Last Update 27 Feb 26

SCL: Higher Future P/E Assumptions Will Support Long-Term Dividend Upside

Analysts have adjusted their Stepan price target to $75.00, with the change tied to updated views on discount rate, revenue growth, profit margin, and a higher assumed future P/E multiple.

What's in the News

- Stepan Company reported an unaudited goodwill impairment of $6,245,000 for the three months ended December 31, 2025. This is a non cash charge related to the value of acquired assets (Key Developments).

Valuation Changes

- Fair Value: Model fair value remains at $75.00, with no change from the prior estimate.

- Discount Rate: The discount rate has risen slightly from 8.36% to 8.48%, reflecting a modestly higher required return in the updated assumptions.

- Revenue Growth: Assumed long term revenue growth has fallen significantly from 6.28% to 4.37%, pointing to a more conservative view on future top line expansion.

- Net Profit Margin: Assumed net profit margin has fallen significantly from 5.34% to 3.69%, implying lower expected profitability on each dollar of revenue.

- Future P/E: Assumed future P/E multiple has risen significantly from 14.22x to 22.49x, indicating a higher valuation multiple applied to projected earnings.

Key Takeaways

- Growth in specialty alkoxylation and strategic end markets indicates potential for continued revenue and earnings increases across key segments.

- The startup of the new Texas site and focus on acquiring over 400 new customers can boost volume growth and supply chain savings.

- Global macroeconomic uncertainties and competitive pressures could negatively impact revenue, margins, and cash flow across multiple segments for Stepan.

Catalysts

About Stepan- Produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products worldwide.

- The startup of the new Pasadena, Texas site is expected to reach full contribution in the second half of 2025, which could boost volume growth and supply chain savings. This is likely to impact revenue and margins positively.

- Strong growth in specialty alkoxylation, showing 19% growth in Q1, suggests continued revenue growth and earnings improvement in the Surfactants business with enhanced customer and product mix.

- The broad-based volume growth in key strategic end markets, including double-digit growth in agricultural and oilfield sectors, indicates potential for continued revenue and earnings growth across these segments.

- The strategic focus on new customer acquisition, especially with over 400 new customers in tier 2 and tier 3, should drive revenue growth and improve net margins due to a more diversified and high-value customer base.

- The successful integration of new technologies and products in the insulation and spray foam markets in the Polymers segment suggests potential for future revenue growth and improved margins as these markets expand.

Stepan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Stepan's revenue will grow by 5.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.5% today to 5.6% in 3 years time.

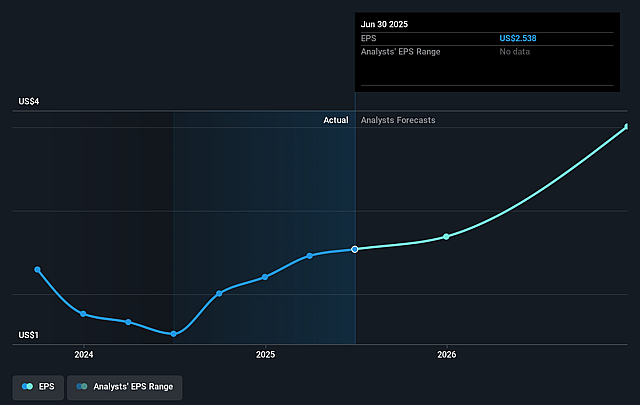

- Analysts expect earnings to reach $146.1 million (and earnings per share of $6.31) by about April 2028, up from $56.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.5x on those 2028 earnings, down from 20.7x today. This future PE is lower than the current PE for the US Chemicals industry at 19.3x.

- Analysts expect the number of shares outstanding to grow by 1.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.32%, as per the Simply Wall St company report.

Stepan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The high interest rate environment and global macroeconomic uncertainties are restraining Rigid Polyol growth in North America and Europe, potentially impacting revenues and net margins.

- Negative free cash flow of $25.8 million due to high working capital requirements and increased raw material purchases could pressure financials such as cash flow and net earnings if not addressed.

- The Surfactants segment faces risks from raw material cost increases that are passed through to selling prices; any inability to effectively manage these costs could compress profit margins.

- Competitive pressures and a decline in selling prices in the Polymers segment, despite volume growth, could lead to lower overall revenue and operating income.

- Tariffs and trade uncertainties may create inflationary pressures and indirect impacts on consumer demand, which could result in decreased sales volumes and negatively affect earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $85.0 for Stepan based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $146.1 million, and it would be trading on a PE ratio of 16.5x, assuming you use a discount rate of 7.3%.

- Given the current share price of $51.6, the analyst price target of $85.0 is 39.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Stepan?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.