Key Takeaways

- Strategic investments in assets and training position Metallus for potential revenue growth as market demand recovers.

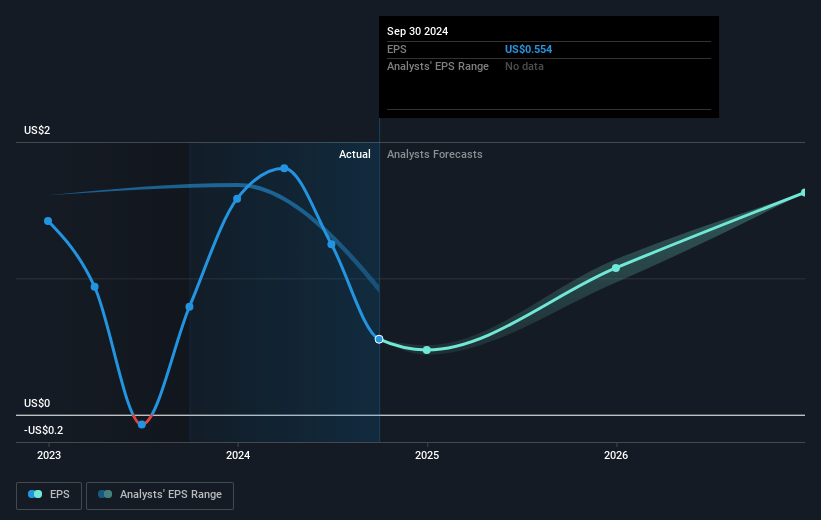

- Capital investments and share repurchase initiatives are expected to improve efficiency and boost earnings per share.

- High capital expenditures may strain cash flow while decreasing shipments and pricing pressure threaten revenue and profit margins across key sectors.

Catalysts

About Metallus- Manufactures and sells alloy steel, and carbon and micro-alloy steel products in the United States and internationally.

- Metallus is positioning for future demand recovery by investing in world-class assets and training, suggesting potential revenue growth when market conditions improve.

- Anticipated increases in aerospace and defense shipments, supported by ongoing investments and new defense programs, are projected to grow to over $250 million by 2026, indicating potential revenue growth.

- Significant capital investments, including new automated processes and furnaces funded in part by government support, aim to improve efficiency and reduce costs, likely leading to increased net margins.

- An active share repurchase program, with $106.3 million remaining in authorized buybacks, is expected to boost earnings per share (EPS) in the future.

- The resolution of current excess inventory issues, coupled with new longer-term contracts in defense, supports a future increase in both revenue and net margins as market demand normalizes and grows.

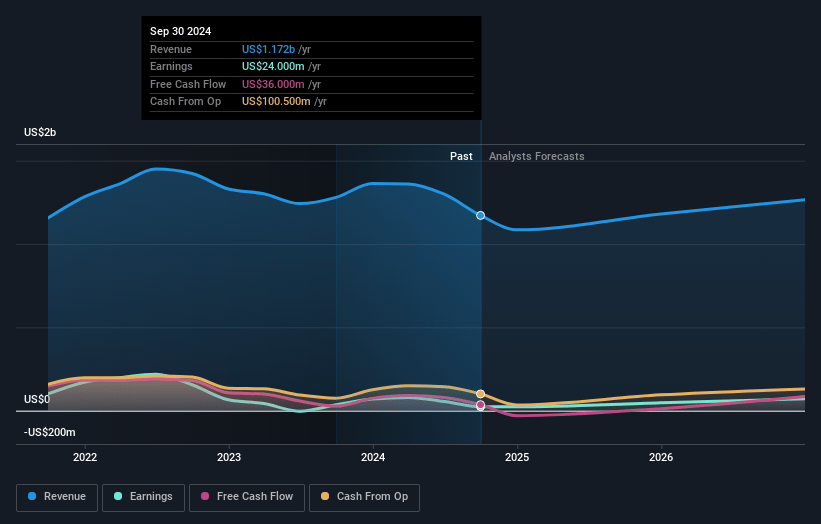

Metallus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Metallus's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.0% today to 7.6% in 3 years time.

- Analysts expect earnings to reach $98.9 million (and earnings per share of $2.27) by about January 2028, up from $24.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, down from 26.8x today. This future PE is lower than the current PE for the US Metals and Mining industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.1%, as per the Simply Wall St company report.

Metallus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sequential decrease of 23% in net sales due to lower shipments across markets raises concerns about the company's ability to sustain revenue growth in the near term.

- Declines in key sectors such as automotive (16% sequential decline) and industrial shipments (6% sequential decline) may continue to suppress overall revenue, impacting net margins negatively.

- The ongoing pricing pressure due to the increase in SBQ and seamless mechanical tubing imports, especially from China, could lead to reduced profit margins.

- Despite an optimistic long-term outlook, the company is currently facing flat demand in the energy sector, which could affect earnings if recovery in this market is slower than anticipated.

- High capital expenditures totaling approximately $65 million in 2024 could strain cash flow, especially if these investments do not lead to the anticipated improvements in asset reliability and customer service.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $20.0 for Metallus based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $98.9 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of $15.11, the analyst's price target of $20.0 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives