Key Takeaways

- Rising global e-commerce and demand for sustainable fiber-based packaging are expanding market opportunities and enabling premium pricing for innovative solutions.

- Operational efficiency efforts and strategic acquisitions are boosting margins, strengthening competitive positioning, and supporting higher shareholder returns through disciplined capital management.

- Heavy reliance on cost-cutting, geographic concentration, and exposure to shifting demand and regulations heighten risks to margins, cash flow, and earnings stability.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- The continued expansion of global e-commerce is expected to drive improved demand for corrugated packaging, directly supporting sustained volume growth and revenue stability as International Paper closes gaps to market share and benefits from improved service capabilities.

- Regulatory and consumer demand for sustainable, recyclable packaging is accelerating the shift from plastic to fiber-based solutions, expanding International Paper’s addressable markets and creating the opportunity for above-market revenue growth and premium pricing, particularly through investments in innovative packaging products.

- Substantial cost reduction and operational efficiency initiatives, including the “80/20” performance system rollout and advanced mill automation, are targeting $1.9 billion in cost savings by 2027, supporting significant margin expansion and higher net earnings even in a muted demand environment.

- The integration of DS Smith is expected to rapidly unlock $600 to $700 million in synergy benefits, with enhanced commercial execution, improved customer focus, and a broadened European footprint boosting both revenue and adjusted EBITDA, as well as increasing resilience against regional economic swings.

- Ongoing portfolio optimization and the divestiture of non-core assets, combined with disciplined capital allocation, are strengthening balance sheet flexibility, enabling enhanced shareholder returns through buybacks and dividends and supporting acceleration toward long-term earnings per share growth.

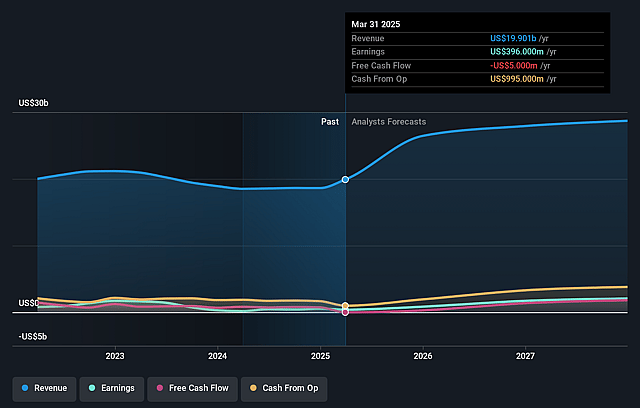

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on International Paper compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming International Paper's revenue will grow by 18.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.0% today to 8.6% in 3 years time.

- The bullish analysts expect earnings to reach $2.8 billion (and earnings per share of $6.44) by about July 2028, up from $396.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.1x on those 2028 earnings, down from 70.2x today. This future PE is lower than the current PE for the US Packaging industry at 27.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.76%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Industry demand for both North America and Europe has remained soft, with management expressing caution due to persistent negative consumer and business sentiment, which introduces risk of stagnant or even declining revenues if secular shifts away from traditional packaging and paper products accelerate.

- The company is heavily relying on significant cost reductions and synergy targets, targeting nearly $1.9 billion of cost out after inflation by 2027, but these savings come with ongoing high capital expenditures for mill modernization and severance or integration costs, placing ongoing pressure on free cash flow and net margins, especially if planned benefits are delayed or unrealized.

- The strategy to win back share focuses on improving service and reliability, especially among local or smaller accounts that are typically more sensitive to economic slowdowns and tend to cut spending faster during downturns, potentially increasing future volume volatility and pressuring future earnings.

- Environmental regulations and greater consumer scrutiny regarding packaging waste and sustainability could raise ongoing compliance costs and restrict viable product offerings, increasing costs of doing business and compressing future net margins compared to lighter-weight and alternative packaging competitors.

- The company remains geographically concentrated in North America for its core business, exposing it disproportionately to regional economic downturns, unfavorable trade policy shifts, or input cost volatility, all of which may create larger swings in revenue and earnings compared with more diversified industry peers.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for International Paper is $65.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of International Paper's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $41.6.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $32.8 billion, earnings will come to $2.8 billion, and it would be trading on a PE ratio of 18.1x, assuming you use a discount rate of 6.8%.

- Given the current share price of $52.65, the bullish analyst price target of $65.0 is 19.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.