Key Takeaways

- Expansion into premium specialty chemicals and advanced materials is increasing margins and positioning for growth as sustainability trends and vehicle electrification accelerate.

- Operational improvements, market exits, and strategic flexibility are driving higher cash flow, enhanced margin stability, and greater portfolio resilience amid changing market dynamics.

- Dependence on automotive emissions control, market concentration, and high debt expose Ingevity to long-term structural risks unless diversification and margin expansion are achieved.

Catalysts

About Ingevity- Manufactures and sells activated carbon products, derivative specialty chemicals, and engineered polymers in North America, the Asia Pacific, Europe, the Middle East, Africa, and South America.

- Ingevity is experiencing growing demand for its higher-margin specialty chemicals and performance additives, driven by global shifts toward sustainable materials and ongoing regulatory pressure to reduce emissions; this repositioning into premium markets is already expanding net margins and expected to provide greater resilience and earnings growth.

- The company's increasing exposure to hybrid vehicles and advanced materials for new energy storage applications positions it to capture opportunities from the accelerating adoption of hybrid and electric vehicles, supporting long-term revenue growth even as internal combustion vehicle volumes decline.

- Recent operational initiatives, such as exiting lower-margin markets, reducing dependency on volatile CTO input costs, and focusing on working capital efficiency, are consistently driving improved free cash flow and EBITDA margins, enhancing long-term earnings sustainability.

- Strategic flexibility-including the ability to pivot capacity to alternate markets like filtration, and an ongoing review of underperforming businesses for potential divestiture-provides room for future portfolio optimization and capital redeployment, which could further improve net margins and accelerate deleveraging.

- Ingevity's efforts to localize supply chains, limit tariff exposure, and employ annual pricing adjustments demonstrate strong operational risk management, helping to insulate the company from global trade tensions and input cost volatility, thereby supporting margin stability and long-term cash flows.

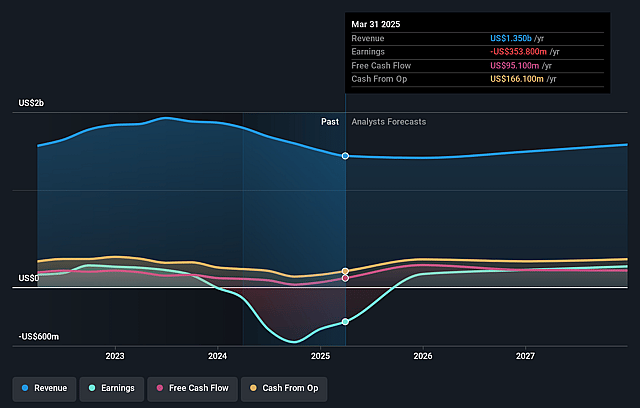

Ingevity Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ingevity's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -26.2% today to 24.2% in 3 years time.

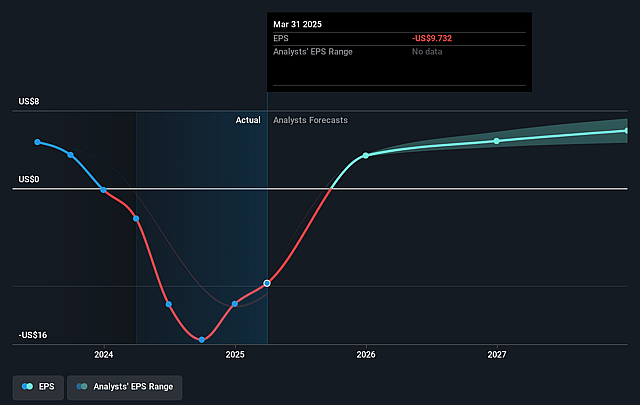

- Analysts expect earnings to reach $351.8 million (and earnings per share of $5.68) by about July 2028, up from $-353.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, up from -4.8x today. This future PE is lower than the current PE for the US Chemicals industry at 23.3x.

- Analysts expect the number of shares outstanding to grow by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.52%, as per the Simply Wall St company report.

Ingevity Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating electrification and a projected decline in North American auto production expose Ingevity's heavy reliance on automotive emissions control products (especially activated carbon)-as electric vehicles require less of these products, a secular trend that could cause long-term declines in revenue and margins if not offset by new growth markets.

- Customer concentration and auto sector dependence create heightened vulnerability; a prolonged or permanent shift away from internal combustion engine (ICE) vehicle production could further erode core revenue streams, increasing earnings volatility and risking both near

- and long-term financial health.

- Increased competitive pressure, especially in Asia (China), is driving down prices in the Advanced Polymer Technologies segment; persistent pricing headwinds and market share challenges may compress segment margins and limit the company's ability to recoup lost earnings in the long term.

- Strategic 'repositioning' actions, including the exit of lower-margin Performance Chemicals markets and ongoing review of Industrial Specialties, have resulted in substantially lower segment sales-if these downsizing moves are not replaced by high-growth/high-margin opportunities, net revenue base and future earnings growth could be structurally constrained.

- High net leverage (currently 3.3x, with targets to reduce to 2–2.5x) leaves the company sensitive to downturns or integration risks from acquisitions; failure to rapidly reduce debt or derive sufficient cash flow from restructured business lines could increase interest expenses, limit strategic flexibility, and pressure net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.25 for Ingevity based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $66.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $351.8 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 8.5%.

- Given the current share price of $46.31, the analyst price target of $54.25 is 14.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.