Last Update01 May 25

Key Takeaways

- Strategic expansion in Motion Pictures and ancillary franchise opportunities, like John Wick, forecast potential revenue growth through diversified projects and new ventures.

- Favorable distribution deals and strategic shifts in streaming services anticipate enhanced profitability and revenue, leveraging content and digital revenue scaling.

- Intense competition, declining subscriptions, high leverage, and operational delays pose significant challenges to Lionsgate's revenue and financial flexibility.

Catalysts

About Lionsgate Studios- Engages in the motion picture and television studio operation business in Canada, the United States, and internationally.

- Lionsgate is strategically expanding their Motion Picture business by capitalizing on mid-budget films and developing sequels, such as Den of Thieves 3, highlighting potential revenue growth as these projects enter production and the slate diversifies.

- The company is enhancing the value of ancillary opportunities from franchises like John Wick, with ventures such as stage plays, video games, and themed experiences, which can significantly bolster future earnings.

- Lionsgate has established favorable distribution deals, like those with Starz and Amazon Prime Video, which provide a robust post-theatrical film windowing strategy, thus setting the stage for revenue and earnings enhancement from 2025 through 2028.

- The separation of Starz, with a shift towards digital revenue and new bundling agreements, positions it for increased profitability and revenue scaling as streaming continues to evolve, impacting Starz's earnings.

- Lionsgate's overall creative output, bolstered by a slate of new projects in both TV and film, ensures sustained content delivery and diversification, likely leading to stable or increasing revenue and potentially improved net margins.

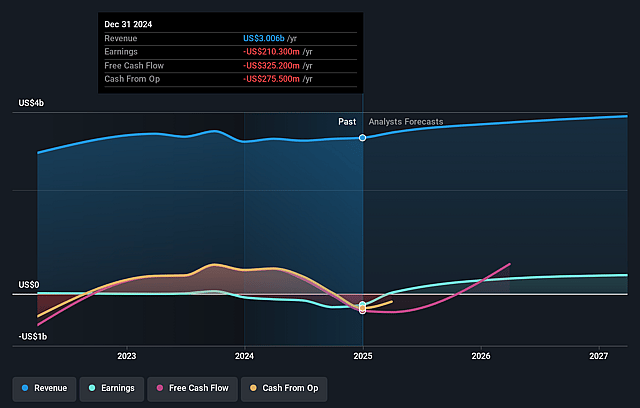

Lionsgate Studios Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lionsgate Studios's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -7.0% today to 19.8% in 3 years time.

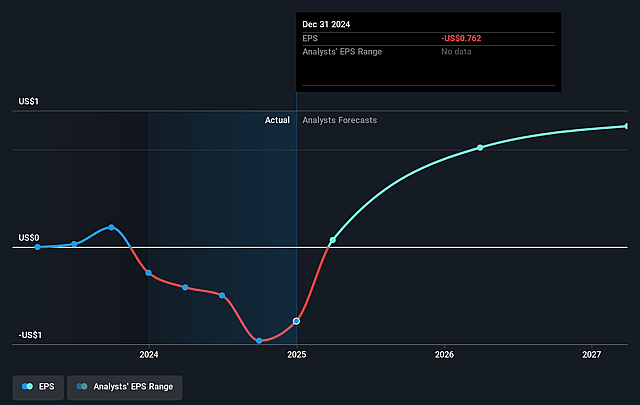

- Analysts expect earnings to reach $708.7 million (and earnings per share of $2.45) by about May 2028, up from $-210.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.4x on those 2028 earnings, up from -9.9x today. This future PE is lower than the current PE for the US Entertainment industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Lionsgate Studios Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive environment in television production is challenging, with market corrections impacting the diversification of buyer mixes and shrinking profit margins in Lionsgate's TV segment. This is likely to affect revenue and net margins.

- The continued linear subscriber losses at Starz and the resulting pressure on subscription revenue amidst industry declines present a challenge to maintaining stable revenue growth.

- High leverage at the studio level could affect Lionsgate's earnings or financial flexibility, making it challenging to invest in future growth opportunities or manage interest rate increases.

- The delay in production schedules and the time for new movies and series to hit the market, exacerbated by past strikes and the impact of the LA wildfires on the creative community, could limit short-term revenue growth opportunities.

- There is execution risk associated with entering new business models and segments, such as ancillary markets and bundled digital services, which may not deliver the anticipated revenue contributions if not successful.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $12.167 for Lionsgate Studios based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $15.0, and the most bearish reporting a price target of just $8.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $708.7 million, and it would be trading on a PE ratio of 8.4x, assuming you use a discount rate of 11.4%.

- Given the current share price of $7.23, the analyst price target of $12.17 is 40.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.