Last Update30 Apr 25Fair value Decreased 20%

AnalystConsensusTarget has increased revenue growth from 3.0% to 3.4%, increased profit margin from 5.4% to 8.4% and decreased future PE multiple from 12.7x to 6.6x.

Read more...Key Takeaways

- Anti-dumping duties and new mine operations position Tronox for increased market share and improved cost structure, driving margin and revenue growth into the coming years.

- Vertical integration and capital discipline support stronger free cash flow, aiding deleveraging and enabling potential increases in shareholder returns.

- Intense global competition, high debt, regulatory risks, and heavy exposure to cyclical markets threaten profitability, with delayed benefits from cost initiatives adding further uncertainty.

Catalysts

About Tronox Holdings- Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

- The imposition of anti-dumping duties in key growth markets (Europe, soon India and Brazil) is driving a shift in regional market share away from low-cost Chinese exporters to Tronox and other local producers, positioning the company to benefit from increasing TiO2 volumes in the second half of 2025 and into 2026, which should directly impact revenue growth.

- Major cost improvement initiatives—including the permanent idling of the high-cost Botlek plant and $125-$175 million in sustainable run-rate cost reductions by 2026—are set to structurally lower SG&A and production costs; this improves profitability and supports long-term margin expansion.

- The commissioning of new high-grade ore mines in South Africa (Fairbreeze and East OFS) in the back half of 2025 will restore and enhance Tronox’s integrated cost advantage, replacing depleted ore bodies and reducing per-unit mining costs, thus boosting gross and net margins beginning in late 2025 and especially into 2026.

- Rising global urbanization, increased infrastructure investment, and the expansion of the middle class in emerging markets are expected to accelerate long-term demand for paints, plastics, and coatings—core TiO2 end markets—which provides a multi-year runway for volume and revenue growth as underlying demand continues to recover.

- Tronox’s vertical integration strategy, ongoing mining investments, and sustained capital discipline are expected to improve free cash flow conversion and support future deleveraging; this strengthens the balance sheet and potentially allows for increased dividends or share buybacks, directly benefiting EPS.

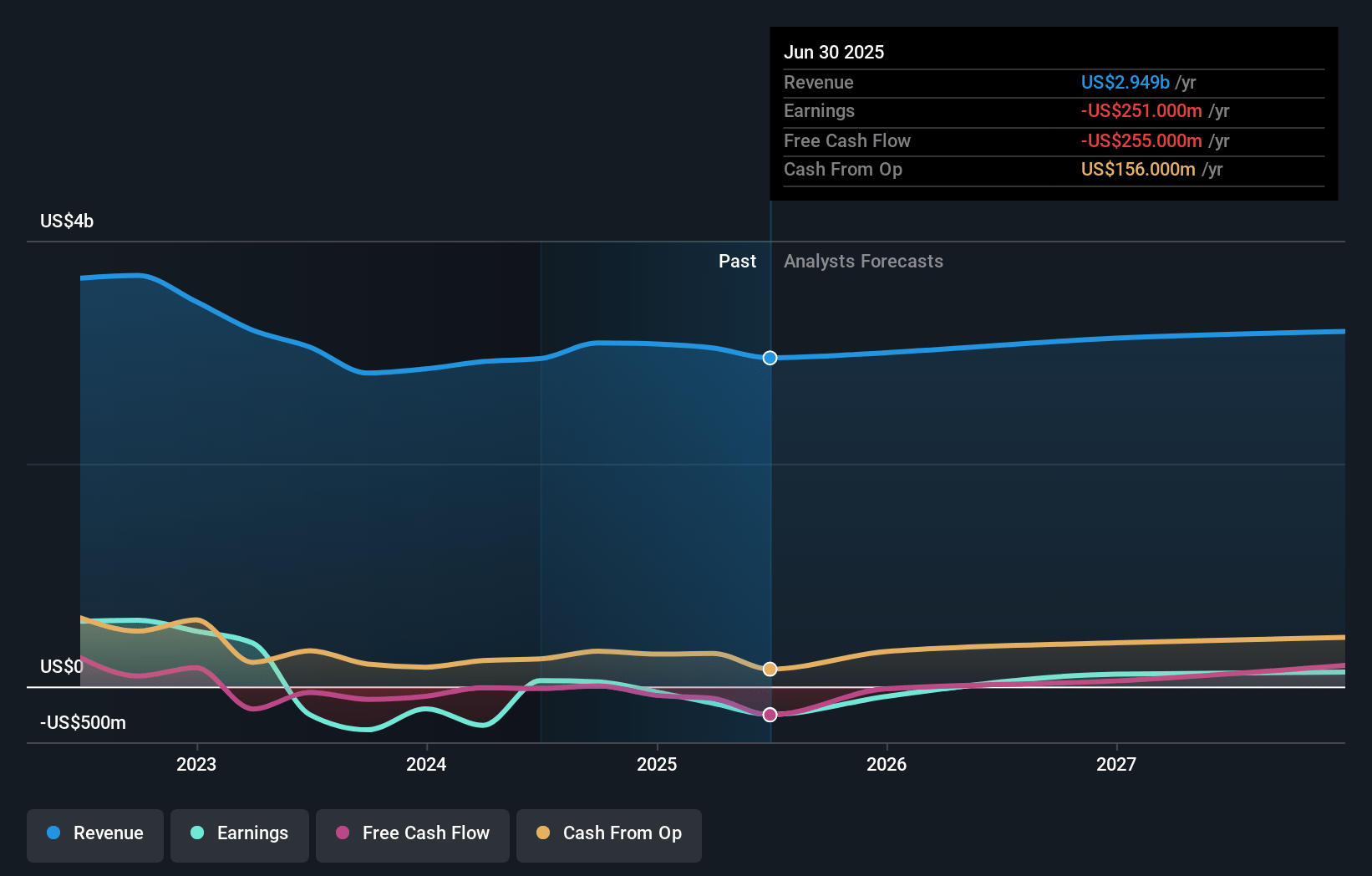

Tronox Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tronox Holdings's revenue will grow by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from -4.9% today to 8.4% in 3 years time.

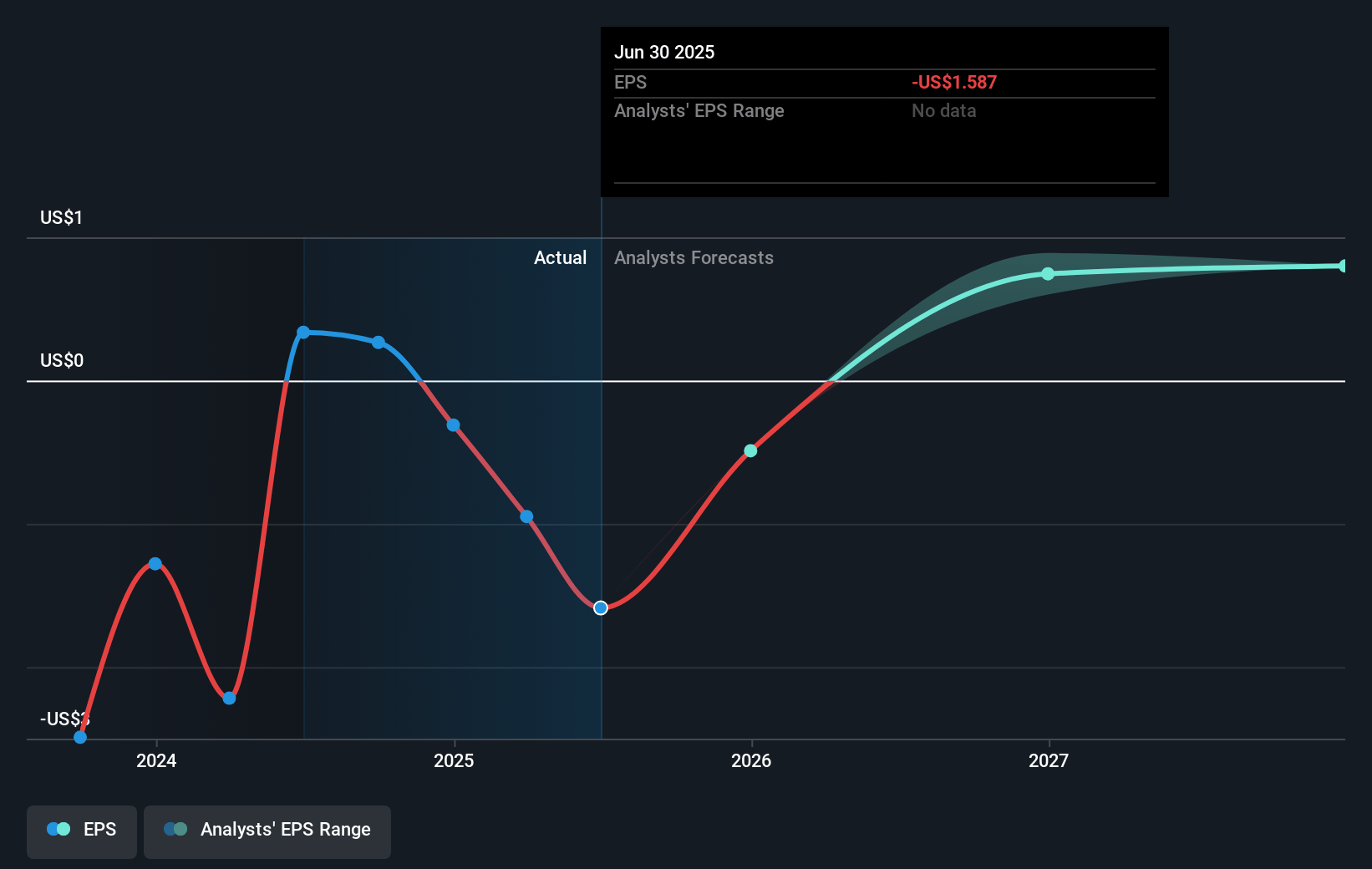

- Analysts expect earnings to reach $283.0 million (and earnings per share of $0.89) by about May 2028, up from $-150.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.6x on those 2028 earnings, up from -5.9x today. This future PE is lower than the current PE for the US Chemicals industry at 21.8x.

- Analysts expect the number of shares outstanding to grow by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Tronox Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tronox continues to face intense competitive pressure from low-cost Chinese producers, leading to global supply imbalances and forcing the idling of its higher-cost Botlek plant; persistent overcapacity and aggressive international competition could limit pricing power and reduce gross and net margins over the long term.

- The company exhibits high leverage, with a net debt/EBITDA ratio of 5.2x and $3 billion in total debt, making it vulnerable to rising interest rates or tightening refinancing conditions; sustained high interest costs could strain free cash flow, constrain capital allocation flexibility, and pressure net earnings in the future.

- Environmental, health, and safety liabilities remain an ongoing risk, as demonstrated by significant restructuring charges related to the Botlek shutdown and continued reliance on mining operations; increasing regulatory scrutiny and potential remediation costs could erode long-term profitability and impact net margins.

- Tronox is heavily concentrated in titanium dioxide and zircon for cyclical end-markets such as coatings, plastics, and paper; any prolonged downturn in global construction, automotive, or consumer markets—especially amid macroeconomic headwinds such as inflation and muted consumer sentiment—can lead to revenue volatility and pressured earnings.

- While initiatives such as vertical integration and cost improvement programs are in progress, realized benefits are not immediate and require execution across multiple years; if market recovery is slower than forecast or internal operational targets are missed, expected efficiency gains may not materialize, leading to under-delivery on EBITDA growth and free cash generation targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $8.389 for Tronox Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $13.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $283.0 million, and it would be trading on a PE ratio of 6.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $5.56, the analyst price target of $8.39 is 33.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.