Key Takeaways

- Ternium's expansion in Mexico, through technology integration and nearshoring, aims to strengthen local supply chains, boosting operational efficiency and market share.

- Environmental focus and improved trade strategies could enhance revenue, with premium, low-emission steel positioning Ternium favorably in the North American market.

- Trade tensions and macroeconomic challenges could hinder Ternium's revenue growth and profitability due to inflation, uncertainties, and potential trade disputes.

Catalysts

About Ternium- Manufactures and distributes steel products in Mexico, Southern Region, Brazil, and internationally.

- The implementation of Plan Mexico aims to bolster industrialization and import substitution through nearshoring, infrastructure development, and SME support, potentially increasing revenue by securing a stronger, localized supply chain in the North American market.

- Enhanced trade strategies and potential renegotiation outcomes of the USMCA could align Mexico's trade strategies more closely with the U.S., mitigating unfair trade practices and potentially increasing Ternium’s market share and revenues in the North American region.

- Ternium's ongoing expansion project in Mexico, including cutting-edge technology integration in new facilities, promises improved operational efficiency and product quality, which could drive higher margins and diversified revenue streams once operational.

- The completion of facilities capable of producing automotive steel with lower CO2 emissions could set Ternium apart in an increasingly environmentally-conscious market, potentially boosting both revenue and margins through premium product offerings.

- Cost reduction initiatives and efficiency improvements are anticipated to continue contributing to higher EBITDA margins by lowering the cost per ton and increasing operational competitiveness against a backdrop of fluctuating global market dynamics.

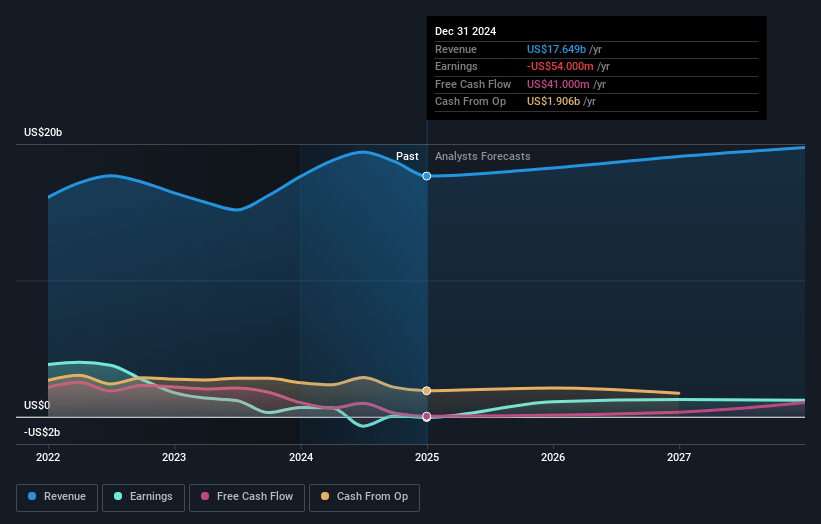

Ternium Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ternium's revenue will grow by 2.0% annually over the next 3 years.

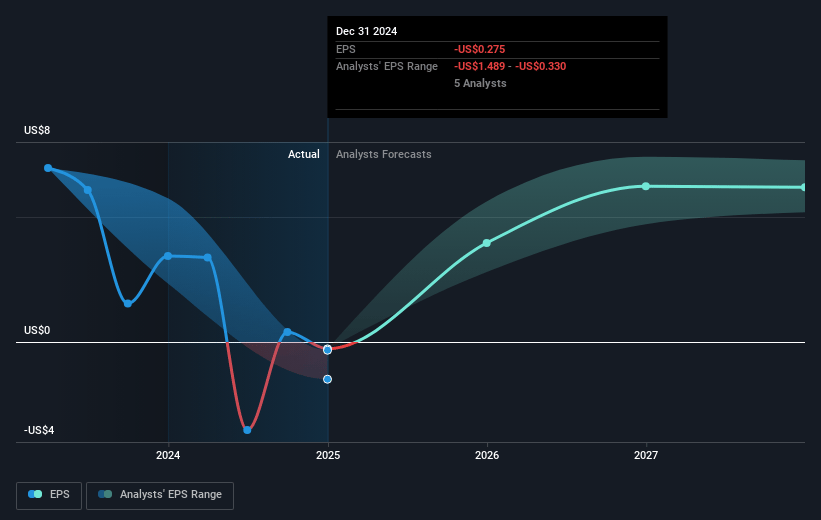

- Analysts assume that profit margins will increase from -0.3% today to 6.0% in 3 years time.

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $5.78) by about May 2028, up from $-53.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.4 billion in earnings, and the most bearish expecting $818 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.2x on those 2028 earnings, up from -108.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 20.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

Ternium Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Trade tensions and uncertainty, especially between the U.S. and Mexico regarding steel tariffs, could negatively impact the pricing environment and demand in Ternium's key markets, affecting revenue and net margins.

- The increased CapEx for the expansion project in Mexico, revised upwards by approximately 16% due to inflation and higher construction costs, puts pressure on cash flow and could impact future earnings if the projects do not generate expected returns.

- The challenging operating environment in Mexico, characterized by subdued steel demand due to economic slowdown and uncertainty in trade negotiations, could limit revenue growth in the near term.

- The significant risks and uncertainties associated with the macroeconomic situation in Argentina, such as high inflation and currency control measures, might impede cash flows and dividend repatriation, affecting overall profitability.

- Despite the anticipated benefits from trade alignments with the USMCA, unresolved issues and potential for adverse outcomes in negotiations create volatility that could impact Ternium's strategic positioning and financial stability, particularly if trade disagreements escalate further.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.167 for Ternium based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $53.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $18.7 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 8.2x, assuming you use a discount rate of 8.2%.

- Given the current share price of $29.55, the analyst price target of $37.17 is 20.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.