Key Takeaways

- Targeted investments in advanced facilities and sustainable packaging are set to drive revenue growth, margin expansion, and operational efficiency across key markets.

- Strategic integration, divestitures, and technology-led cost reductions will streamline focus, boost profitability, and position the company for durable, long-term growth.

- Digital decline, operational inefficiencies, global overcapacity, high capital needs, and sustainability pressures combine to threaten growth, profitability, and cash flow resilience.

Catalysts

About International Paper- Produces and sells renewable fiber-based packaging and pulp products in North America, Latin America, Europe, and North Africa.

- International Paper’s aggressive capital investments in new and upgraded state-of-the-art box plants, with a focus on strategically located facilities that directly serve high-growth e-commerce and protein markets, are expected to reduce costs by 20% per unit and support significant revenue growth and EBITDA margin expansion as customer service and reliability metrics improve.

- The upcoming integration of DS Smith and targeted divestitures of non-core assets will streamline the business around high-margin, sustainable packaging and core geographies, leading to more resilient net margins and better capital allocation, which is forecasted to structurally boost profitability.

- Systematic cost reduction initiatives, including a $1.6 billion cost-out program, broad deployment of productivity-focused “lighthouse” optimization pilots across over 20 box plants, and an overhaul of the capital investment process are expected to restore $300-$400 million in earnings drag and deliver substantial, sustainable EBITDA and free cash flow improvements over the next several years.

- International Paper’s ability to capture rising demand from increasing e-commerce penetration, shifting consumer and regulatory preferences for sustainable, recyclable corrugated packaging, and legislative bans accelerating the substitution of paper for plastic are set to drive volume growth and pricing power, producing strong multi-year revenue and margin upside.

- Accelerated investments in technology, automation, and reliability at core mill and packaging assets—combined with expansion into faster-growing emerging markets—will diversify and grow revenue streams, reduce cost volatility, and increase returns on invested capital, justifying bullish long-term earnings projections.

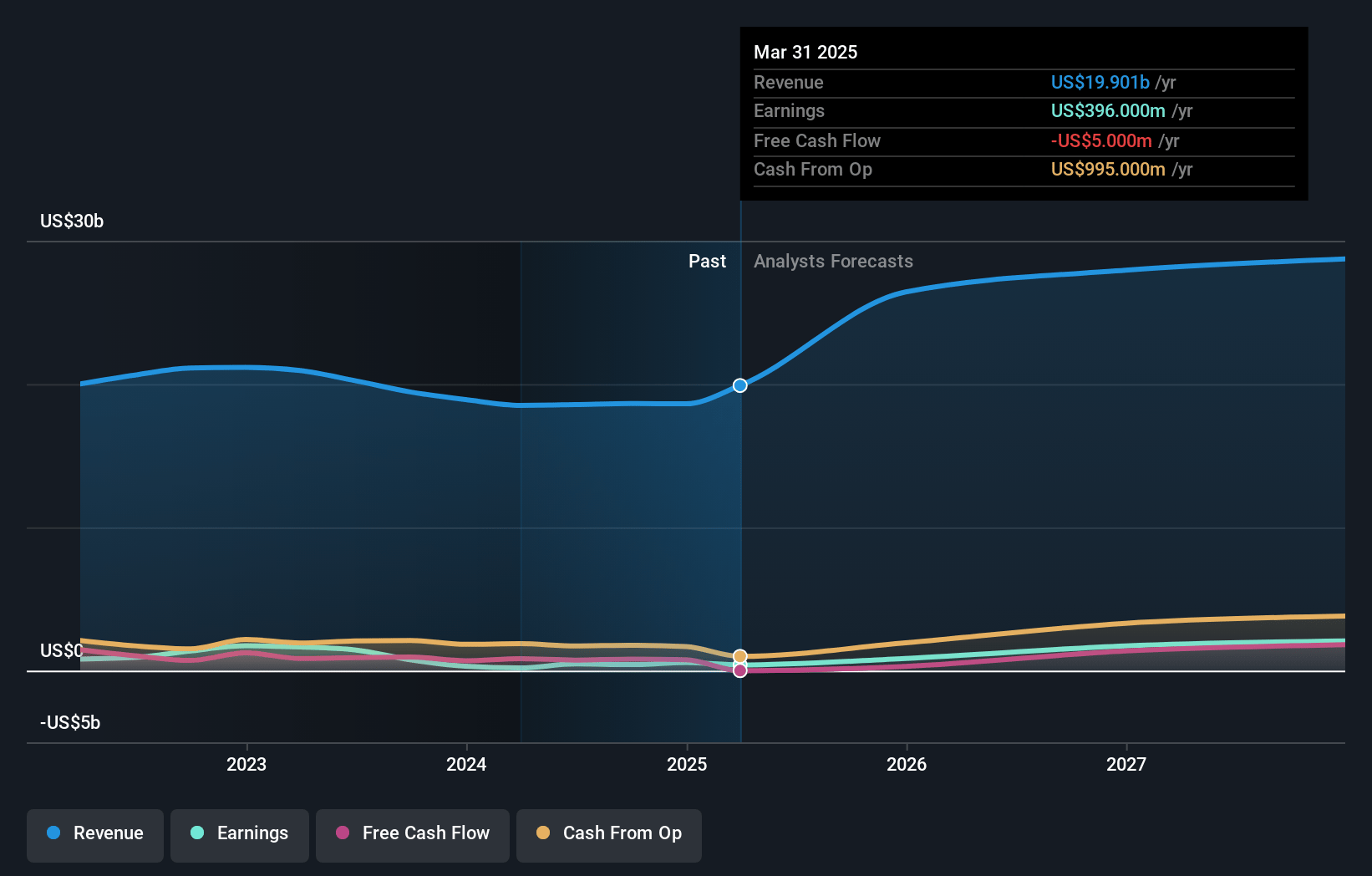

International Paper Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on International Paper compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming International Paper's revenue will grow by 17.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.0% today to 7.3% in 3 years time.

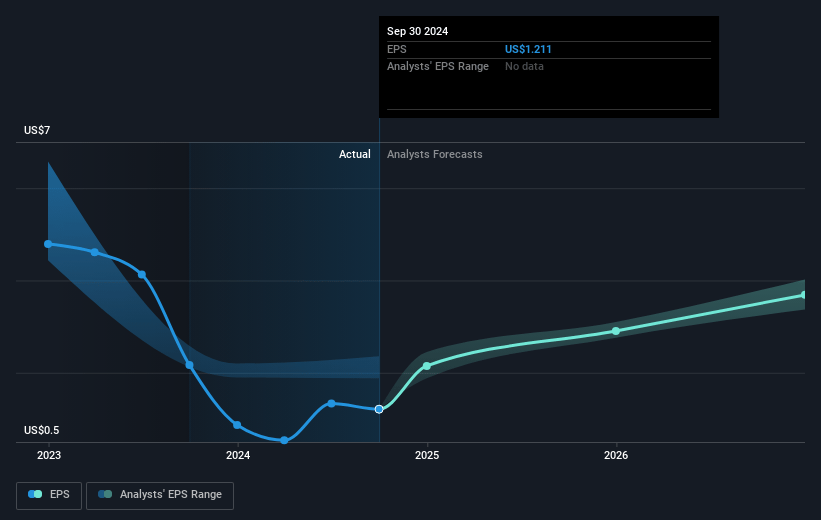

- The bullish analysts expect earnings to reach $2.2 billion (and earnings per share of $4.64) by about April 2028, up from $557.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.6x on those 2028 earnings, down from 44.0x today. This future PE is greater than the current PE for the US Packaging industry at 20.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.35%, as per the Simply Wall St company report.

International Paper Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Acceleration of digitalization and ongoing declines in demand for traditional office and printing paper continue to erode International Paper’s legacy revenue streams, potentially offsetting gains from packaging and undermining total top-line growth over the long term.

- Years of underinvestment in maintenance and reliability across the mill and box plant network have resulted in operational inefficiencies and higher costs, leading to a $300 million to $400 million annual drag on profitability that management acknowledges will take multiple years—and substantial spending—to correct, pressuring net margins and free cash flow.

- Persistent overcapacity in the global packaging and containerboard industry, especially from emerging markets and China, increases the risk of prolonged price competition and margin suppression for International Paper, challenging earnings growth even if volumes stabilize.

- Heavy capital requirements for plant upgrades, greenfield expansions, and environmental compliance are expected to remain elevated for at least three more years, constraining free cash flow and raising the risk that high leverage and interest costs could limit reinvestment and impact net profits.

- Adoption of alternative, sustainable packaging materials and intensifying regulatory demands—especially around carbon emissions and waste—threaten International Paper’s long-term sales by potentially diverting customers and increasing operational costs, with negative implications for both revenue growth and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for International Paper is $67.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of International Paper's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $44.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $30.2 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 23.6x, assuming you use a discount rate of 6.3%.

- Given the current share price of $46.48, the bullish analyst price target of $67.0 is 30.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NYSE:IP. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives