Key Takeaways

- News Corp's strategic partnership with AI firms and litigation plans aim to boost revenues and protect intellectual property, enhancing margin efficiency.

- Focused B2B growth in Dow Jones and HarperCollins' digital sales position them for significant revenue and margin expansion amid rising global demand and regulatory challenges.

- Legal challenges, advertising volatility, property market hurdles, streaming investment costs, and business model transition risks could impact revenue and profitability.

Catalysts

About News- A media and information services company, creates and distributes authoritative and engaging content, and other products and services for consumers and businesses worldwide.

- News Corp's strategic partnership and litigation plans with AI companies, such as OpenAI, are expected to generate additional revenues and protect intellectual property, potentially enhancing margins by leveraging AI for content licensing and operational efficiencies.

- Dow Jones' focus on B2B growth with strong performance in the Professional Information business, especially in Risk and Compliance and Energy, could enhance revenue growth and improve segment profitability due to high demand for compliance solutions amid increasing global regulatory challenges.

- REA Group's potential in digital real estate, with its expansion in financial services and technology enhancements, is expected to drive future revenue growth and improve earnings as the company capitalizes on high listing volumes and yield increases in the housing market.

- HarperCollins' strong performance in digital sales, notably in audio books and e-books, positions the publishing unit for continued revenue growth and margin expansion, supported by high demand for digital formats and anticipated seasonal sales boosts.

- Continued strategic transformation efforts, such as maximizing value from Foxtel through potential restructuring and leveraging strong brands like The Wall Street Journal and Dow Jones, are expected to address market undervaluation and improve overall company financials through asset optimization and revenue diversification.

News Future Earnings and Revenue Growth

Assumptions

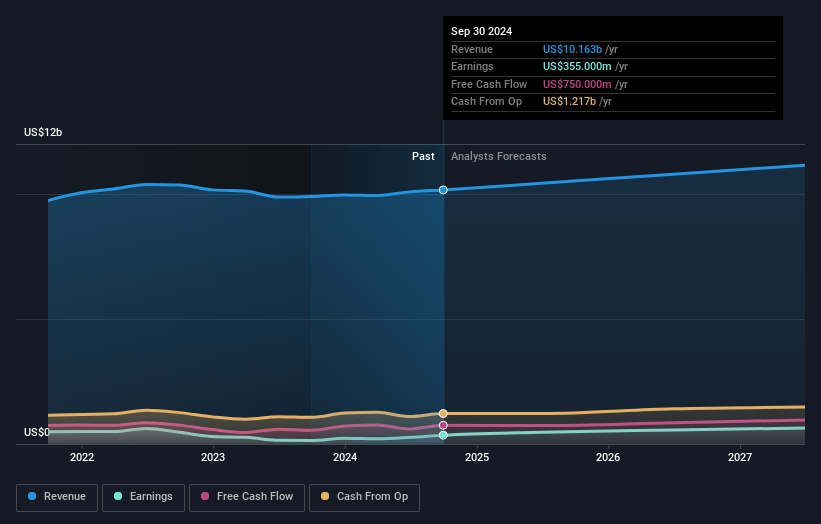

How have these above catalysts been quantified?- Analysts are assuming News's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.5% today to 5.9% in 3 years time.

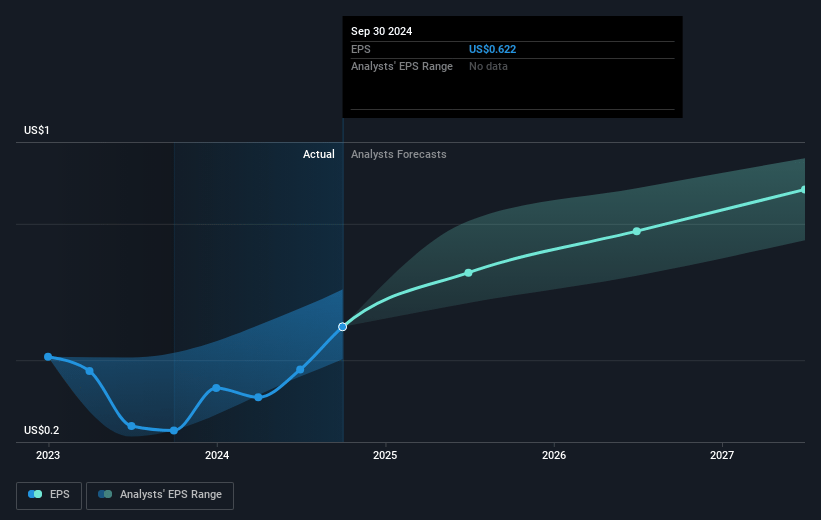

- Analysts expect earnings to reach $663.7 million (and earnings per share of $1.2) by about January 2028, up from $355.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $744.2 million in earnings, and the most bearish expecting $545.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.0x on those 2028 earnings, down from 45.0x today. This future PE is greater than the current PE for the US Media industry at 13.4x.

- Analysts expect the number of shares outstanding to decline by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.62%, as per the Simply Wall St company report.

News Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Legal proceedings against AI companies for misuse of News Corp's intellectual property could lead to significant litigation costs, impacting net margins and overall earnings.

- Volatility remains in the advertising market, with advertising revenue already accounting for a smaller percentage of total revenue, and further declines could reduce revenue growth.

- The U.S. property market faces challenges with high mortgage rates impacting sales and lead volume, which could negatively affect digital real estate revenues.

- Shift towards streaming, while growing, involves upfront costs such as investment in new products and technology, which could pressure profit margins in the near term.

- There is execution risk involved with transitioning Foxtel's business model and potential restructuring or divestment activities; any delays or failures could impair revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $35.63 for News based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $24.14.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $11.2 billion, earnings will come to $663.7 million, and it would be trading on a PE ratio of 36.0x, assuming you use a discount rate of 6.6%.

- Given the current share price of $28.15, the analyst's price target of $35.63 is 21.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives