Key Takeaways

- Strategic initiatives and expansion projects are set to permanently improve margins, earnings, and revenue growth through increased production and economies of scale.

- Diversification in niche markets and infrastructure spending boosts are expected to enhance profitability, sales volumes, and competitive positioning.

- Economic and geopolitical factors pose risks to revenue, profitability, and market competitiveness, with interest rates, tariffs, and competition affecting future performance.

Catalysts

About Commercial Metals- Manufactures, recycles, and fabricates steel and metal products, and related materials and services in the United States, Poland, China, and internationally.

- CMC's strategic initiatives, particularly the Transform, Advance, and Grow (TAG) program, are projected to generate an additional $25 million in benefits over the rest of fiscal 2025 and promise further enhancements in the coming years. These improvements are likely to permanently improve margins and increase earnings.

- Significant expansion projects such as the Arizona 2 micro mill and the upcoming Steel West Virginia site are expected to boost production volumes and profitability starting late 2025 and beyond. This will directly impact revenue growth as new capacity comes online and improves earnings as economies of scale are achieved.

- CMC is actively pursuing organic and inorganic growth opportunities to diversify its product portfolio and improve its competitive position, particularly in niche markets like performance reinforcing steel and Geogrid solutions. Such investments, requiring less capital but yielding high returns, aim to enhance net margins and expand earnings.

- The global and domestic infrastructure spending surge, including major projects in North America and stimulus measures in Europe, is anticipated to drive increased construction demand, benefiting CMC through higher sales volumes and improved pricing leverage, thereby augmenting revenues.

- CMC's operational focus on efficiency gains and cost management, particularly in the European segment, has enabled cost savings and boosted profitability. Continued efforts in this domain are expected to enhance net margins and underpin stronger financial results in future periods.

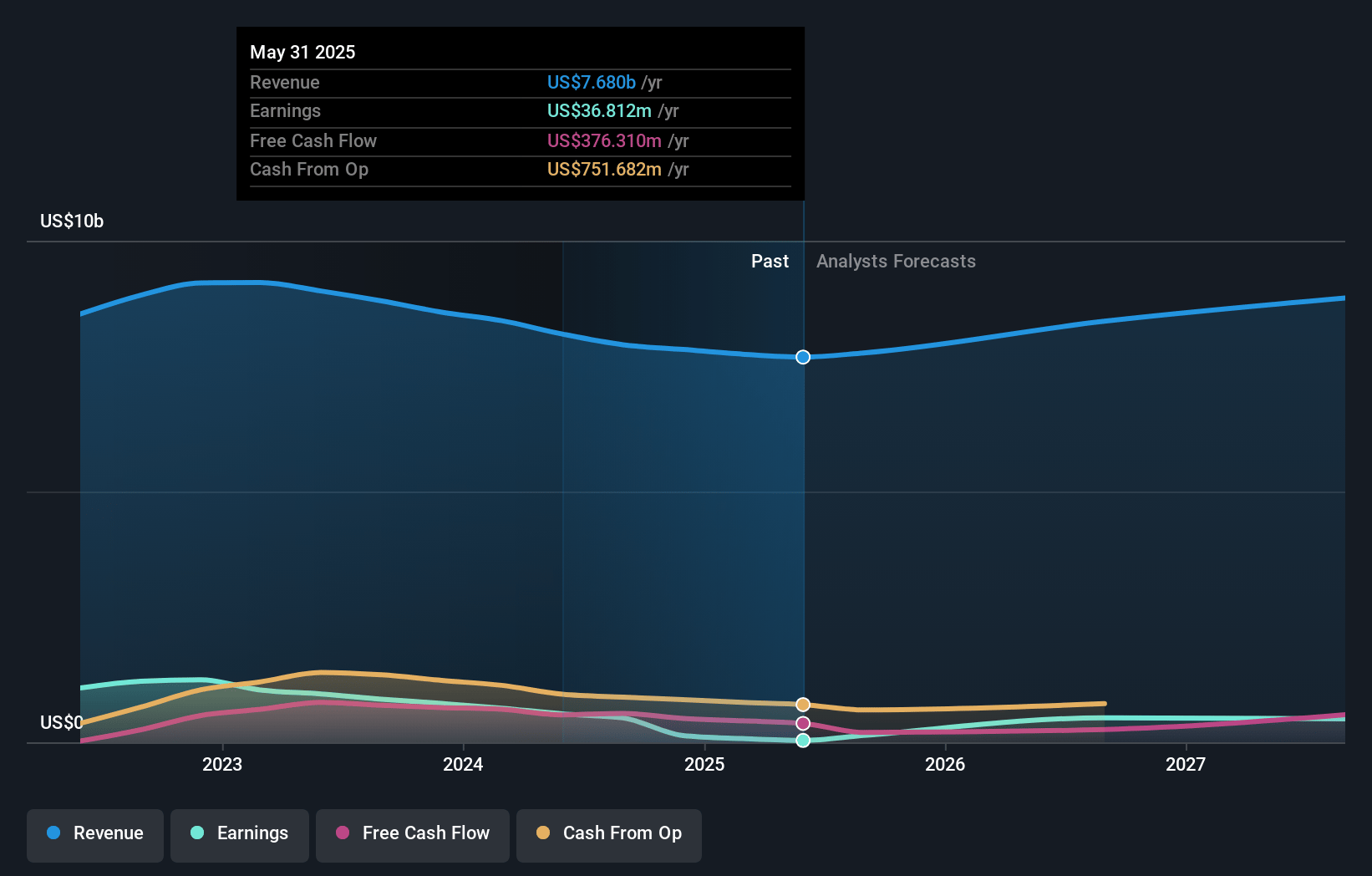

Commercial Metals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Commercial Metals's revenue will grow by 6.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.9% today to 8.7% in 3 years time.

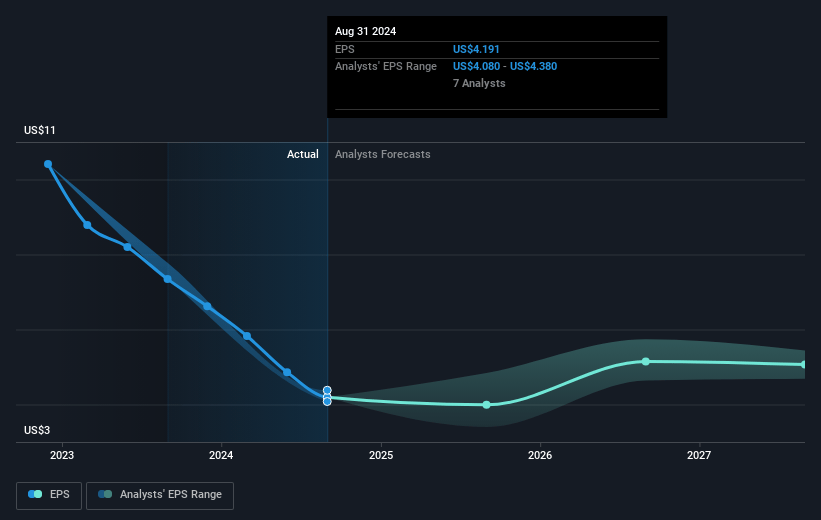

- Analysts expect earnings to reach $799.2 million (and earnings per share of $4.24) by about May 2028, up from $73.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, down from 70.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 21.6x.

- Analysts expect the number of shares outstanding to decline by 1.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Commercial Metals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Economic uncertainty and the impact of interest rates and tariffs could slow new construction project awards, affecting future revenues and earnings.

- Lower margins over scrap and higher costs related to weather disruptions and copper hedging losses can negatively impact net margins and overall profitability.

- CMC's geographic expansion, such as the Arizona 2 mill, faces startup challenges, indicating potential inefficiencies and delays in achieving profitability and positive earnings.

- The influx of new rebar capacity from competitors could increase market supply, impacting CMC's ability to maintain pricing power and affecting revenue and margins.

- Reliance on European market improvement amid geopolitical tensions and policy changes represents a risk that could affect segment profitability and future earnings if conditions worsen.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.167 for Commercial Metals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $41.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.2 billion, earnings will come to $799.2 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 7.3%.

- Given the current share price of $45.39, the analyst price target of $52.17 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.