Key Takeaways

- Strategic focus on specialty materials, portfolio optimization, and targeted investments is driving operating leverage, margin expansion, and improved capital efficiency.

- Strong demand for sustainable plastics, vehicle electrification, and electronics supports robust growth, premium pricing, and favorable earnings mix.

- Weak demand, structural overcapacity, intense Asian competition, high leverage, and rising ESG pressures threaten margins, pricing power, and long-term revenue growth.

Catalysts

About Celanese- A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

- Accelerating demand for specialty polymers and engineered materials driven by the lightweighting and electrification of vehicles, as well as expanded use in electronics, is positioning Celanese for outsized volume growth and incremental share capture, particularly as its content in China’s EV market increased 20% last year and is targeted to repeat such gains. These factors point toward sustained revenue growth and the potential for outsized earnings contribution from high-impact programs in auto and electronics.

- The integration and synergy realization from the DuPont Mobility & Materials acquisition, including extensive cross-selling opportunities, product mix optimization, and operating costs reductions, is expected to deliver significant improvement in consolidated net margins and drive earnings as Celanese pivots toward higher-value specialty applications.

- Celanese’s strategic investments in expanding capacity for acetic acid and engineered materials, as well as its downstream integration with increased internal consumption, are set to lower input cost volatility and increase operating leverage. As industrial demand and construction activity recover from cyclical lows, these investments should translate into robust margin expansion and growth in free cash flow.

- Heightened global demand for sustainable, advanced, and recyclable plastics, along with tightening regulatory requirements for safer chemicals, is favoring Celanese’s strong technical expertise in bio-based and recyclable specialty plastics. This supports long-term volume growth at premium pricing, driving both top-line acceleration and a favorable shift in profit mix.

- The ongoing portfolio optimization, including divestitures of non-core businesses and sharp focus on high-impact, high-growth programs, is expected to increase capital efficiency and shift resources toward the most lucrative growth opportunities. This is likely to yield an improvement in return on invested capital and a higher sustained run-rate of free cash flow, which can support deleveraging and future shareholder returns.

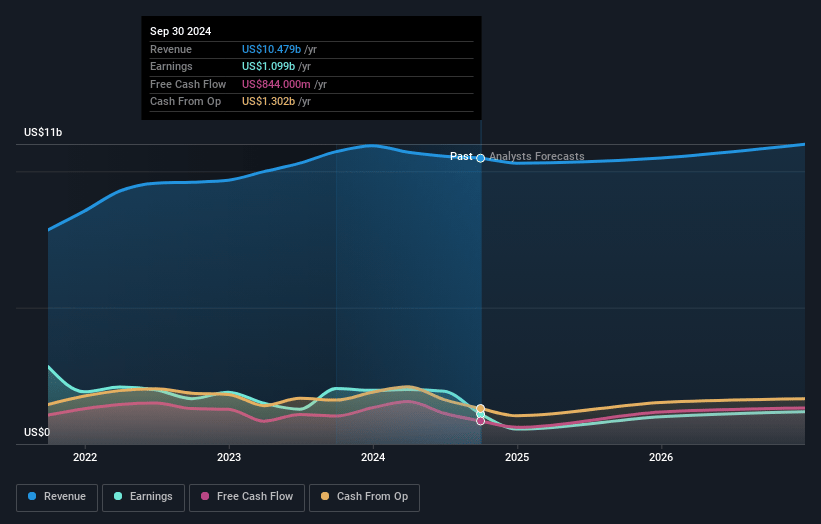

Celanese Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Celanese compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Celanese's revenue will grow by 4.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -16.4% today to 9.0% in 3 years time.

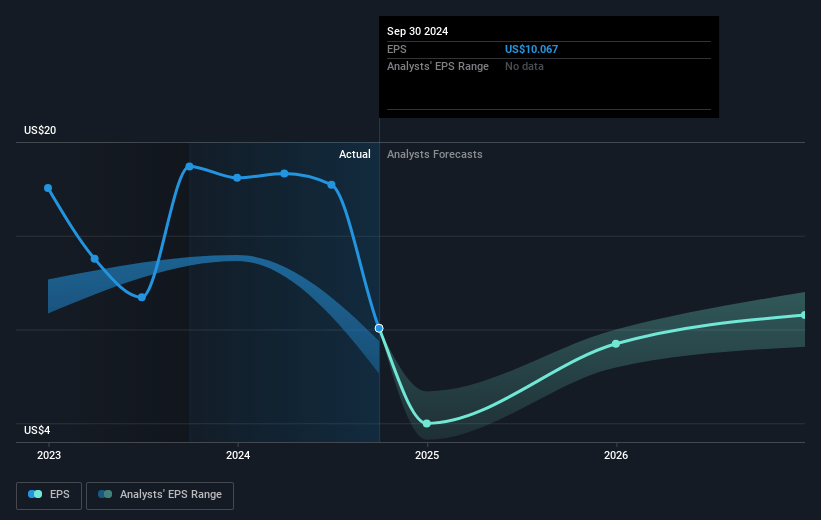

- The bullish analysts expect earnings to reach $1.0 billion (and earnings per share of $9.53) by about May 2028, up from $-1.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from -3.3x today. This future PE is lower than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Celanese Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Structural overcapacity and weak demand, especially in nylon 66 and acetyl chain, continue to erode margins and profits, with management openly highlighting overcapacity in Asia and major earnings declines since 2021, which could lead to long-term pressure on revenues and profit margins.

- Intensifying global competition—particularly from low-cost Asian producers, especially China—has led to compressed prices and market share challenges, with management admitting Western product that historically found a market in China is being displaced, threatening Celanese’s pricing power and future revenue growth.

- Demand uncertainty persists across key end markets such as automotive, paints, coatings, and electronics, and management repeatedly cited unpredictable near-term and long-term demand, making revenue and earnings highly vulnerable to cyclical and secular declines in those sectors.

- The company’s high leverage from large acquisitions (such as the DuPont M&M deal), alongside a heavy reliance on restructuring and divestiture to generate cash, increases financial risk and could constrain net profit margins and flexibility to invest for growth, especially in a weak earnings environment.

- Increasing regulatory, consumer, and ESG pressures against single-use plastics and petrochemical-based materials risk further demand erosion for Celanese’s core products, requiring accelerated sustainability innovation and potentially raising compliance costs, which could depress long-term EBITDA and margins if the company fails to keep pace with green chemistry trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Celanese is $93.44, which represents two standard deviations above the consensus price target of $58.69. This valuation is based on what can be assumed as the expectations of Celanese's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $120.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $11.5 billion, earnings will come to $1.0 billion, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 11.4%.

- Given the current share price of $49.05, the bullish analyst price target of $93.44 is 47.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives