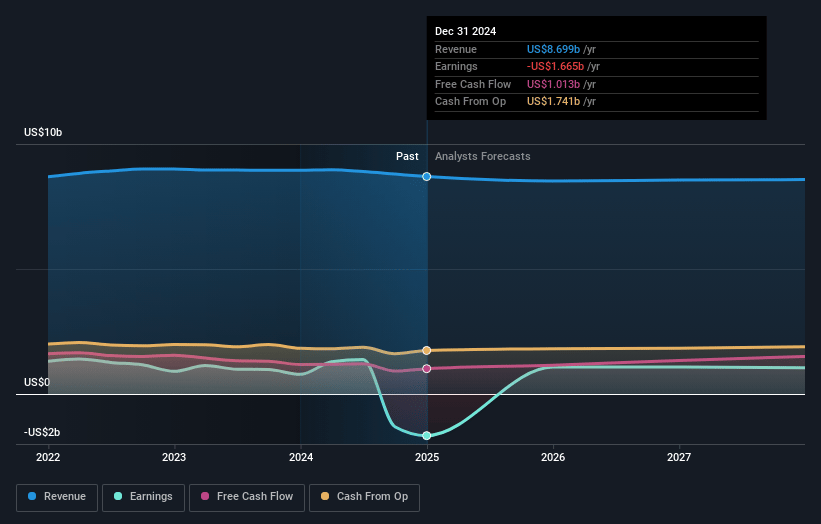

Sirius XM Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sirius XM Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sirius XM Holdings's revenue will decrease by 0.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -19.3% today to 13.9% in 3 years time.

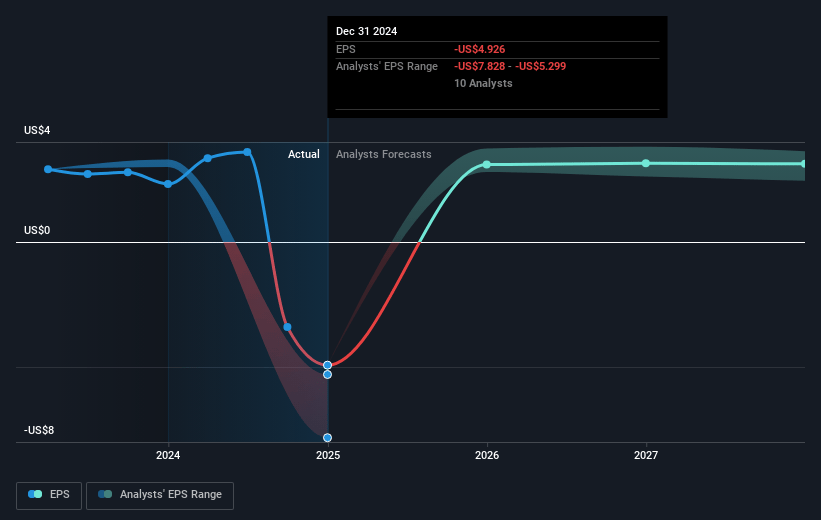

- The bullish analysts expect earnings to reach $1.2 billion (and earnings per share of $3.58) by about May 2028, up from $-1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, up from -4.4x today. This future PE is lower than the current PE for the US Media industry at 15.4x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

Sirius XM Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift from traditional radio consumption to on-demand streaming and podcasts continues to reduce Sirius XM’s audience engagement, as shown by negative streaming net adds in Q1 and only modest in-car subscriber growth, which puts long-term pressure on revenue and subscriber-related earnings.

- Generational changes in media preferences, including lower willingness to pay for satellite radio by younger cohorts, threaten future revenue streams as Sirius XM’s core in-car audience ages and newer drivers increasingly favor alternative digital platforms.

- Slowing subscriber growth and rising churn rates, illustrated by overall subscriber declines and management’s expectation of additional drag from “click to cancel,” short-term promotions, and reduced digital marketing, signal a trend of stagnating or declining revenue growth going forward.

- Rising content acquisition and royalty costs, combined with the need to invest in exclusive content and compete for talent with tech giants, pose a risk to net margins and could erode bottom-line earnings as Sirius XM seeks to keep its content offering competitive.

- Escalating competition from well-capitalized tech and streaming companies, alongside the proliferation of connected cars and smart infotainment systems, is likely to increase customer acquisition costs, fragment market share, and compress margins, putting further pressure on both revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sirius XM Holdings is $30.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sirius XM Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.7 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 8.5%.

- Given the current share price of $21.47, the bullish analyst price target of $30.0 is 28.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.