Narratives are currently in beta

Key Takeaways

- New smelter operations and innovative leach technologies are expected to enhance copper production efficiency, boosting future earnings and cash flow.

- Expansion projects and high-demand sectors entry predict revenue growth, while the acquisition of Cerro Verde shares boosts earnings and dividend prospects.

- Production, liquidity, and revenue are at risk from Indonesian smelter issues, regulatory changes, China's economic dependency, project delays, and rising North American costs.

Catalysts

About Freeport-McMoRan- Engages in the mining of mineral properties in North America, South America, and Indonesia.

- The commissioning of new smelter operations and precious metals refinery in Indonesia, alongside restored and enhanced smelter capabilities after resolving the fire incident, is expected to secure continuity of copper concentrate exports and potentially secure long-term operating rights, impacting future earnings and cash flow generation.

- Advancements in high-potential innovative leach technologies could significantly scale and lower copper production costs in the Americas, thereby increasing incremental copper output and improving net margins through cost efficiencies.

- Brownfield expansion opportunities in the U.S. at Baghdad and Safford Lone Star present the potential to double current production levels while utilizing existing operations and infrastructure. This is likely to contribute to revenue growth as production scales.

- Entry into high-growth demand sectors such as power cable and AI data centers, alongside maintaining demand from China, supports an optimistic outlook for copper, which should enhance revenue despite traditional demand sectors slowing, thus potentially increasing net margins with better prices.

- The acquisition of additional Cerro Verde shares increases exposure to a high-quality long-lived asset, contributing positively to Freeport’s earnings and potential dividend income.

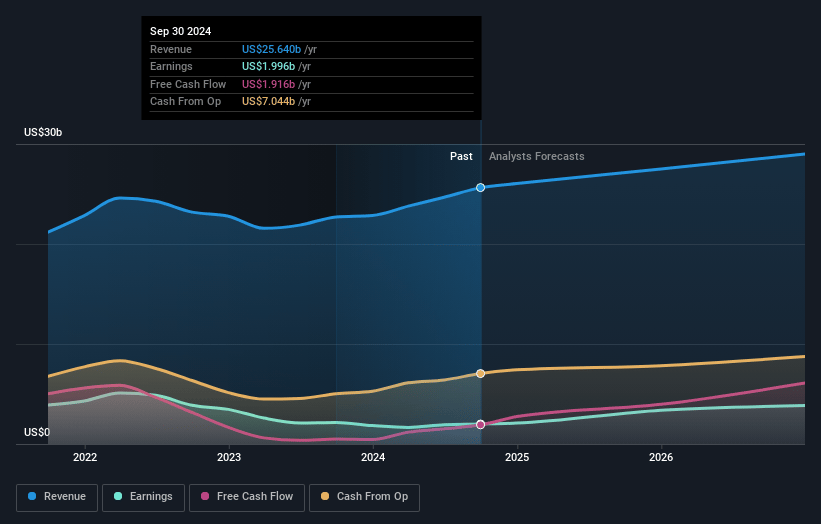

Freeport-McMoRan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Freeport-McMoRan's revenue will grow by 5.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.8% today to 8.9% in 3 years time.

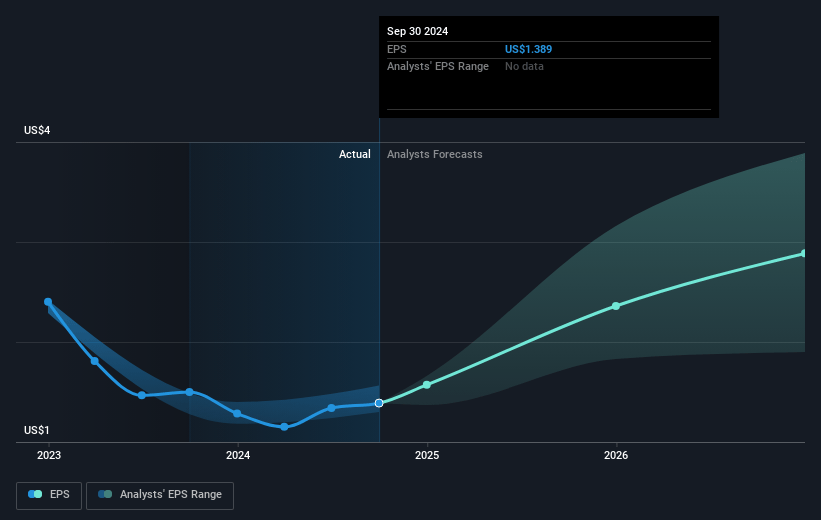

- Analysts expect earnings to reach $2.7 billion (and earnings per share of $1.93) by about November 2027, up from $2.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.6 billion in earnings, and the most bearish expecting $2.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.6x on those 2027 earnings, up from 31.0x today. This future PE is greater than the current PE for the US Metals and Mining industry at 18.8x.

- Analysts expect the number of shares outstanding to decline by 0.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.5%, as per the Simply Wall St company report.

Freeport-McMoRan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The recent smelter fire in Indonesia may lead to production delays and potential disruptions in copper concentrate exports, impacting short-term revenue and cash flow. This risk is compounded by the lack of business interruption insurance for such events.

- Regulatory changes in Indonesia, such as the restricted cash policy on export proceeds, may affect liquidity, as capital is temporarily tied up in deposits for 90 days, impacting financial flexibility and potentially affecting net margins.

- The dependency on economic stimulus in China to sustain copper demand may pose a risk if these measures fail to materialize or are delayed, leading to weaker copper prices and impacting revenue and earnings.

- Potential delays in the approval or execution of key growth projects, such as those in Safford/Lone Star or Baghdad, could hinder expected increases in production capacity and revenue growth.

- Rising costs in North America, including contractor and equipment expenses along with lower ore grades, pose a risk to maintaining or improving net margins, despite ongoing efficiency initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $55.41 for Freeport-McMoRan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $43.08.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $30.4 billion, earnings will come to $2.7 billion, and it would be trading on a PE ratio of 35.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of $43.12, the analyst's price target of $55.41 is 22.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives