Key Takeaways

- Expansion in electric vehicles and streaming advances improves subscriber numbers and revenue, strengthening Sirius XM’s market position.

- Cost structure optimization and digital ad growth strategies enhance profitability and contribute positively to financial performance.

- Sirius XM faces challenges from declining subscription revenue, reduced marketing efforts, and competitive pressure, posing risks to profitability and future earnings.

Catalysts

About Sirius XM Holdings- Operates as an audio entertainment company in North America.

- Sirius XM Holdings is expanding its automotive subscription business through a 3-year OEM subscription program, which is strengthening growth in the self-pay subscriber base. This initiative is expected to improve revenue and reduce churn, enhancing long-term customer retention.

- The launch of SiriusXM services in Tesla and Rivian models, utilizing the 360L technology, expands the company's presence in the electric vehicle market. This increased reach is set to bolster subscriber numbers and drive revenue growth through new segments.

- The strategic shift towards streaming and digital content, including podcasts and exclusive sports and music events, is enhancing customer engagement and retention. This focus on high-margin digital offerings is likely to contribute positively to net margins and earnings by attracting a wider audience and advertisers.

- The company is aggressively optimizing its cost structure and operational efficiencies, targeting $200 million in annualized savings by the end of 2025. This focus on efficiency is expected to improve free cash flow and overall profitability, supporting favorable net margin trends.

- With its strong presence in the audio streaming market and strategic investments in ad technology, Sirius XM aims to capitalize on growing digital ad revenues. Enhanced ad capabilities will likely drive advertising revenue upward, benefiting overall financial performance and contributing to bullish growth projections.

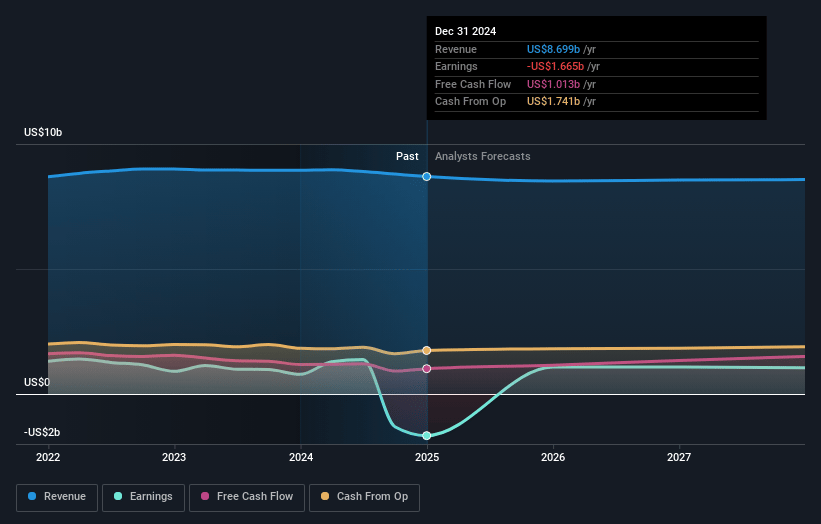

Sirius XM Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sirius XM Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sirius XM Holdings's revenue will decrease by 0.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -19.1% today to 12.9% in 3 years time.

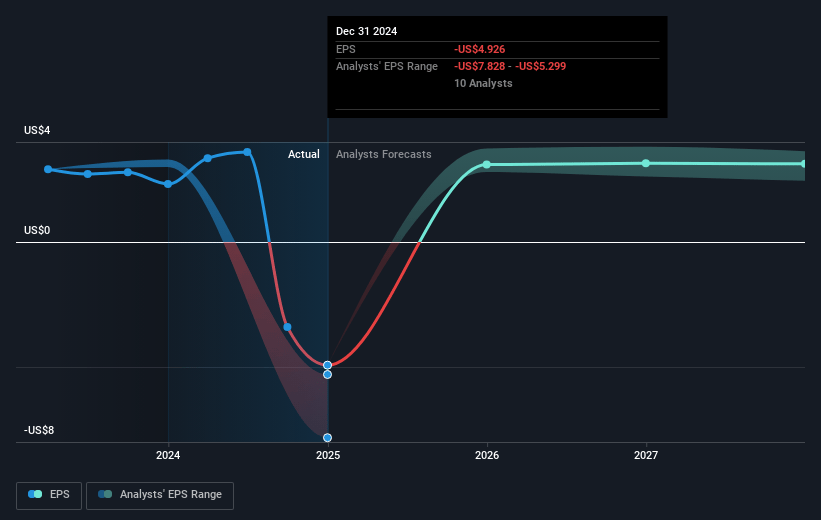

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $3.53) by about April 2028, up from $-1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, up from -4.2x today. This future PE is lower than the current PE for the US Media industry at 13.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

Sirius XM Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sirius XM's subscription revenue saw a decline of 4% compared to the previous year primarily because of slower subscriber growth and challenges in conversion rates, which negatively impact overall revenue.

- Adjusted EBITDA for the fourth quarter declined by approximately 4% year-over-year, which could indicate pressure on the company's profitability margins.

- The company's strategy to reduce marketing to higher-cost, higher-churn audiences might reduce subscriber acquisition in the short term, affecting future revenue streams.

- The potential short-term onetime impacts from click to cancel and other subscriber adjustments are expected to pressure subscriber results, particularly in the first half of the year, potentially affecting net margins.

- Pressure on the conversion rates due to competition from other services and newer trialers, particularly younger consumers entering the automotive funnel, poses a risk to maintaining subscriber retention levels, ultimately impacting future earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sirius XM Holdings is $28.52, which represents one standard deviation above the consensus price target of $24.1. This valuation is based on what can be assumed as the expectations of Sirius XM Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.8 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 8.6%.

- Given the current share price of $20.42, the bullish analyst price target of $28.52 is 28.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:SIRI. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.