Last Update 19 Aug 25

Fair value Increased 22%Flexible Solutions International’s price target has been raised to $11.00 as analysts cite the company’s recent major food contract win, which is expected to accelerate earnings growth, strengthen its position in the sector, and boost revenue visibility.

Analyst Commentary

- Bullish analysts are raising price targets due to the company securing its second major food contract.

- The new contract is expected to significantly drive earnings growth in upcoming quarters.

- The deal increases confidence in the company’s ability to secure additional agreements in the future.

- Recent developments demonstrate Flexible Solutions’ strengthening position in the food sector.

- The company’s improving revenue visibility supports a higher valuation.

What's in the News

- Announced a new food grade contract for the Illinois plant, with estimated annual revenue between $6.5 million and $13 million, scalable to over $25 million; no additional equipment or capital improvements required.

- The new five-year contract includes tariff and inflation protections, with a redacted version to be filed with the SEC.

- Received $2.5 million payment for assisting in developing a new food grade product, with potential for additional payments and possible new manufacturing business for the NCS division.

- Added as a constituent to multiple Russell indices, including the Russell 3000E, Russell 3000E Growth, Russell Microcap, and Russell Microcap Growth benchmark indices.

Valuation Changes

Summary of Valuation Changes for Flexible Solutions International

- The Consensus Analyst Price Target has significantly risen from $9.00 to $11.00.

- The Consensus Revenue Growth forecasts for Flexible Solutions International has significantly risen from 34.6% per annum to 49.2% per annum.

- The Future P/E for Flexible Solutions International has significantly fallen from 9.34x to 6.95x.

Key Takeaways

- Long-term food-grade contracts and specialty chemical innovation enhance revenue visibility and market position in sustainable agriculture and environmental solutions.

- Investment in international manufacturing and strong internal funding improves margins, cash flow stability, and positions the company for profitable global growth.

- Heavy dependence on a few large contracts and ongoing margin, tariff, and agricultural sector pressures threaten earnings stability and limit profitability and growth prospects.

Catalysts

About Flexible Solutions International- Develops, manufactures, and markets specialty chemicals that slow the evaporation of water in Canada, the United States, and internationally.

- Significant new long-term food-grade contracts-including a 5-year deal with inflation and tariff protection, minimum revenue of $6.5M/year, and growth potential up to $25M+-position the company for step-function revenue growth beginning in late 2025, leveraging rising demand for sustainable, biodegradable chemical solutions in food and agriculture.

- Completion and scaling of the Panama manufacturing facility will sidestep high U.S. tariffs on international sales and speed logistics, likely improving gross and net margins as most international agricultural and polymer production shifts to a lower-cost site starting Q3 2025.

- The company's core NanoChem Solutions (NCS) division is benefitting from industry-wide movement towards sustainable, eco-friendly crop and water conservation products, supporting stable or growing recurring revenue streams as climate change and water security initiatives accelerate globally.

- The substantial CapEx for food-grade capacity has largely been deployed using internal funds, with no need for equity financing, while debt obligations are nearly retired; this will soon free up additional cash flow and lower interest expense, positively impacting future net margins and earnings consistency.

- The company's history and ongoing focus on providing innovative, customized R&D solutions to customers (evidenced by recent R&D payments and multi-year contracts) strengthens its differentiated positioning in specialty chemicals, increasing potential for premium pricing and higher-margin business in growth markets tied to food security and environmental sustainability.

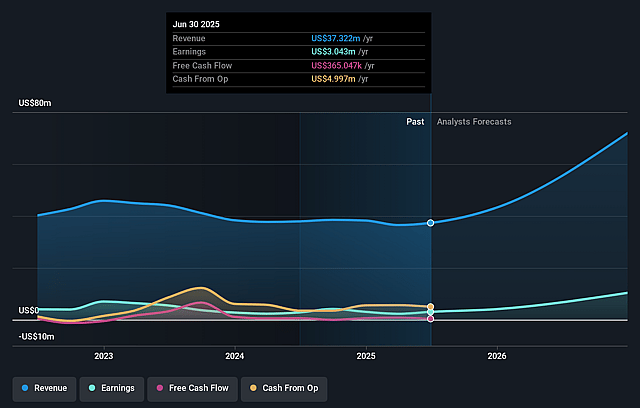

Flexible Solutions International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Flexible Solutions International's revenue will grow by 49.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 20.4% in 3 years time.

- Analysts expect earnings to reach $25.2 million (and earnings per share of $1.73) by about September 2028, up from $3.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.9x on those 2028 earnings, down from 41.2x today. This future PE is lower than the current PE for the US Chemicals industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 1.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.96%, as per the Simply Wall St company report.

Flexible Solutions International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on a small number of large food contracts creates risk of revenue and earnings volatility if customers reduce orders, delay ramp-up, or terminate agreements, especially as management expects several quarters to elapse before finding new major customers, increasing concentration risk for revenue and net profits.

- Margin pressure is likely to persist as the company accepted below-target margins (22%-25% pre-tax) to secure large food contracts, which may constrain overall profitability and slow margin recovery if competitive pricing or persistent cost inflation continue in the sector, impacting net margin expansion.

- Ongoing exposure to high U.S. tariffs on raw materials from China and transition inefficiencies while scaling up the Panama operation present continued risk of elevated input costs and operational complexities in the near-to-medium term, with potential negative effects on gross margin and quarterly earnings consistency.

- The agricultural segment, which remains a key portion of the revenue mix, faces sector headwinds such as stagnant crop prices, political uncertainty, and lost sales due to global trade tensions, all of which threaten revenue stability and put downward pressure on company-wide growth.

- Significant intermittent R&D revenue recognized in Q2 may not be sustainable, and the overall financials could revert to lower levels as one-off payments decline; the company's underlying core sales remain weak, suggesting potential future decreases in net earnings and cash flows if new product commercialization lags or contracts underperform.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.0 for Flexible Solutions International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $123.9 million, earnings will come to $25.2 million, and it would be trading on a PE ratio of 6.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of $9.91, the analyst price target of $11.0 is 9.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.