Narratives are currently in beta

Key Takeaways

- Strategic investments in facilities and innovation are expected to enhance cost advantages, support revenue growth, and elevate margins in key markets.

- Sustainability initiatives and accurate pricing mechanisms are likely to attract eco-conscious clients, stabilize earnings, and improve financial performance.

- Declining pricing, modest volume growth, and cost inflation challenge revenue and earnings growth despite strategic divestitures and promotional activities.

Catalysts

About Graphic Packaging Holding- Designs, produces, and sells consumer packaging products to brands in food, beverage, foodservice, household, and other consumer products.

- The investment in the Waco, Texas recycled paperboard manufacturing facility, set to start operations in Q4 2025, is expected to enhance cost and quality advantages in North America, likely supporting revenue and margins.

- The commissioning of high-value equipment at the Poznan facility in Poland is poised to bolster Graphic Packaging's position in the European health and beauty market, potentially increasing revenue and elevating net margins through premium offerings.

- The virtual power purchase agreement for new solar plants in Spain aims to significantly reduce carbon emissions, aligning with sustainability trends, which might boost revenue by attracting environmentally conscious clients.

- Shifting to more accurate pricing mechanisms for paperboard sales should reduce earnings volatility, potentially stabilizing or increasing earnings through better pricing alignment with costs.

- The $200 million in projected innovation sales growth signals strong product development, expected to boost future revenues and contribute positively to net margins through high-margin, innovative packaging solutions.

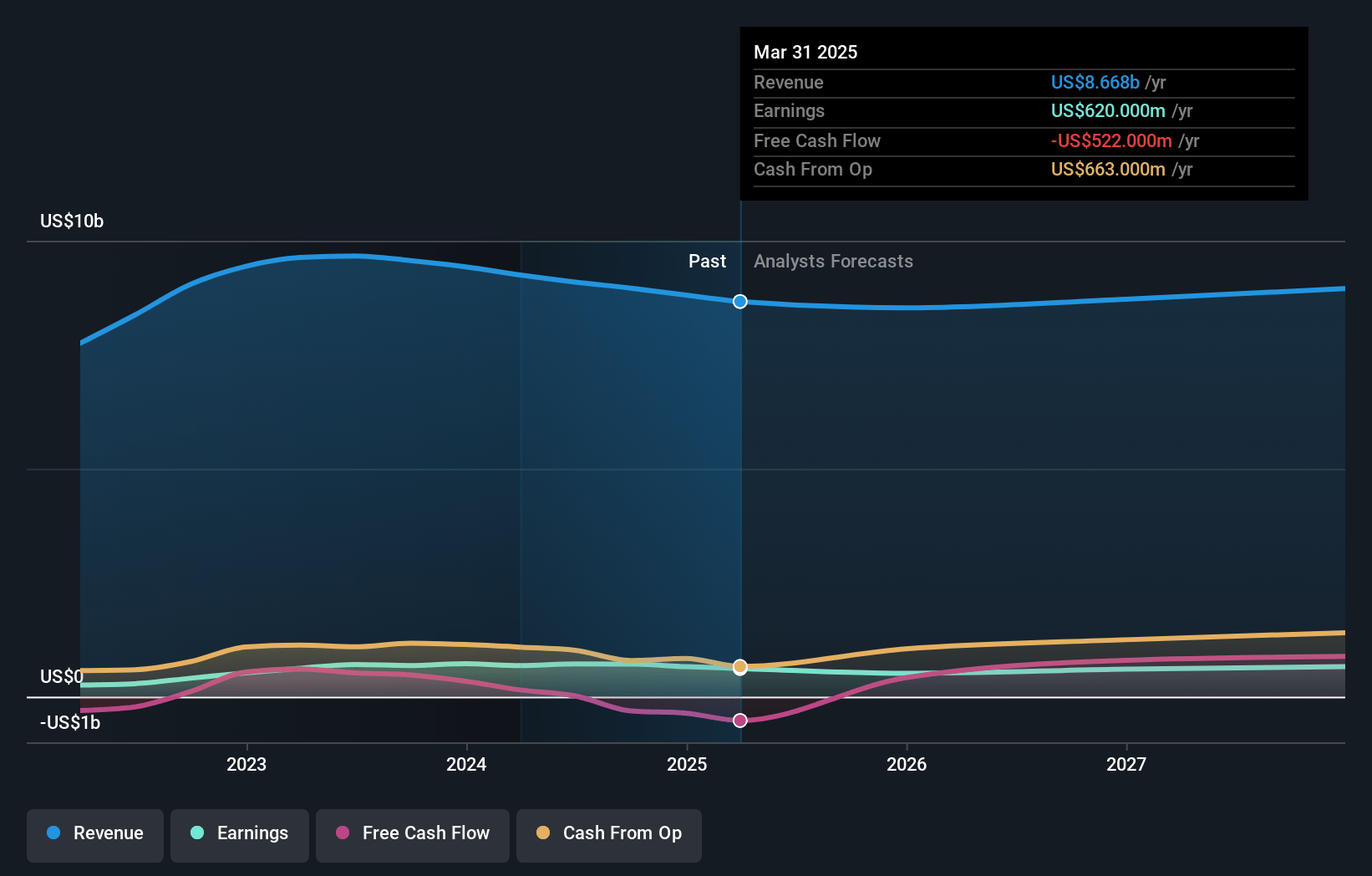

Graphic Packaging Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Graphic Packaging Holding's revenue will grow by 2.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.0% today to 8.8% in 3 years time.

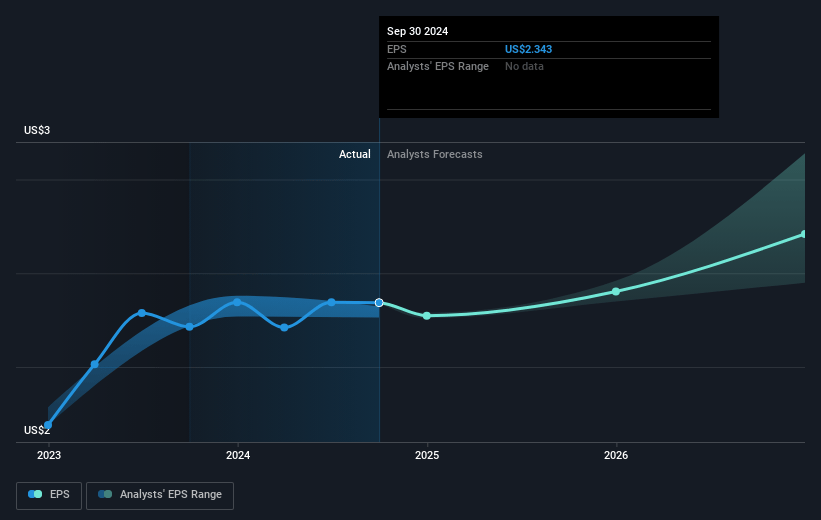

- Analysts expect earnings to reach $847.5 million (and earnings per share of $2.82) by about November 2027, up from $716.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $955 million in earnings, and the most bearish expecting $741.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.0x on those 2027 earnings, up from 12.0x today. This future PE is lower than the current PE for the US Packaging industry at 24.5x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.62%, as per the Simply Wall St company report.

Graphic Packaging Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced a 2% decline in pricing, similar to the previous quarter, which could negatively impact revenue growth in 2025.

- Volume growth remains modest, with only a 1% increase this quarter, which is below expectations, suggesting future revenue estimates might be overly optimistic.

- The sale and divestiture of the Augusta facility, while strategic, led to a sales decline of $109 million, resulting in reduced revenue from that segment.

- Potential cost inflation, such as the unexpected $100 million increase in project costs for the Waco facility, could impact net margins.

- The market conditions remain challenging with higher promotional activities, but these do not appear to be translating into materially higher volumes, which could affect earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $32.53 for Graphic Packaging Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.8, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $9.7 billion, earnings will come to $847.5 million, and it would be trading on a PE ratio of 14.0x, assuming you use a discount rate of 6.6%.

- Given the current share price of $28.63, the analyst's price target of $32.53 is 12.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives