Last Update01 May 25Fair value Increased 75%

Key Takeaways

- Heavy reliance on non-recurring licensing deals and industry cost pressures threaten long-term margin, growth, and earnings stability.

- Competitive, platform, and viewer behavior risks challenge international expansion, subscriber growth, and premium valuation assumptions.

- CuriosityStream’s strategic focus on licensing, operational efficiency, and diversified partnerships drives resilient financial growth, international expansion, and reduced reliance on direct consumer markets.

Catalysts

About CuriosityStream- A media and entertainment company, provides factual content through multiple channels.

- Despite recent positive earnings and revenue momentum, there is elevated investor optimism around CuriosityStream’s ability to keep scaling licensing revenues—particularly from AI companies and hyperscalers—even though such deals are not contractually recurring, introducing risk to future topline growth and potential volatility in earnings.

- The stock appears to be pricing in ongoing robust international expansion facilitated by falling translation costs and multi-currency rollouts, although competitive barriers (including piracy and platform accessibility issues in emerging markets) threaten to limit subscriber and licensing revenue growth abroad.

- Investors are likely ascribing durable margin expansion due to perceived structural operating leverage from content amortization declines and cost rationalization, possibly underestimating the rising industry-wide pressure from escalating content production/licensing costs, which could compress future net margins.

- There is an expectation that the surge in demand for educational and factual content will persist, offsetting challenges from audience fatigue or shifts toward short-form/user-generated video consumption, yet increasing competition from tech giants and changing viewer behaviors may restrict long-term revenue growth and lead to higher customer acquisition costs.

- Premium valuation may reflect assumptions that broader streaming market growth and ongoing linear TV decline will deliver sustained subscriber and revenue increases for CuriosityStream, despite risks of subscription fatigue, greater churn, and marginalization due to industry consolidation and bundling favoring larger platforms—factors that could impair future earnings resilience.

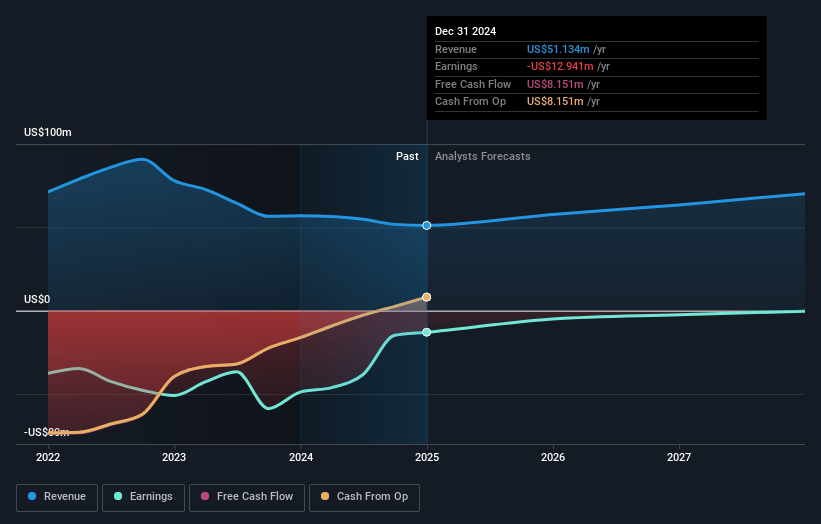

CuriosityStream Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CuriosityStream's revenue will grow by 15.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -14.0% today to 10.4% in 3 years time.

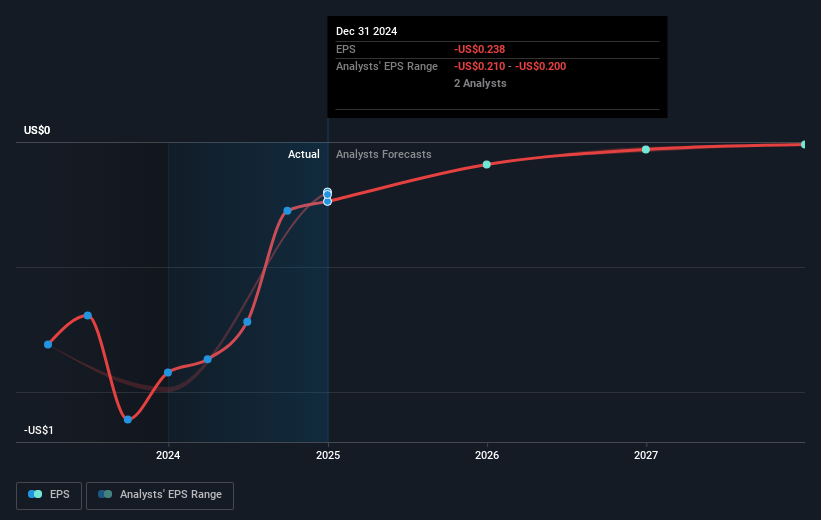

- Analysts expect earnings to reach $8.6 million (and earnings per share of $0.1) by about June 2028, up from $-7.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.5x on those 2028 earnings, up from -52.2x today. This future PE is greater than the current PE for the US Entertainment industry at 21.2x.

- Analysts expect the number of shares outstanding to grow by 5.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.47%, as per the Simply Wall St company report.

CuriosityStream Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid growth in licensing revenue—particularly to technology and AI companies—highlights CuriosityStream’s strong positioning within the secular trend of rising demand for high-quality factual and data-rich content, which could sustain or accelerate top-line revenue growth and insulate the business from fluctuations in direct consumer subscriptions.

- Operational efficiency, ongoing cost rationalization, and the potential for GenAI-driven reductions in translation and content-related expenses support structurally improving gross and net margins, increasing the probability of positive, sustainable earnings growth in the long-term.

- Five consecutive quarters of positive free cash flow, first-ever positive net income, and sizable cash reserves with zero debt provide considerable operating flexibility, enabling reinvestment in growth and supporting both dividend payments and potential strategic initiatives that could further strengthen the business’s long-term financial profile.

- Increased international expansion through multi-currency launches and declining translation costs directly aligns with the global adoption of streaming and globalization of content consumption, creating sustainable opportunities for international revenue and subscriber growth beyond domestic market saturation.

- The company’s deepening relationships with third-party partners—including tech “hyperscalers,” traditional media firms, and increasingly, government entities—point toward scalable institutional partnership revenue, a key long-term trend that can diversify and stabilize revenue streams and reduce reliance on volatile direct-to-consumer marketing efforts.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.4 for CuriosityStream based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $4.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $83.0 million, earnings will come to $8.6 million, and it would be trading on a PE ratio of 53.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of $6.87, the analyst price target of $5.4 is 27.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.