Key Takeaways

- Dow is likely to face revenue growth constraints due to weak global manufacturing, housing affordability issues, and geopolitical volatility impacting future earnings.

- Planned cost reductions and strategic asset sales indicate potential overvaluation concerns amid uncertain demand and margin pressures.

- Dow's strategic investments, cost efficiency, and innovation are expected to enhance financial flexibility, growth, and competitive positioning despite economic challenges.

Catalysts

About Dow- Through its subsidiaries, provides various materials science solutions for packaging, infrastructure, mobility, and consumer applications in the United States, Canada, Europe, the Middle East, Africa, India, the Asia Pacific, and Latin America.

- Dow's future earnings growth is likely to face significant headwinds due to a less favorable macroeconomic environment, characterized by weak global manufacturing activity, ongoing affordability challenges in the housing and durable goods sectors, and geopolitical volatility, all of which could constrain revenue growth.

- The planned cost reduction of $1 billion primarily targets third-party contract labor and purchased services, and while necessary, these measures may indicate that Dow doesn't expect significant margin recovery, potentially impacting future earnings and indicating current overvaluation.

- The sale of a minority stake in U.S. Gulf Coast infrastructure assets is expected to generate up to $3 billion in cash proceeds, but the ongoing strategic review and potential restructuring of European assets, which are facing persistent demand challenges, suggest possible impairment charges or additional expenditures, weighing on Dow's future net margins.

- Maintenance turnarounds and higher anticipated feedstock costs could pressure margins, especially since higher input costs have not yet been offset by price increases, which may negatively impact short-term earnings and indicate potential overvaluation.

- Despite planned growth investments, such as the Path2Zero project, protracted timelines and the high capital expenditure required, coupled with cautious reductions in 2025 spending due to uncertain demand, may suggest that long-term EBITDA contributions will take longer to materialize, contributing to current overvaluation concerns.

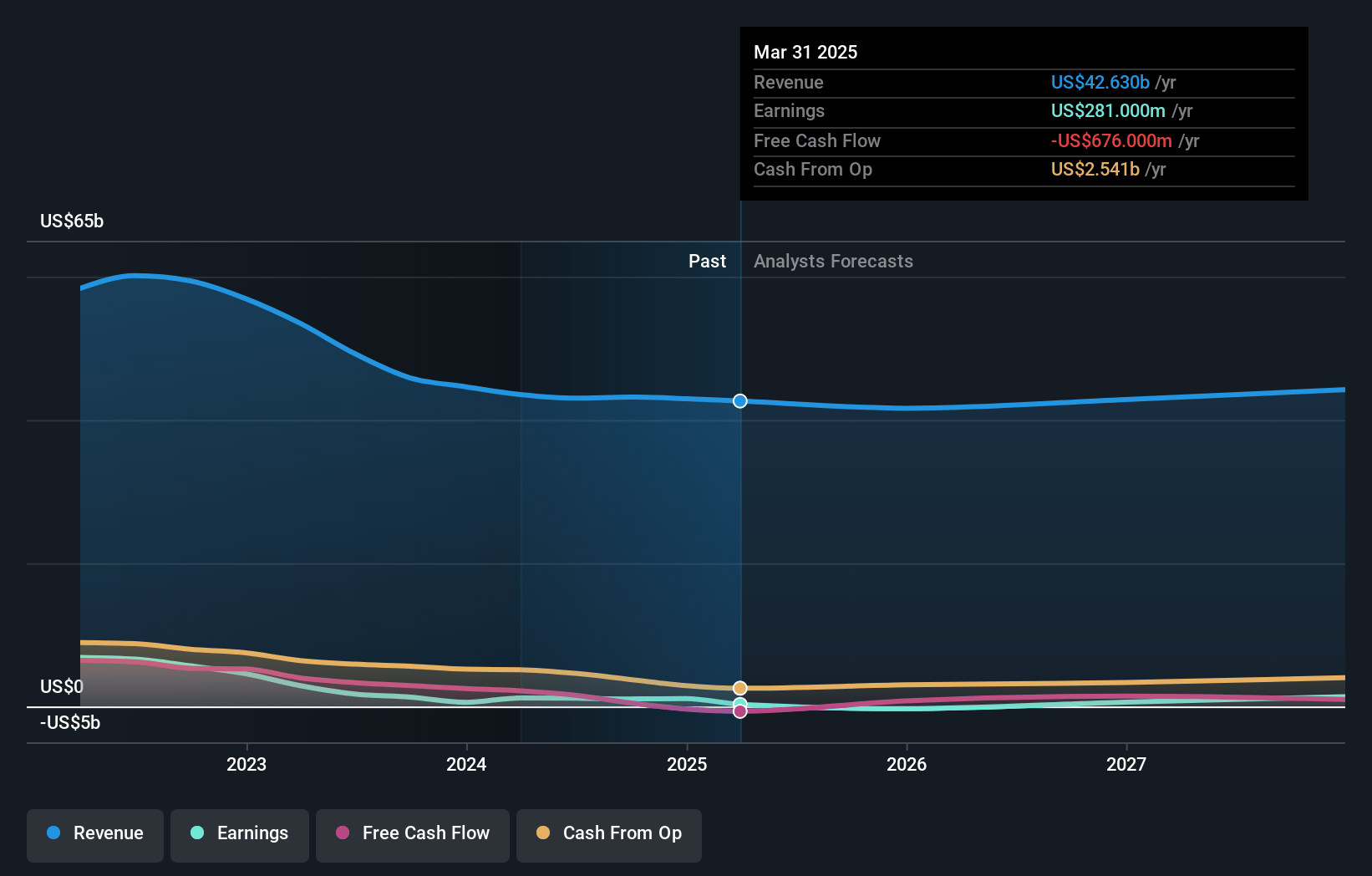

Dow Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Dow compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Dow's revenue will decrease by 0.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.6% today to 4.2% in 3 years time.

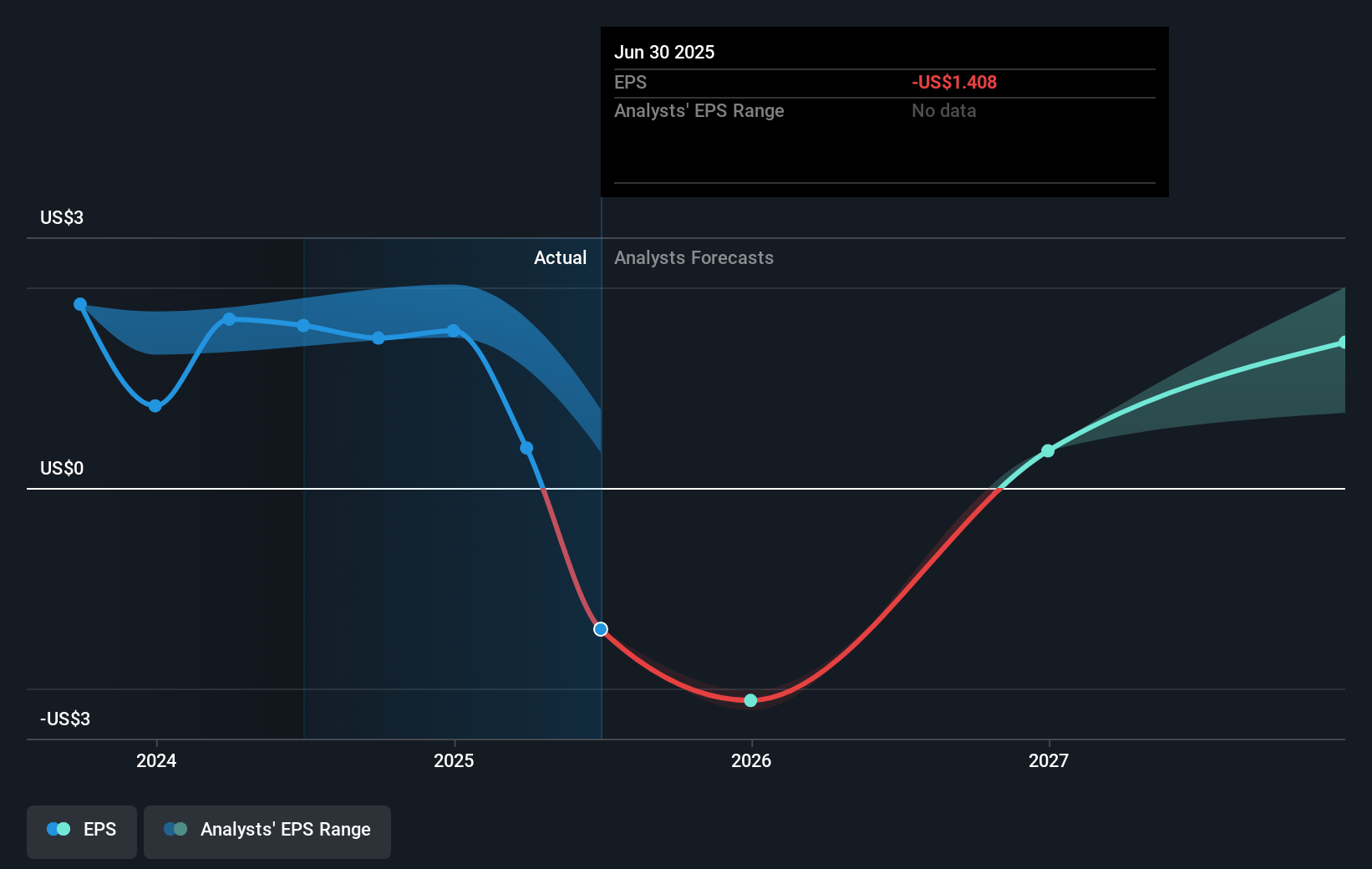

- The bearish analysts expect earnings to reach $1.8 billion (and earnings per share of $2.45) by about April 2028, up from $1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, down from 18.5x today. This future PE is lower than the current PE for the US Chemicals industry at 18.2x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.46%, as per the Simply Wall St company report.

Dow Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dow's ability to achieve long-term profitable growth and enhance shareholder returns is supported by proactive cost-reduction actions, portfolio optimization, and long-term strategic investments, which could help improve net margins through cost efficiency.

- The company is anticipating increased cash proceeds, up to $3 billion, from the sale of a minority stake in infrastructure assets, enhancing its financial flexibility to reinvest in growth projects and maintain steady earnings.

- Dow has demonstrated resilience and growth potential through ongoing investments such as the Path2Zero project, expected to generate approximately $1 billion in incremental EBITDA by 2030, potentially boosting both revenue and net margins as these projects mature.

- Despite weaker macroeconomic conditions, Dow has reported five consecutive quarters of year-over-year volume growth, which suggests a strong operational execution that might sustain revenue and earnings levels.

- The ongoing focus on innovation, customer engagement, and commercialization of Dow's pipeline strengthens its competitive position and might lead to increased revenue and improved net margins through differentiated product offerings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Dow is $30.24, which represents one standard deviation below the consensus price target of $40.95. This valuation is based on what can be assumed as the expectations of Dow's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $65.0, and the most bearish reporting a price target of just $29.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $42.3 billion, earnings will come to $1.8 billion, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 8.5%.

- Given the current share price of $28.88, the bearish analyst price target of $30.24 is 4.5% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystLowTarget holds no position in NYSE:DOW. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives