Key Takeaways

- Celanese's structural actions, cost reductions, and divestitures are driving higher-than-expected earnings, margin improvement, and stronger free cash flow resilience.

- Unique product offerings and manufacturing advantages position the company to benefit as demand for advanced polymers and onshoring trends accelerate across key markets.

- Margin and revenue pressures from weak demand, overcapacity, high debt, rising costs, and slow innovation challenge Celanese's profitability and long-term competitiveness.

Catalysts

About Celanese- A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

- Analyst consensus expects $100 million in cost reductions and a $2 per share EPS run rate, but given management's comments on controllable levers and ongoing structural actions, the company could potentially exceed these targets as volumes normalize, lifting both net margins and earnings well above expectations.

- While analysts broadly agree divestitures will support the balance sheet and cash flow, stronger progress and management's growing confidence in non-Micromax divestitures suggest that $1 billion in proceeds could be realized faster, accelerating debt reduction and materially boosting free cash flow and earnings per share.

- The accelerating global shift toward lightweight, high-performance polymers-especially for electric vehicles and next-generation electronics-is creating multiyear demand tailwinds, and Celanese's unique portfolio and customer wins position it for above-market revenue and margin growth as secular adoption rates climb.

- Structural moves toward onshoring and regionalized manufacturing in North America and Europe, combined with Celanese's advantaged U.S. and European manufacturing footprint, mean the company is poised to disproportionately benefit from the supply chain transformation, driving stronger volume recovery and sustained margin expansion.

- The company's sustained focus on process innovation, advanced manufacturing, and successful integration of the DuPont Mobility & Materials assets is driving ongoing cost advantages and end-market diversification, making future earnings, EBITDA, and free cash flow structurally higher and less cyclical than consensus believes.

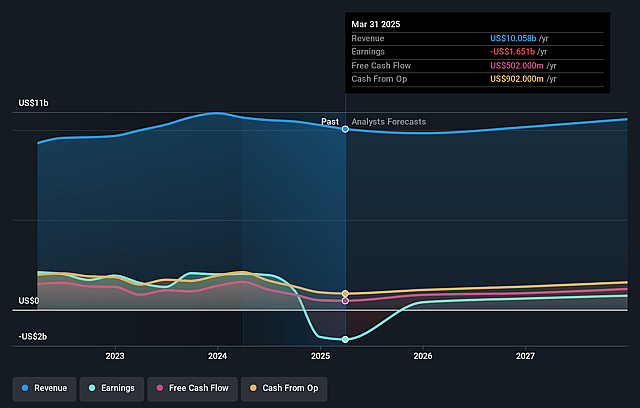

Celanese Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Celanese compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Celanese's revenue will grow by 2.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -16.1% today to 9.9% in 3 years time.

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $9.62) by about September 2028, up from $-1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.4x on those 2028 earnings, up from -3.1x today. This future PE is lower than the current PE for the US Chemicals industry at 25.9x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Celanese Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged softness and structural uncertainty in key end-markets such as automotive, construction, and electronics, especially in the Western Hemisphere and China, may reduce volumes and suppress revenues, putting sustained pressure on top-line growth.

- Increased global overcapacity, particularly in acetic acid and acetyls value chains, as well as persistent margin compression in China, threaten Celanese's pricing power and could continue to erode net margins and overall earnings.

- High debt levels and significant annual interest expense-highlighted by $650 million to $700 million in interest costs-following recent large acquisitions constrain free cash flow, limit capital allocation flexibility, and increase financial risk, especially if cash generation is back-end loaded or cyclical conditions worsen.

- Rising costs and volatility in key raw materials, including coal and natural gas, along with shifts in regulatory frameworks and growing pressure for sustainable and circular materials, threaten profitability and challenge the relevance of Celanese's traditional petrochemical product lines, putting longer-term revenues and earnings at risk.

- The company's slow pace of specialty innovation, together with ongoing commoditization in the chemical sector and the accelerating adoption of recycling and bio-based alternatives, increases the risk of market share loss and margin erosion, negatively impacting long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Celanese is $84.78, which represents two standard deviations above the consensus price target of $54.69. This valuation is based on what can be assumed as the expectations of Celanese's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $10.8 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 12.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $44.68, the bullish analyst price target of $84.78 is 47.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Celanese?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.