Narratives are currently in beta

Key Takeaways

- Comcast's strategic focus on bundled services and convergence with high-speed Internet and wireless offerings aims to enhance revenue, reduce churn, and improve net margins.

- Investments in Epic Universe and broadcasting sports events like the Paris Olympics demonstrate efforts to drive revenue and profitability across various segments.

- Declines in video and broadband revenue, alongside strategic uncertainties and competitive pressures, pose challenges to Comcast's growth and profitability.

Catalysts

About Comcast- Operates as a media and technology company worldwide.

- Comcast's focus on convergence with high-speed Internet and wireless services positions it to maintain a leadership role in connectivity, potentially increasing revenue from bundled services and reducing customer churn, thereby positively impacting net margins.

- The development of Epic Universe as a premier theme park destination is expected to significantly boost revenue and profitability by transforming Universal Orlando into a weeklong vacation experience, enhancing visitor numbers and per capita spending.

- NBCUniversal's successful broadcast and streaming of the Paris Olympics, with record revenue generation, demonstrates its capability to leverage sports events for media segment growth and drive profitability across broadcast and streaming platforms like Peacock.

- Comcast's investment in Xfinity Mobile and its integrated broadband offering aims to further penetrate the wireless market. This strategy is likely to enhance overall customer value, reduce churn, and improve profitability through increased service revenue and ARPU growth.

- Comcast's consideration of creating a new company for its cable networks could lead to streamlined operations and targeted strategic initiatives, potentially unlocking shareholder value and allowing remaining businesses to focus on higher-growth opportunities, thereby positively impacting earnings growth.

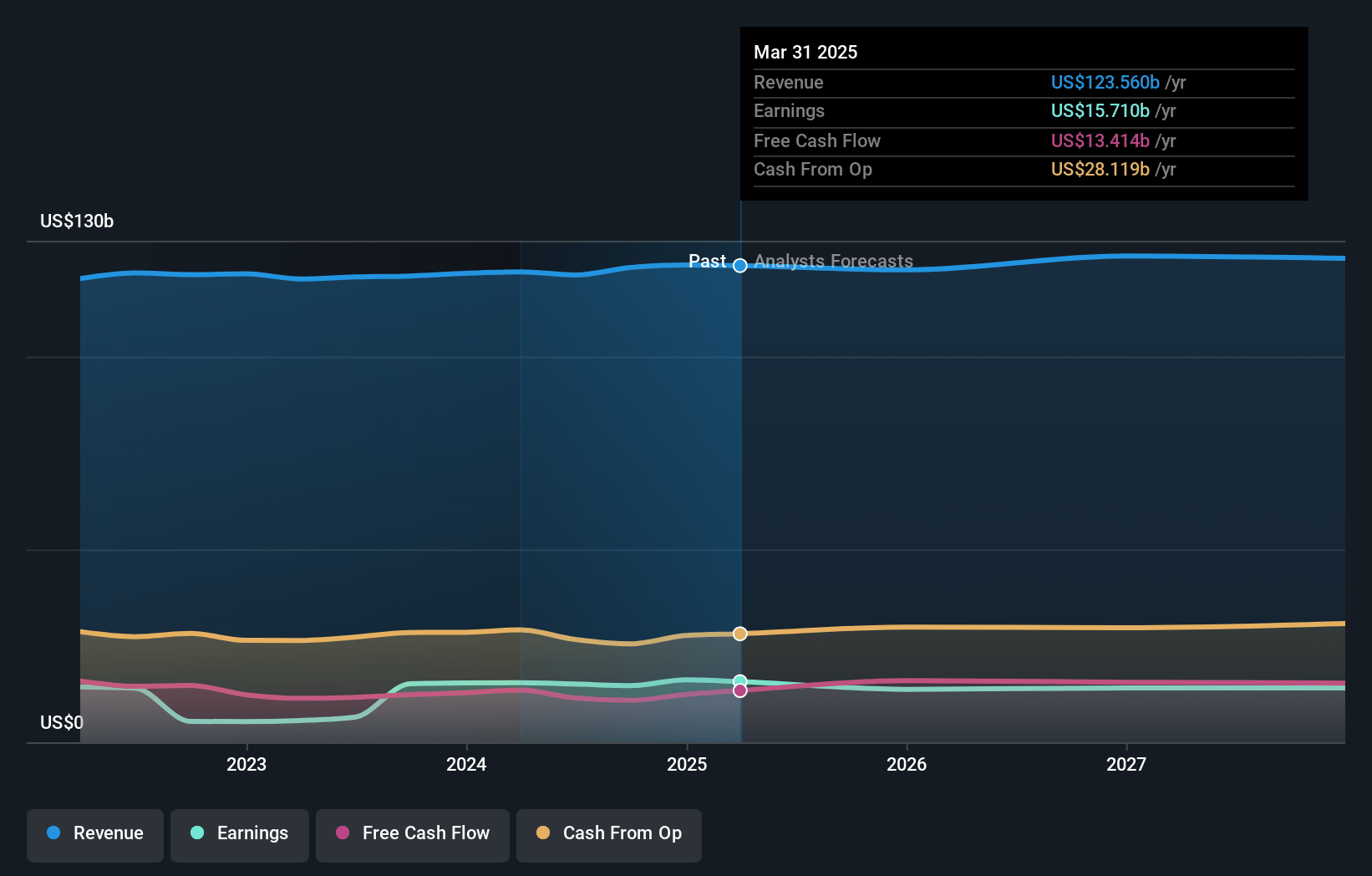

Comcast Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Comcast's revenue will decrease by 0.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.9% today to 12.1% in 3 years time.

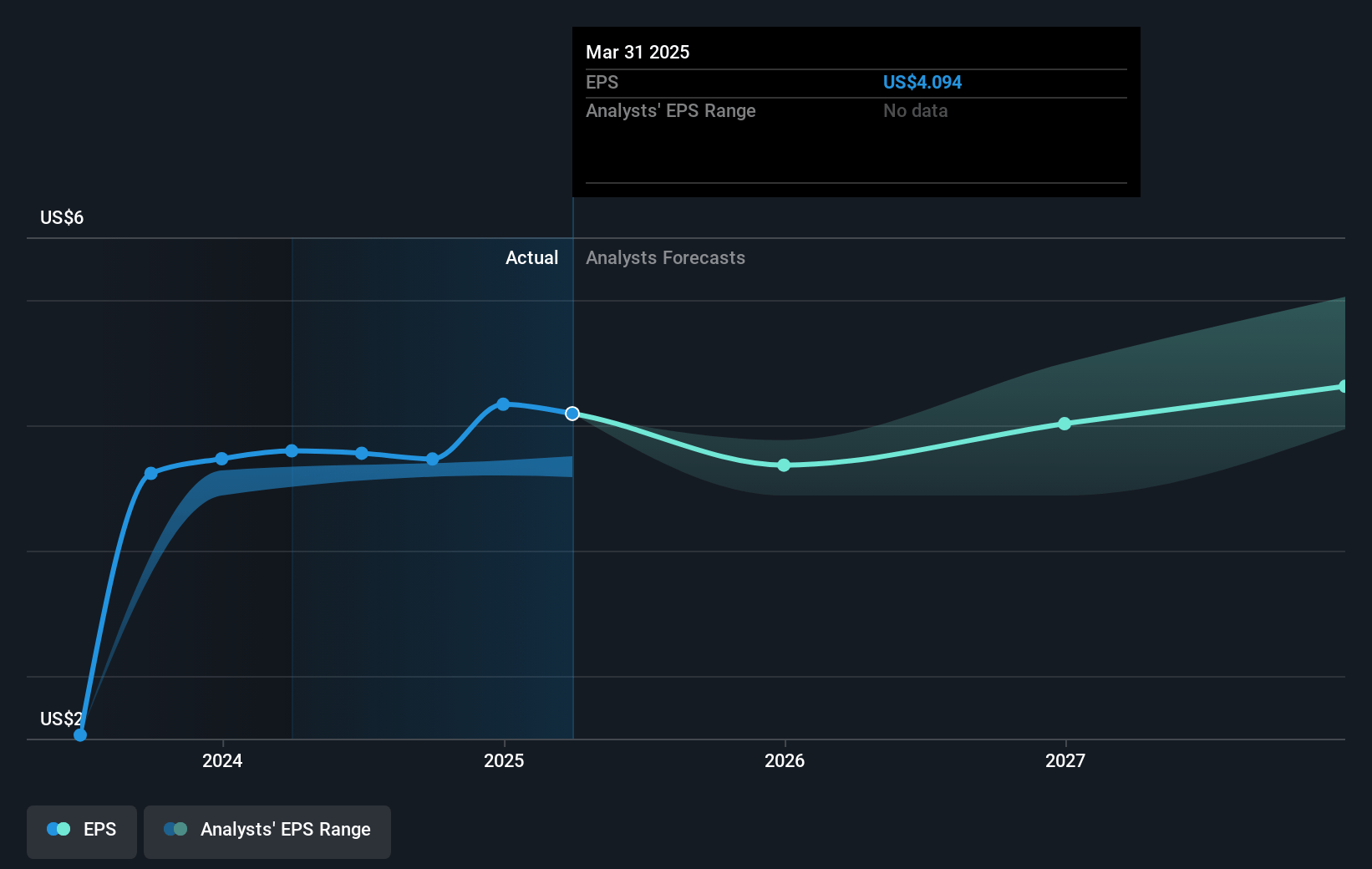

- Analysts expect earnings to reach $15.3 billion (and earnings per share of $4.62) by about January 2028, up from $14.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.8x on those 2028 earnings, up from 9.8x today. This future PE is lower than the current PE for the US Media industry at 13.4x.

- Analysts expect the number of shares outstanding to decline by 4.66% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Comcast Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- An unexpected decline in theme park attendance, particularly at domestic parks, indicates potential future revenue challenges, and pre-opening costs for Epic Universe may further pressure net margins.

- The decline in video revenue due to continued customer losses and slower domestic ARPU growth could limit overall revenue growth in Comcast's connectivity and platforms segment.

- The competitive landscape in broadband remains intense, with Comcast experiencing broadband subscriber losses and increased ARPU not fully offsetting declines, which could impact future earnings.

- Media segment profitability was negatively affected by the timing of sports expenses, and the complexity of potential partnerships in streaming could pose a risk to achieving revenue and profit growth in this segment.

- Potential exploration of a spin-off or restructuring of cable network assets adds strategic uncertainty, which might impact Comcast’s ability to enhance shareholder value through streamlined growth and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $47.7 for Comcast based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $57.0, and the most bearish reporting a price target of just $37.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $126.4 billion, earnings will come to $15.3 billion, and it would be trading on a PE ratio of 12.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $37.55, the analyst's price target of $47.7 is 21.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

WallStreetWontons

Community Contributor

Broadband Giant is Significantly Undervalued

Catalysts Total Revenue Growth : In Q1 2024, Comcast’s total revenue increased by 1% to $30.1 billion. This growth is a positive sign for the company.

View narrativeUS$68.19

FV

51.2% undervalued intrinsic discount14.07%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

7 months ago author updated this narrative