Narratives are currently in beta

Key Takeaways

- Scholastic's strategic investments in Book Fairs and acquisitions in its Entertainment segment aim to enhance revenue and operational efficiency.

- New literacy programs and restructuring efforts are poised to improve margins and drive sustainable growth.

- Decreased revenues and cash flow, along with education policy uncertainties, pose financial flexibility challenges and potential earnings impacts across segments and operations.

Catalysts

About Scholastic- Scholastic Corporation publishes and distributes children’s books worldwide.

- Scholastic is leveraging its global children's media and content capabilities to drive long-term growth. New models, channels, and products are being explored, which could increase revenue streams and enhance profitability by optimizing existing intellectual properties.

- The company is making strategic investments to expand its Book Fairs, significantly increasing fair counts and engagement, which should boost revenue and support modest growth in fiscal 2025 and beyond.

- Scholastic's Entertainment segment is being bolstered by the acquisition of 9 Story Media Group, with a promising development slate including popular franchises. This integration could lead to higher revenue and operating margin improvements starting in fiscal 2026.

- The Education Solutions division is developing new literacy programs aligned with educational trends, expected to launch in fiscal 2026, which may significantly impact future revenue growth and margins.

- Strategic cost actions, targeted investments, and organizational restructuring are underway to optimize operational efficiency, expected to improve net margins and reduce discretionary spending, contributing to better financial performance in the coming years.

Scholastic Future Earnings and Revenue Growth

Assumptions

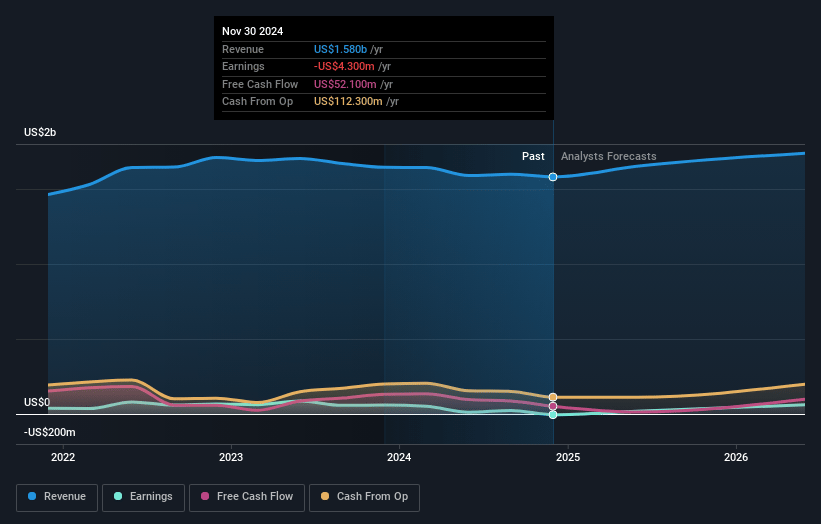

How have these above catalysts been quantified?- Analysts are assuming Scholastic's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 13.9% in 3 years time.

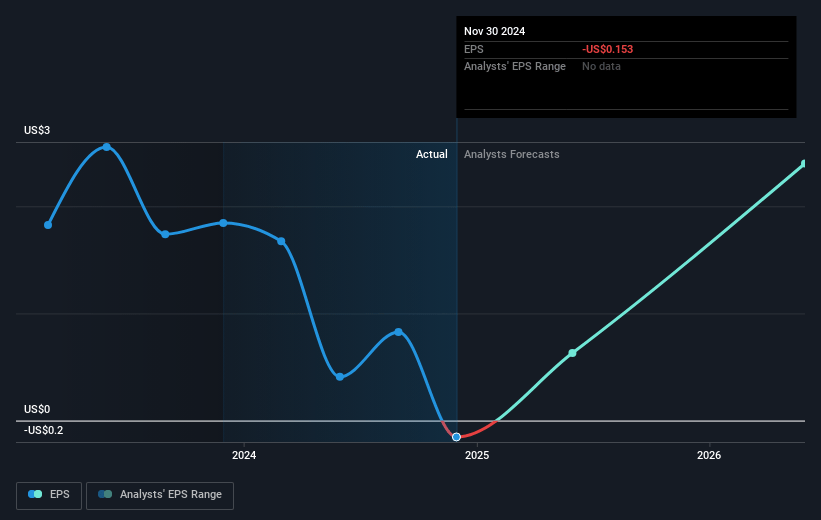

- Analysts expect earnings to reach $266.4 million (and earnings per share of $10.38) by about January 2028, up from $-4.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.6x on those 2028 earnings, up from -135.7x today. This future PE is lower than the current PE for the US Media industry at 13.8x.

- Analysts expect the number of shares outstanding to decline by 2.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.3%, as per the Simply Wall St company report.

Scholastic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenue in the Children's Book Publishing and Distribution segment decreased by 6% in the second quarter due to timing factors, which could imply future revenue volatility or potential challenges in hitting growth targets.

- The Entertainment segment faced an operating loss, partially due to increased amortization expense on intangible assets, indicating challenges in profitability and potential for continued negative impact on net margins.

- Education Solutions segment saw a 12% decrease in revenues due to lower spending on supplemental curriculum products, suggesting continued sales headwinds that could impact earnings.

- The uncertainty around potential changes in U.S. education policy, including decentralization of funding, presents a risk to revenue streams that depend on state and local education budgets.

- Cash flow from operations decreased significantly year-over-year due to higher inventory purchases, higher interest payments, and lower customer remittances, which could strain financial flexibility and impact overall earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.0 for Scholastic based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $266.4 million, and it would be trading on a PE ratio of 4.6x, assuming you use a discount rate of 7.3%.

- Given the current share price of $20.77, the analyst's price target of $40.0 is 48.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives