Narratives are currently in beta

Key Takeaways

- Focus on CTV growth and generative AI innovation positions PubMatic for increased revenue and improved net margins.

- Strategic partnerships with major companies enhance revenue streams and profit margins through targeted market growth.

- Dependency on political ads, competition in CTV, execution risk in new revenue streams, and DSP reliance pose significant revenue volatility risks.

Catalysts

About PubMatic- A technology company, engages in the provision of a cloud infrastructure platform that enables real-time programmatic advertising transactions for digital content creators, advertisers, agencies, agency trading desks, and demand side platforms worldwide.

- PubMatic's focus on CTV (Connected TV), with monetized impression volume up over 100% year-over-year and now working with 70% of the top 30 streaming publishers, indicates a significant growth driver expected to boost future revenue, enhanced by increasing adoption of their new CTV tools and marketplace.

- The integration of generative AI to classify ads efficiently and enhance political ad spending capabilities demonstrates PubMatic's innovative approach to unlocking new inventory opportunities, which is likely to result in increased revenues and improved net margins.

- The addition of over 80,000 mobile app developers into PubMatic’s sales funnel and a 20% year-over-year growth in the mobile app business show a solid position for continued growth in this segment, expected to positively impact revenue.

- Strategic partnerships with major companies like X (formerly Twitter) for expanding their ad reach outside their walled garden, and integration partnerships with Western Union and other commerce media illustrate PubMatic's targeted growth strategy in new markets, which should enhance revenue streams and profit margins.

- Investment in sell-side optimization through partnerships like Dentsu's Mercury for Media initiative and deep integration into buyer ecosystems like supply path optimization and Connect underline a forward-looking growth strategy that can increase revenues and potentially improve EBITDA margins as these partnerships mature.

PubMatic Future Earnings and Revenue Growth

Assumptions

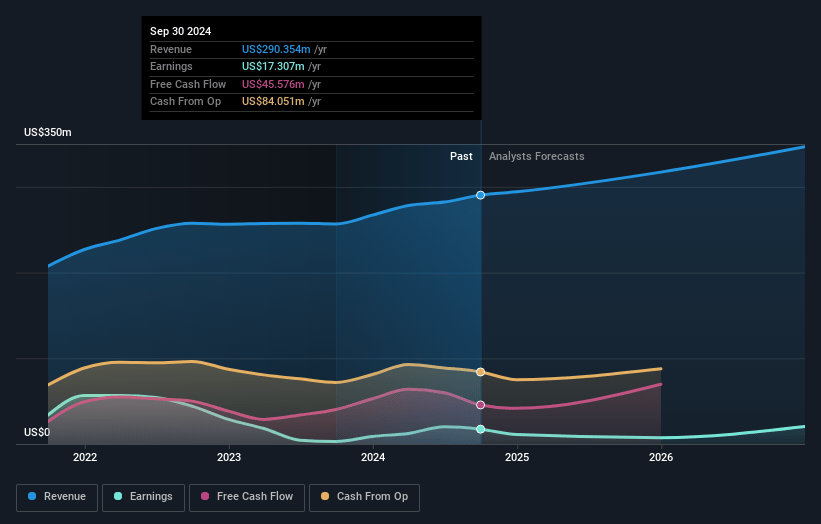

How have these above catalysts been quantified?- Analysts are assuming PubMatic's revenue will grow by 8.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.0% today to 6.1% in 3 years time.

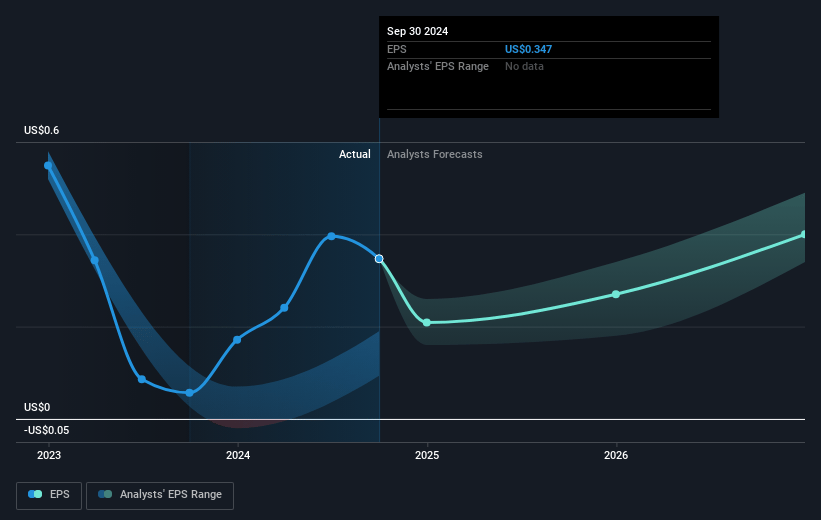

- Analysts expect earnings to reach $22.4 million (and earnings per share of $0.44) by about January 2028, up from $17.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 54.0x on those 2028 earnings, up from 40.7x today. This future PE is greater than the current PE for the US Media industry at 14.1x.

- Analysts expect the number of shares outstanding to grow by 1.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.29%, as per the Simply Wall St company report.

PubMatic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces risks related to its dependence on political advertising, which may create volatility in revenue, particularly if political ad demand fluctuates or decreases in non-election years.

- Increasing competition and supply growth in CTV could lead to pricing pressure on CPM rates, potentially impacting revenue growth and net margins.

- There is execution risk in scaling emerging revenue streams like Commerce Media, which requires effective technology integration and customer adoption to maintain earnings growth.

- The company may face challenges from macroeconomic conditions affecting advertiser budgets, which can result in uneven demand trends and impact overall revenue.

- Reliance on a few large DSPs for significant portions of business poses a risk due to potential changes in their spending levels or strategic shifts, adversely affecting revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.11 for PubMatic based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $365.9 million, earnings will come to $22.4 million, and it would be trading on a PE ratio of 54.0x, assuming you use a discount rate of 6.3%.

- Given the current share price of $14.73, the analyst's price target of $20.11 is 26.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives