Key Takeaways

- Exposure to volatile markets, high debt, and regulatory pressures limits Tronox’s revenue growth, margin improvement, and financial flexibility.

- Advancements in vertical integration and sustainability may support margins long-term, but risks from oversupply, recycling trends, and market cycles persist.

- Persistent global competition, high leverage, end-market volatility, and production cost pressures threaten Tronox’s revenue stability and limit its resilience to cyclical or regulatory changes.

Catalysts

About Tronox Holdings- Operates as a vertically integrated manufacturer of TiO2 pigment in North America, South and Central America, Europe, the Middle East, Africa, and the Asia Pacific.

- While global anti-dumping duties in regions like Europe, India, and Brazil are expected to allow Tronox to recapture market share from Chinese producers and lift TiO2 sales volumes into 2025 and beyond, this benefit is countered by continued pricing pressure in other international regions due to oversupply and aggressive competition, which could cap revenue growth and margin expansion.

- Although investments in vertical integration and efficiency—including the completion of new South African mining projects—should lower production costs and support higher net margins from 2026 onward, Tronox remains exposed to volatile raw material prices and significant near-term cost headwinds from mining lower-grade ore, which could delay the realization of these margin improvements.

- While global urbanization and the growth of a middle class in emerging economies are likely to boost long-term demand for paints, coatings, and plastics (key end markets for TiO2), the adoption of circular economy practices and increased recycling in these industries may structurally limit growth in virgin pigment demand, constraining top-line revenue potential over the coming decade.

- Despite the company’s cost savings programs and the expected one-time working capital release from the Botlek plant closure, substantial financial leverage, with net debt at $2.8 billion and a net leverage ratio of 5.2 times trailing EBITDA, increases exposure to rising interest costs and restricts flexibility for investment or dividend growth, thereby weighing on future earnings stability.

- While Tronox is moving toward more sustainable and specialty products in response to tightening environmental standards, its core revenue dependence remains in commodity-grade TiO2 pigments, making the company vulnerable to further regulatory changes and cyclical downturns that could lead to unsteady revenues and diminished cash flow in less favorable economic or regulatory environments.

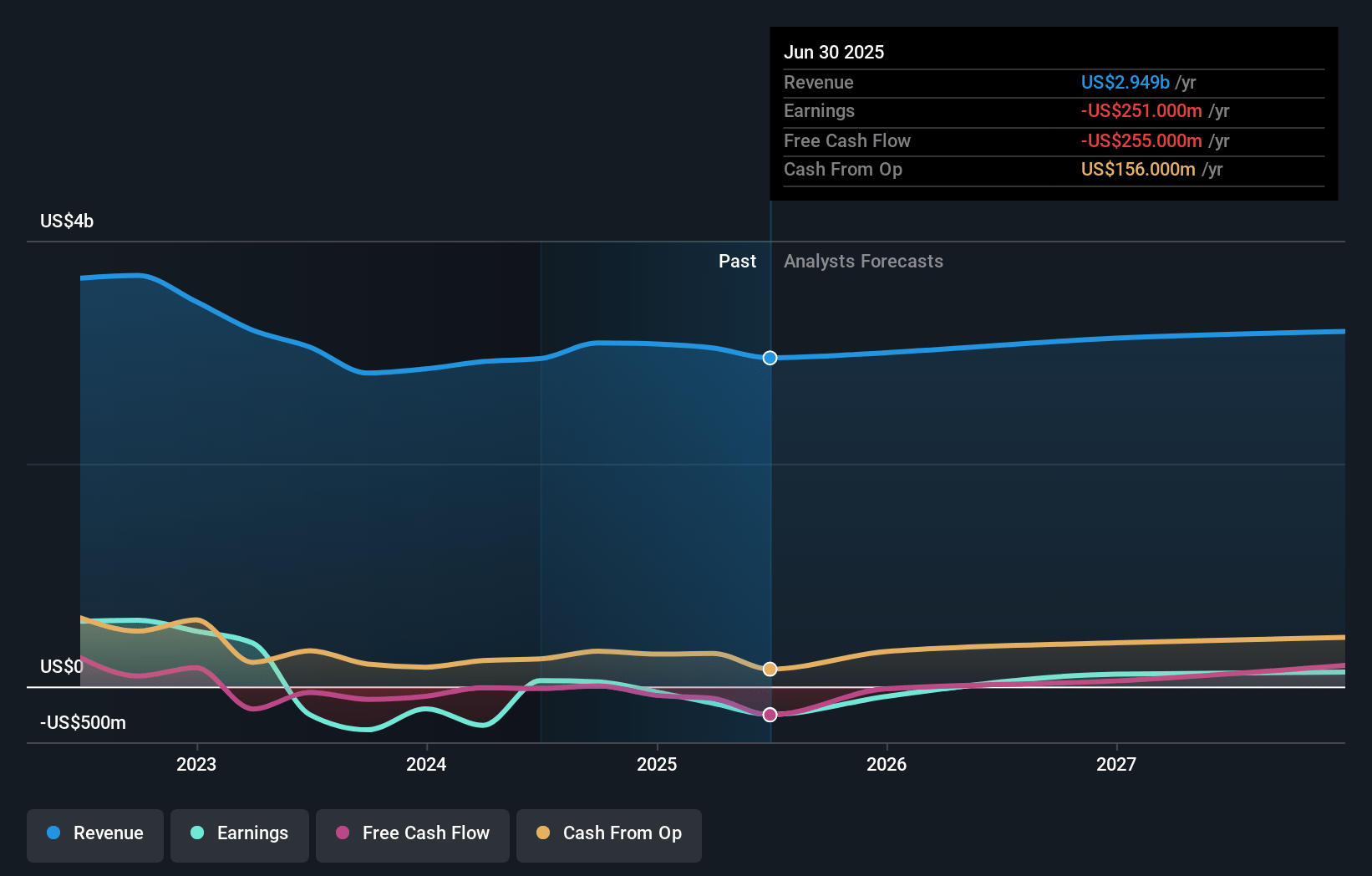

Tronox Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tronox Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tronox Holdings's revenue will decrease by 1.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -4.9% today to 6.4% in 3 years time.

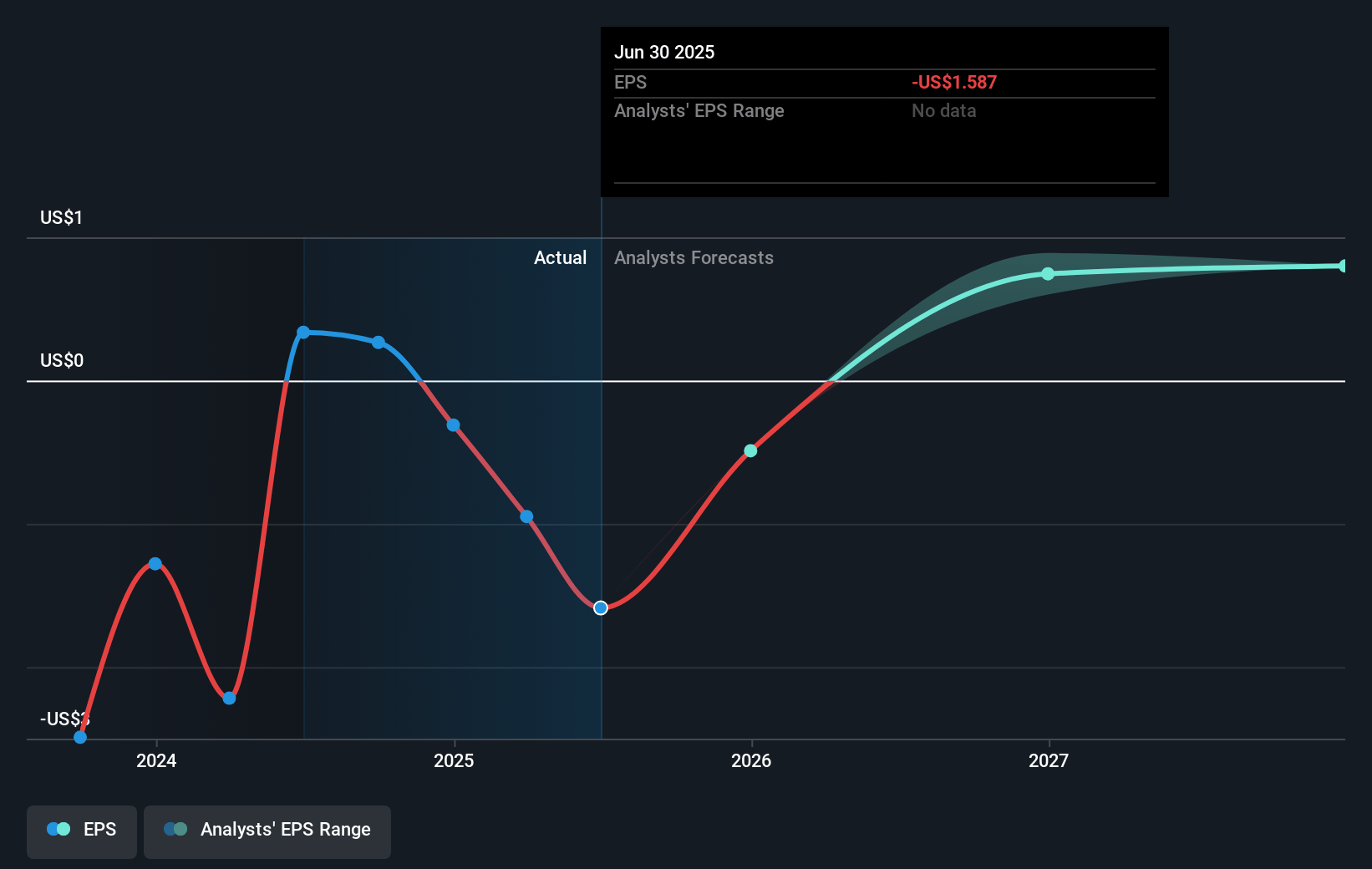

- The bearish analysts expect earnings to reach $186.5 million (and earnings per share of $1.18) by about June 2028, up from $-150.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.3x on those 2028 earnings, up from -5.7x today. This future PE is lower than the current PE for the US Chemicals industry at 22.1x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Tronox Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense and persistent global competition from Chinese producers has created a structural supply imbalance, leading to Tronox's decision to idle its high-cost Botlek plant and continuing to exert downward pressure on average selling prices, directly threatening long-term revenue and margin stability.

- Tronox’s high financial leverage, with a net leverage ratio of 5.2 times and $3.0 billion in total debt, significantly limits financial flexibility and raises vulnerability to rising interest rates or economic downturns, which could substantially suppress net margins and earnings.

- Ongoing declines in zircon sales volumes, continuing weakness in key markets like China, and only modest growth projections indicate that Tronox remains heavily exposed to end-market volatility for both its core and co-products, constraining revenue growth and predictability.

- The company faces elevated production costs due to operating issues, increased direct material prices, and transitions to new mining projects, resulting in negative free cash flow, use of working capital, and pressure on gross margins despite ongoing cost-reduction initiatives.

- While cost improvement programs are underway, Tronox’s continued dependence on core titanium dioxide pigments and lack of sizable diversification mean any cyclical downturn, regulatory change, or shift toward sustainable alternatives in end markets could sharply impact long-term revenue and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tronox Holdings is $7.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tronox Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $7.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $186.5 million, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 11.6%.

- Given the current share price of $5.41, the bearish analyst price target of $7.0 is 22.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.