Key Takeaways

- Digital and streaming initiatives, local sports content, and advanced ad tech are boosting audience engagement, revenue diversification, and digital profitability.

- Regulatory shifts, improved M&A prospects, and stable retransmission revenues are enhancing Sinclair's operational flexibility, scalability, and long-term earnings stability.

- Declining traditional TV revenues, high debt, weak digital growth, uncertain regulatory gains, and sports rights fragmentation threaten Sinclair's earnings and operational stability.

Catalysts

About Sinclair- A media company, provides content on local television stations and digital platforms in the United States.

- The upcoming 2026 political cycle, featuring a high number of competitive Senate, Gubernatorial, and House races within Sinclair's markets, is likely to drive a significant increase in political ad spending, providing a major revenue tailwind for the company in election years.

- Sinclair's expansion of digital and streaming initiatives, particularly through the hiring of an executive with deep streaming expertise to lead the Tennis Channel, a unified national sponsorship platform, and continued investment in data-driven ad tech (Compulse), position the company to capture a greater share of the growing OTT/CTV ad market and improve both revenue diversification and digital margins.

- Increased demand for highly localized content and sports programming is enhancing audience engagement for Sinclair's local news, live sports, and podcasts, supporting stronger advertiser relationships while growing revenue and sustaining market share in the face of national media fragmentation.

- Industry-wide expectations for regulatory reform and a more favorable M&A environment could allow Sinclair to further consolidate, unlock operational efficiencies, and scale, with the recently extended debt maturity giving the company the financial flexibility to act, positively impacting earnings and margin growth over the long term.

- Continued moderation in subscriber churn, alongside creative bundling agreements and renewal of major distribution contracts, are stabilizing and growing retransmission revenues, supporting longer-term top-line expansion and contributing to improved overall earnings stability.

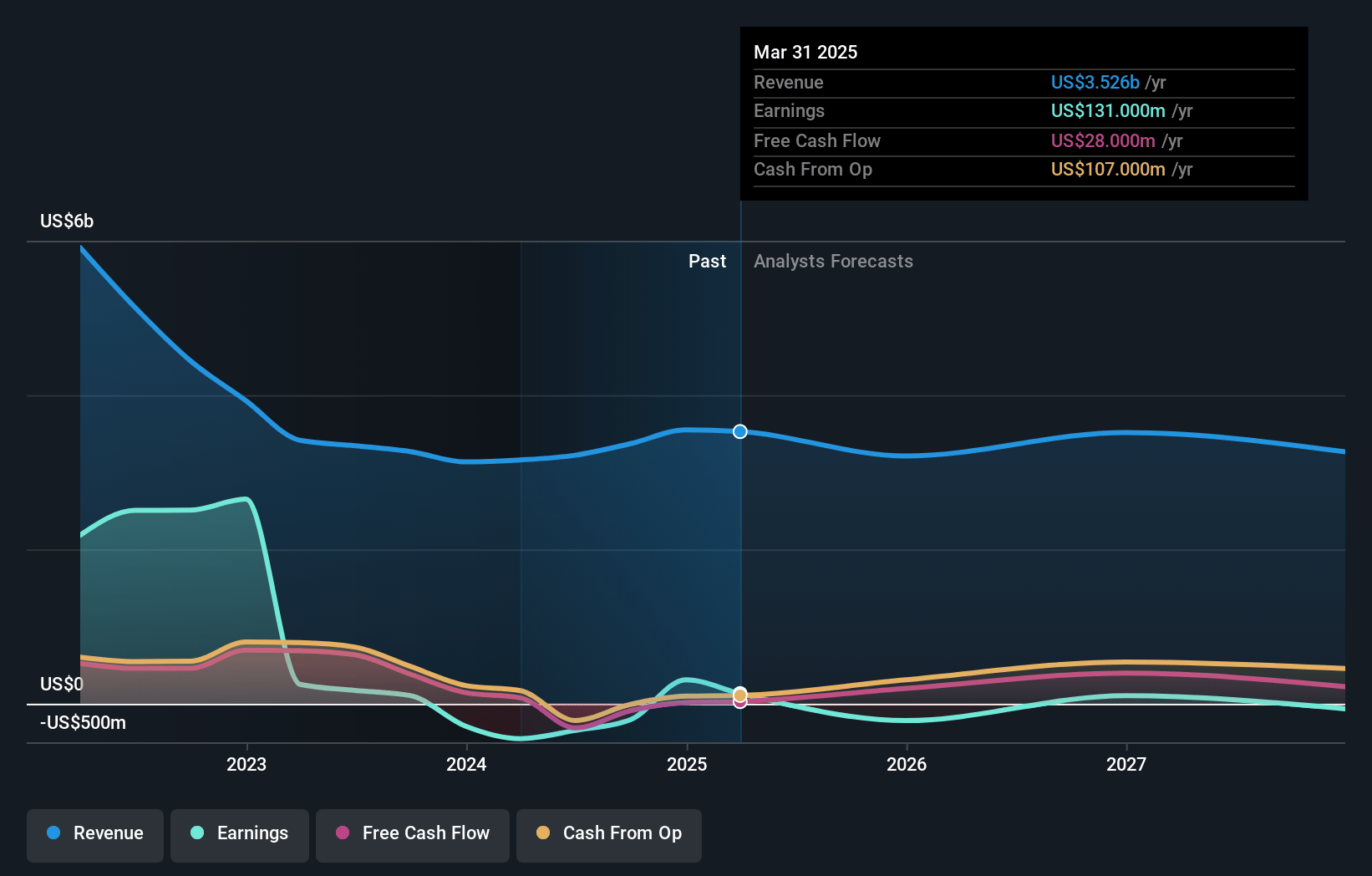

Sinclair Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sinclair's revenue will decrease by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.7% today to 0.9% in 3 years time.

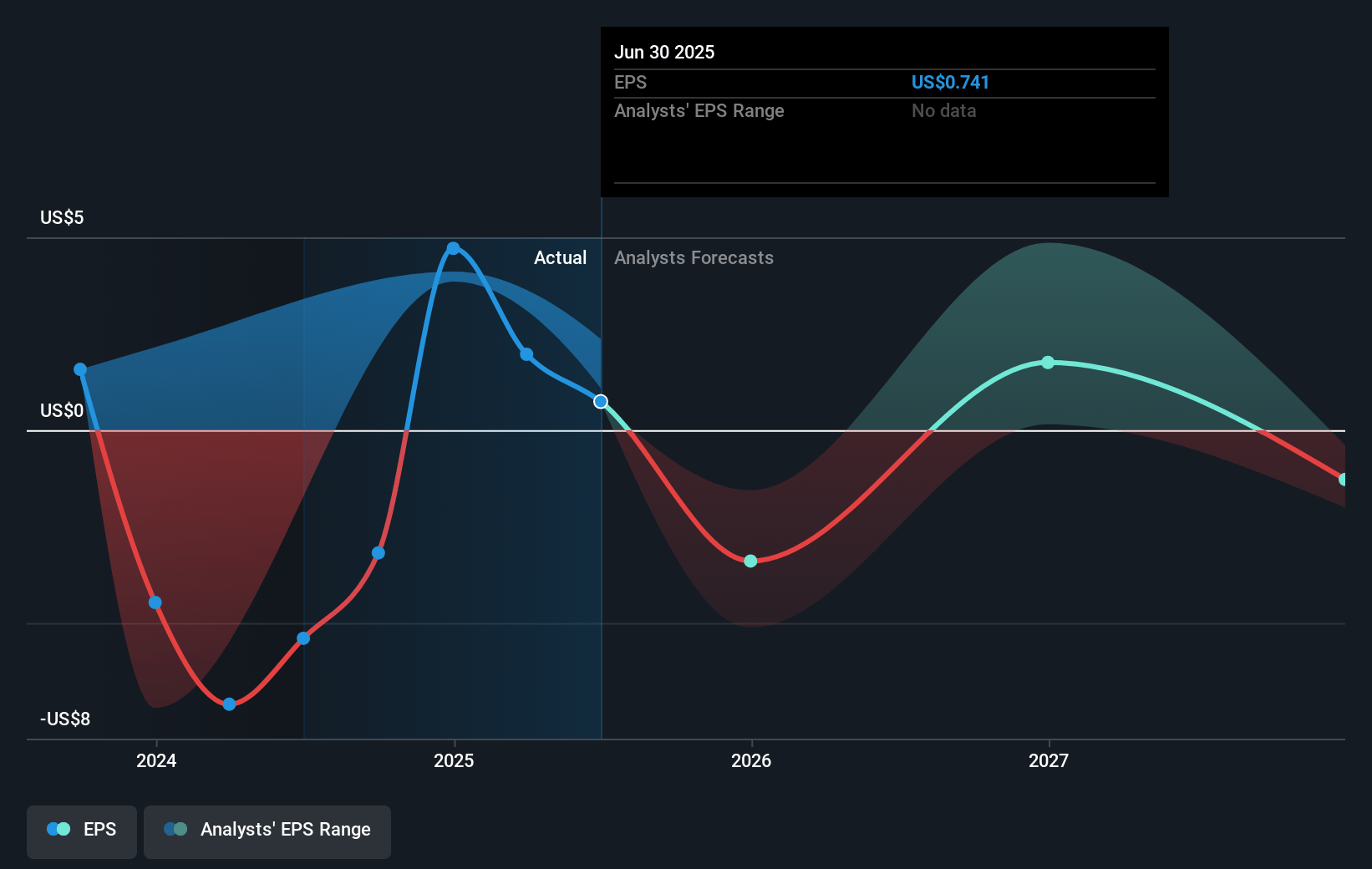

- Analysts expect earnings to reach $29.9 million (and earnings per share of $0.4) by about July 2028, down from $131.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 63.8x on those 2028 earnings, up from 8.0x today. This future PE is greater than the current PE for the US Media industry at 17.8x.

- Analysts expect the number of shares outstanding to grow by 4.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Sinclair Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent decline in linear TV consumption and ongoing cord-cutting, coupled with limited visibility into advertising trends and cautious advertiser behavior due to macroeconomic and tariff-related uncertainties, may significantly reduce future core advertising revenues and overall top-line growth.

- Heavy indebtedness, even after refinancing, constrains Sinclair's financial flexibility and increases interest expense, which could weigh on net margins and earnings, particularly if cash flows soften or economic conditions remain volatile.

- Inability to fully offset declines in traditional broadcast revenue by scaling digital platforms and competing effectively with digital-first media companies for advertising dollars may result in lower-than-expected growth in digital ad revenues and margin pressure.

- Potential failure to achieve or capitalize on anticipated regulatory changes-such as deregulatory support or relaxed media ownership rules-could limit Sinclair's ability to consolidate, grow through accretive M&A, or reduce major expense items (e.g., network programming fees), with direct implications for future earnings and operational efficiencies.

- The trend of sports leagues and content owners moving toward direct-to-consumer streaming and fragmentation in sports rights could diminish the value and revenue potential of Sinclair's regional sports networks and broadcast sports content, negatively impacting mid

- to long-term distribution revenues and audience engagement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.143 for Sinclair based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $29.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.3 billion, earnings will come to $29.9 million, and it would be trading on a PE ratio of 63.8x, assuming you use a discount rate of 11.6%.

- Given the current share price of $15.04, the analyst price target of $17.14 is 12.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.