Key Takeaways

- Expansion into higher-value products and the U.S. PVC market positions Olin to benefit from sustained demand in construction, renewables, and advanced manufacturing sectors.

- Operational optimization, targeted acquisitions, and disciplined capital allocation are set to enhance efficiency, margins, and overall shareholder returns.

- Weak organic growth, regulatory and environmental challenges, costly asset upkeep, and rising competition threaten profitability and long-term market position amid a sustainability shift.

Catalysts

About Olin- Manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada.

- Olin’s entry into the U.S. PVC market via a tolling partnership enables it to upgrade significant EDC capacity and unlock incremental caustic soda volume, positioning the company to benefit from long-term growth in construction and infrastructure driven by global urbanization and population growth, supporting higher baseline revenues and expansion opportunities.

- Strategic focus on higher-value downstream products, such as specialized epoxy resins and advanced chlorinated organics, combined with anticipated antidumping decisions in the U.S. and EU, positions Olin to capitalize on the transition toward renewable energy, electric vehicles, and more sophisticated electronics manufacturing, which should drive improved pricing power and sustained earnings growth as new demand emerges.

- Ongoing investments to optimize core assets, including automation, digitalization, and targeted $250 million in structural cost reductions by 2028, are set to enhance operational efficiency, lower production costs, and drive margin expansion, ultimately supporting stronger net margins and cash flow generation over the coming years.

- The Winchester segment’s bolt-on acquisition of AMMO, Inc. assets and continued focus on high-return, smaller-scale M&A will create material synergies through economies of scale and operational specialization, leading to immediate EBITDA accretion and accelerating long-term earnings growth as U.S. and global military and defense spending continues to rise.

- Olin’s disciplined capital allocation, including substantial share repurchases and an uninterrupted dividend history, is likely to amplify per-share earnings growth and total shareholder returns, particularly as cyclical recovery in the chemicals sector combines with secular tailwinds such as water treatment infrastructure expansion and global demand for caustic soda.

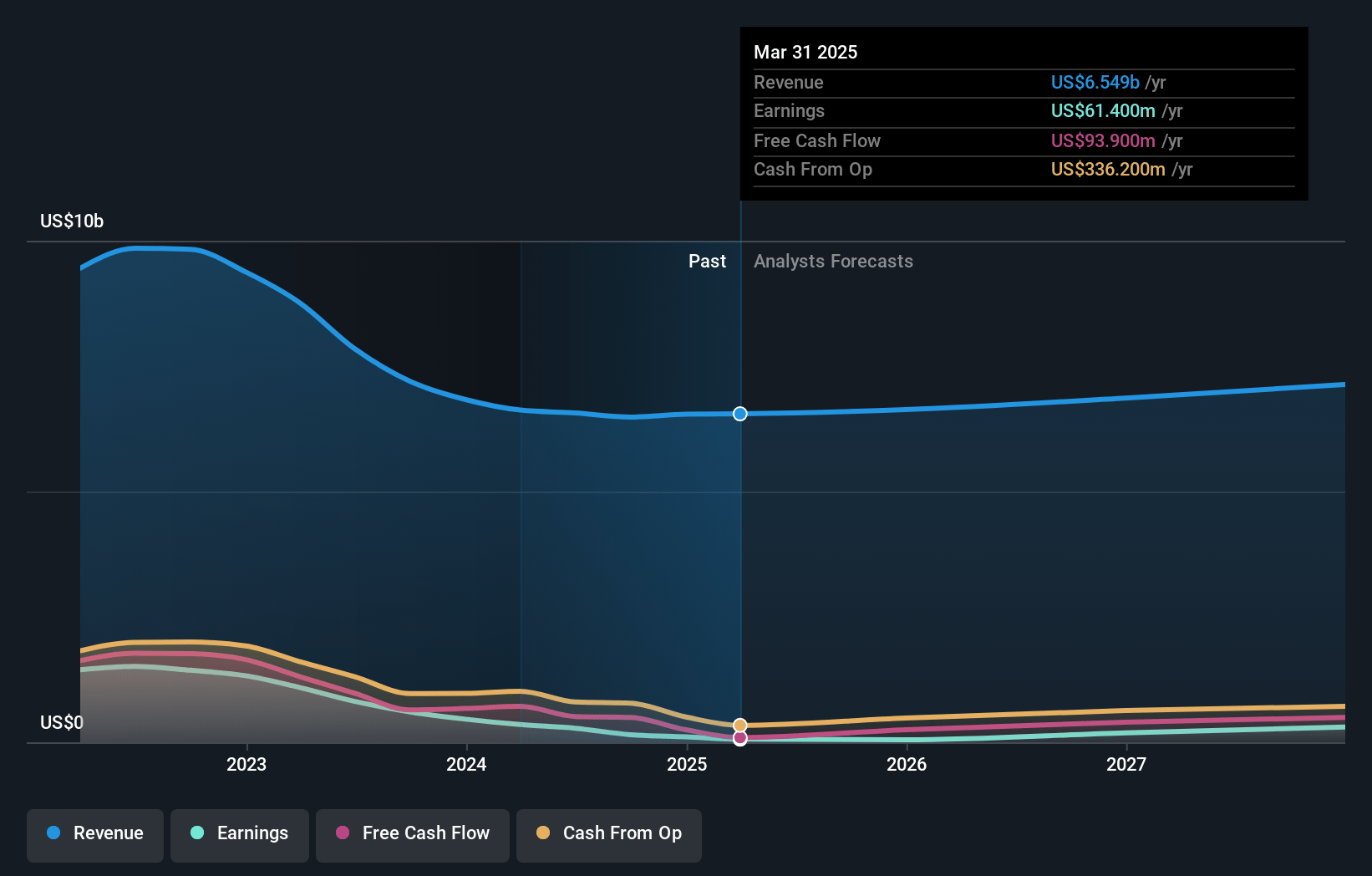

Olin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Olin compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Olin's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.7% today to 4.7% in 3 years time.

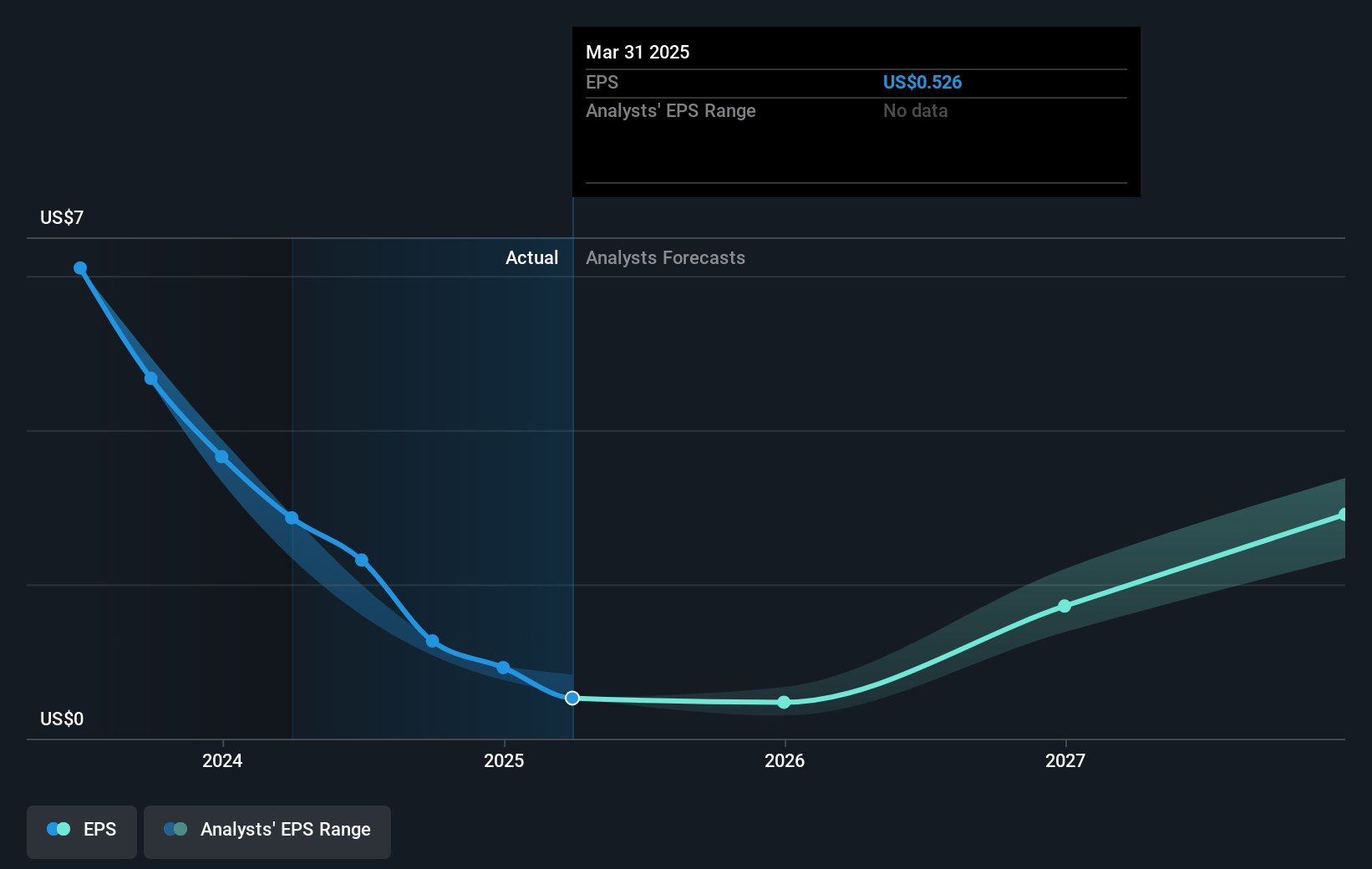

- The bullish analysts expect earnings to reach $358.0 million (and earnings per share of $3.4) by about April 2028, up from $108.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, down from 23.3x today. This future PE is lower than the current PE for the US Chemicals industry at 18.3x.

- Analysts expect the number of shares outstanding to decline by 3.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.18%, as per the Simply Wall St company report.

Olin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Olin faces persistent underwhelming organic growth and has had limited success with product diversification, which could suppress long-term revenue expansion and erode competitive positioning, posing a risk to sustained earnings growth.

- The company is subject to increasing regulatory pressure and public scrutiny regarding environmental, social, and governance issues, especially given its hazardous chemical production, which may elevate compliance costs and reduce net margins over the long term.

- Global decarbonization efforts and a societal shift toward sustainability could curb demand for core Olin products such as chlorine and vinyls, potentially leading to structurally lower long-term revenues and profit opportunities.

- High ongoing capital expenditures and the need for maintenance on aging assets pressure free cash flow and net margins, and could limit the company’s ability to fund future growth initiatives or weather industry downturns.

- Olin’s exposure to technological disruption—such as the rise of bio-based and green chemical alternatives—and intensifying international competition from low-cost Asian producers threaten market share and could result in lower pricing power, further compressing margins and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Olin is $34.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Olin's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $34.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $7.6 billion, earnings will come to $358.0 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 9.2%.

- Given the current share price of $22.0, the bullish analyst price target of $34.0 is 35.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:OLN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives