Key Takeaways

- Prolonged industry downturn and demand issues in Epoxy and Chlor Alkali may limit Olin's revenue growth and pricing power.

- Cost reduction efforts could be undermined by rising raw material and operational expenses, impacting net margins and cost-saving goals.

- Olin's value-first approach, cost management, and strategic market entry could enhance profitability, stabilize revenues, and boost earnings despite near-term headwinds.

Catalysts

About Olin- Manufactures and distributes chemical products in the United States, Europe, Asia Pacific, Latin America, and Canada.

- Olin is facing a prolonged industry trough, particularly impacting the demand for Epoxy and Chlor Alkali, leading to constraints in volume and pricing power, which could pressure revenue growth.

- Persistent commercial headwinds in the Winchester segment are driven by retailers destocking ammunition inventories and reduced consumer disposable income, potentially compressing net margins as military demand may not be sufficient to offset the softness in commercial sales.

- The strategic entry into the U.S. PVC market through a tolling partnership is yet to be fully realized, leaving ambiguity around its potential revenue contribution and causing uncertainty in pricing and volume recovery for EDC and related products.

- Ongoing geopolitical tensions and associated antidumping decisions in the U.S. and EU for Epoxy imports create an uncertain regulatory environment that may affect Olin's ability to achieve price stabilization and maintain market share, impacting earnings volatility.

- Olin's strategy to reduce costs by over $250 million by 2028 could be limited by higher-than-expected raw material and operational costs, potentially hindering the company's ability to meet projected cost savings and adversely affecting net margins.

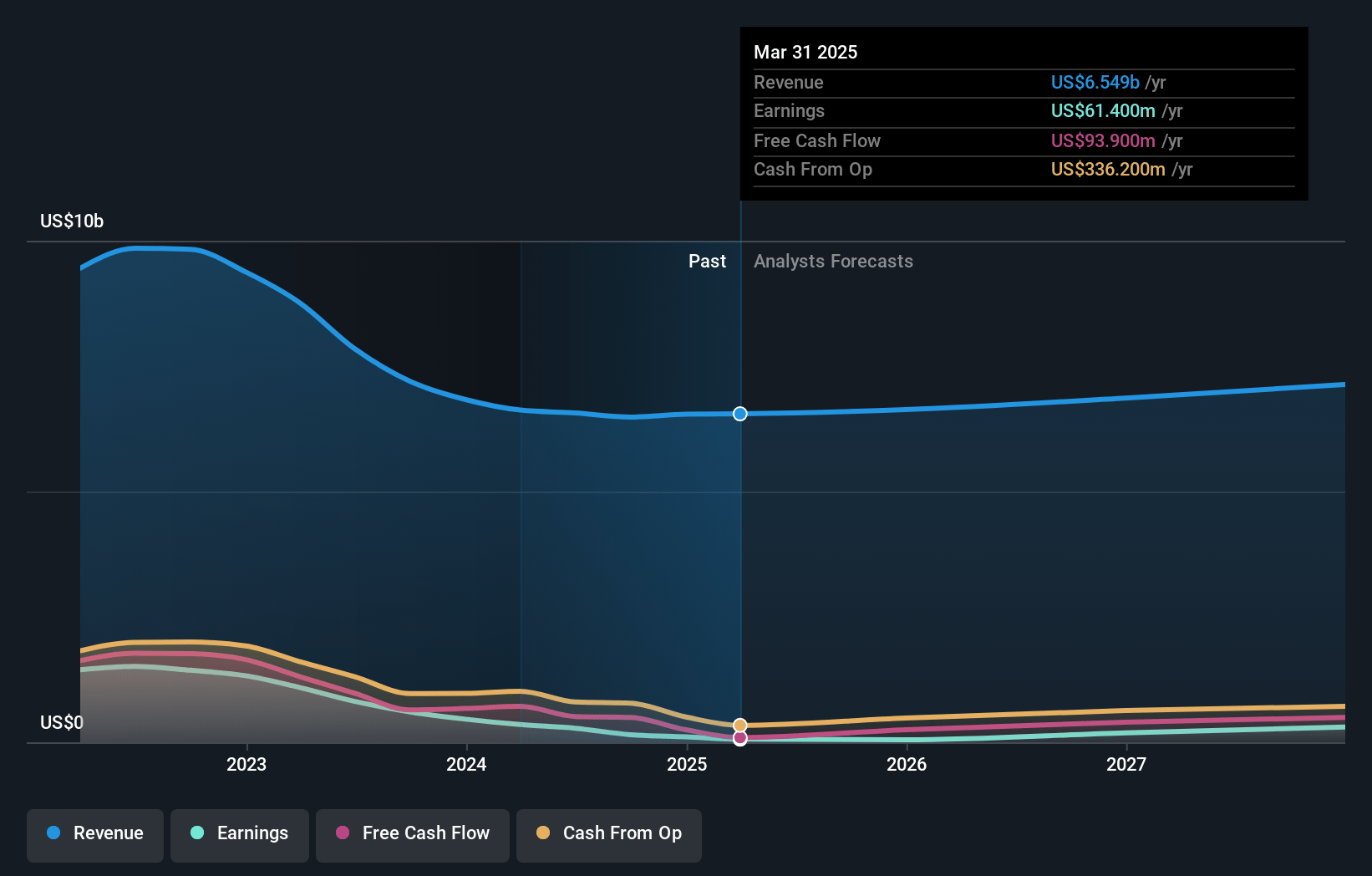

Olin Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Olin compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Olin's revenue will decrease by 0.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.7% today to 5.6% in 3 years time.

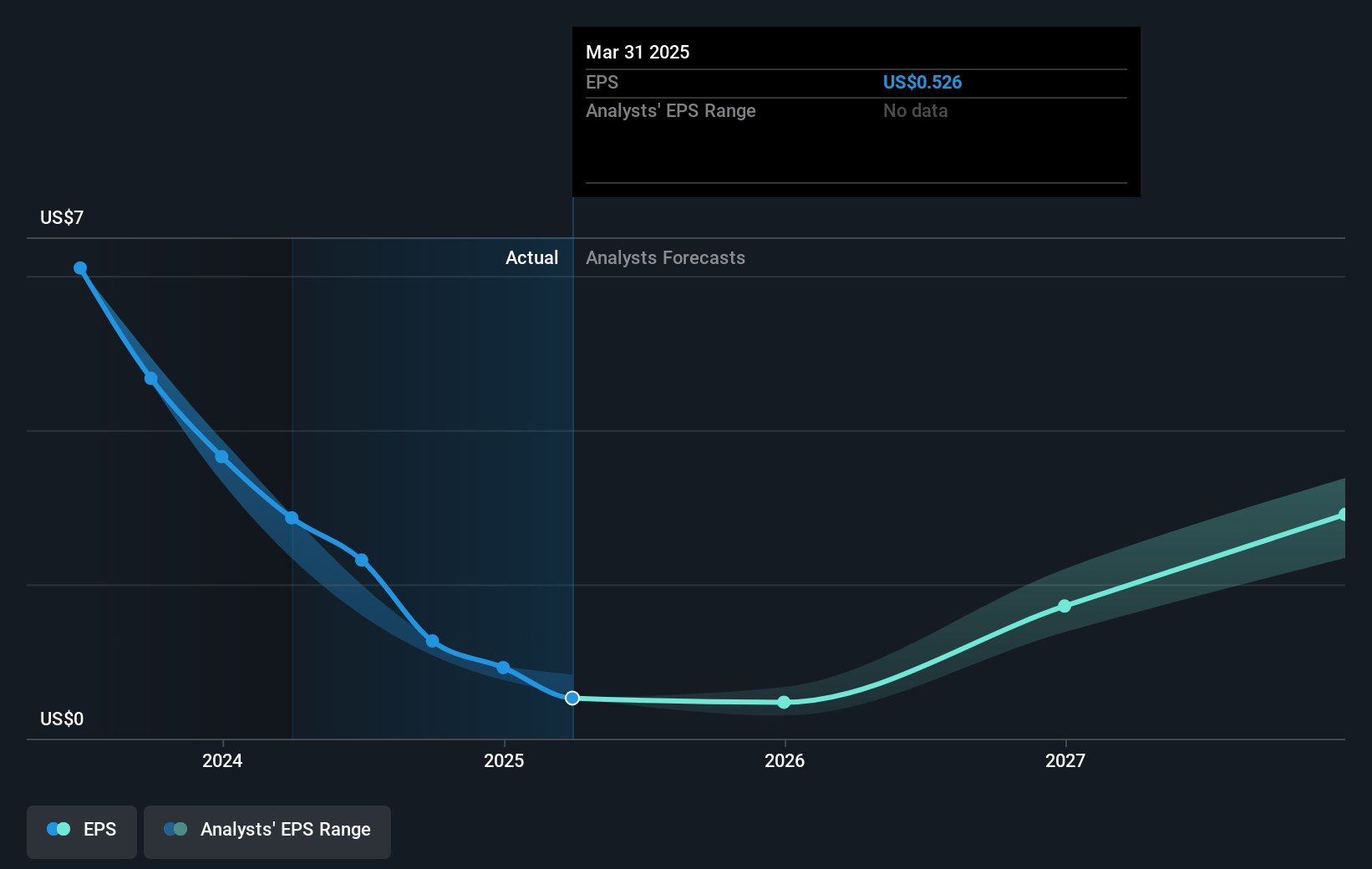

- The bearish analysts expect earnings to reach $357.0 million (and earnings per share of $3.05) by about April 2028, up from $108.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 8.8x on those 2028 earnings, down from 23.3x today. This future PE is lower than the current PE for the US Chemicals industry at 19.1x.

- Analysts expect the number of shares outstanding to decline by 3.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.21%, as per the Simply Wall St company report.

Olin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Olin's focus on a value-first commercial approach and streamlining its assets with projected cost reductions of $250 million by 2028 could positively impact net margins and overall profitability.

- Despite near-term headwinds, Olin anticipates strong military demand in its Winchester business, which is expected to offset lower commercial demand and could lead to stable or improved revenues.

- The company expects its Chlor Alkali Products and Vinyls segment to benefit from improved pricing and strong demand for caustic soda, potentially stabilizing or increasing revenue and earnings.

- Cost management efforts, such as achieving synergies from acquisitions and reducing operating costs, are aimed at enhancing profitability and maintaining a strong balance sheet, which could impact earnings positively.

- Olin's strategic entry into the U.S. PVC market and ongoing initiatives to improve its capital allocation are expected to unlock higher value and potentially boost earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Olin is $23.36, which represents one standard deviation below the consensus price target of $27.29. This valuation is based on what can be assumed as the expectations of Olin's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $34.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.4 billion, earnings will come to $357.0 million, and it would be trading on a PE ratio of 8.8x, assuming you use a discount rate of 9.2%.

- Given the current share price of $22.03, the bearish analyst price target of $23.36 is 5.7% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:OLN. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives