Key Takeaways

- Persistent declines in core app engagement and shifting youth preferences threaten revenue growth, with innovation efforts failing to reignite sustained user activity.

- Increasing regulatory costs and demographic headwinds challenge profitability and limit the impact of international expansion and new features.

- Advanced AI features, global expansion, organizational streamlining, portfolio diversification, and alternative payments are set to drive efficiency and sustainable earnings growth.

Catalysts

About Match Group- Engages in the provision of digital technologies.

- Persistent declines in Tinder's monthly active users, down 9% year-over-year and continuing a multi-quarter trend, indicate that even with new features and AI-driven discovery, core user engagement remains weak. This erosion in the largest brand's user base is likely to suppress payer counts and direct revenue growth well into future periods.

- Despite management's focus on innovation and reorganization, younger demographics are increasingly seeking alternative online socialization modes and show fatigue toward traditional dating apps, which could deepen long-term challenges in reigniting growth and drive further compression in average revenue per user and net margins.

- The company faces greater exposure to global digital privacy regulation and rising consumer data protection concerns, especially as new AI-driven personalization features are rolled out. This is expected to elevate compliance and technology costs, putting increasing pressure on margins and making it harder to profitably scale new features internationally.

- Expanding into international markets, particularly in regions like Asia and Latin America, may not offset growth headwinds because broader demographic shifts—such as lower population growth and delayed marriage ages—could meaningfully shrink the pool of new potential online dating customers, resulting in muted topline revenue expansion.

- Proliferation of advanced AI/VR-powered social platforms outside the dating vertical threatens to further siphon user engagement away from Match Group's offerings, ultimately constraining both organic user acquisition and undermining long-term earnings power.

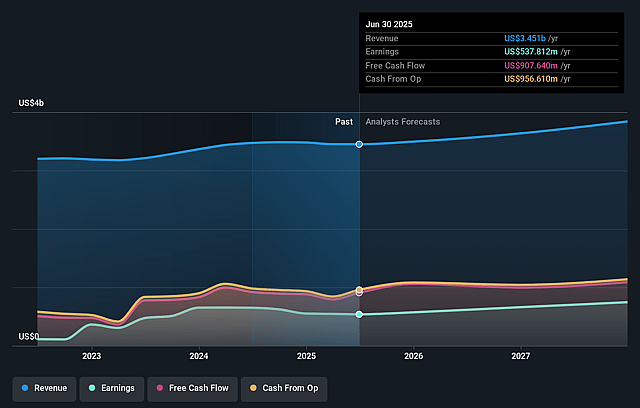

Match Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Match Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Match Group's revenue will grow by 1.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 15.8% today to 16.4% in 3 years time.

- The bearish analysts expect earnings to reach $595.3 million (and earnings per share of $2.51) by about July 2028, up from $545.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, down from 15.2x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 17.4x.

- Analysts expect the number of shares outstanding to decline by 4.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.6%, as per the Simply Wall St company report.

Match Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating integration of advanced AI-driven features, such as personalized daily matches and conversational voice-based experiences, is already improving user engagement and match quality, which can stimulate long-term retention and new user acquisition, benefitting both future revenue and earnings.

- The company’s organizational transformation into a more unified and product-led structure, with significant cost reductions and a focus on product velocity, is expected to unlock operational efficiencies and allow for reinvestment into growth initiatives, enhancing operating margins and sustainable earnings growth.

- Expansion efforts across international markets, including strategic brand launches in high-growth regions like Latin America, Asia, and the Middle East, are positioning Match Group to capture a broader, underserved user base, which could drive robust top-line revenue increases over the coming years.

- Hinge’s continued double-digit revenue growth, high user momentum, and successful global expansion demonstrate portfolio diversification and the company’s ability to incubate and scale hit brands, which can strengthen consolidated revenue streams and margin profiles.

- The adoption of alternative app payment platforms due to recent legal changes may allow Match Group to reduce app store commission expenses, directly increasing net margins and boosting bottom-line earnings even if top-line growth remains moderate.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Match Group is $28.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Match Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $46.0, and the most bearish reporting a price target of just $28.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $595.3 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 8.6%.

- Given the current share price of $33.87, the bearish analyst price target of $28.0 is 21.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.