Last Update 11 Dec 25

CE: Digital Platform And Low Carbon Materials Will Support Margin Upside

Analysts have modestly raised their price target on Celanese, reflecting a reassessment of its earnings power and risk profile that supports a fair value of approximately $52.50 per share.

What's in the News

- Celanese received Carbon Footprint Certification from ISCC for its Hostaform and Celcon POM ECO-C grades in Frankfurt and Bishop, supported by CCU technology at the Clear Lake methanol joint venture with Mitsui. This reinforces its sustainable plastics leadership (Key Developments).

- The company booked approximately $1.5 billion of asset impairments in third quarter 2025, largely tied to goodwill and certain trade names, primarily Zytel, following its annual impairment testing (Key Developments).

- Celanese plans to cease operations at its acetate tow facility in Lanaken in the second half of 2026, citing weak demand, regulatory uncertainty, and high operating costs. About 160 jobs may be affected (Key Developments).

- At the K Show in Dusseldorf, Celanese is showcasing new digital services and advanced materials, including an enhanced Chemille digital assistant that provides AI driven material selection support, regulatory documentation, and 24/5 live engineer chat (Key Developments).

- The company is highlighting low carbon POM ECO C, new high performance automotive and consumer materials, and expanded NVH testing capabilities to differentiate its service offering across key end markets (Key Developments).

Valuation Changes

- Fair Value: unchanged at approximately $52.50 per share, indicating no material shift in the intrinsic value assessment.

- Discount Rate: steady at 12.5 percent, suggesting no reassessment of the company’s risk profile or required return.

- Revenue Growth: effectively unchanged at about 40.2 percent over the modeled period, with only immaterial numerical rounding differences.

- Net Profit Margin: stable at roughly 8.0 percent, reflecting no meaningful revision to long term profitability assumptions.

- Future P/E: flat at about 10.5x, signaling a consistent view of Celanese’s earnings multiple relative to its risk and growth outlook.

Key Takeaways

- Strategic cost reductions and operational integration have enhanced margins and cash flow resilience, positioning the company to benefit from any market recovery.

- Focus on sustainable materials and product diversification is set to capture growth as regulation tightens and customer demand shifts toward green solutions.

- Structural market headwinds, margin pressures, and elevated financial leverage highlight uncertainty around earnings recovery and sustainable growth despite ongoing cost-cutting efforts.

Catalysts

About Celanese- A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

- Celanese is positioned to benefit from the shift toward lightweight and fuel-efficient solutions in automotive and aerospace, with the upcoming wave of new EV launches by Western OEMs and continuing demand for high-performance polymers expected to reignite volume growth and revenues as end-market demand normalizes.

- Strategic cost optimization-such as supply chain consolidation, SKU rationalization, inventory reduction, and streamlined SG&A-has materially lowered the company's fixed cost base, enhancing operating leverage and supporting higher EBITDA margins and net earnings when volumes recover.

- Celanese's investments in green chemistry and downstream product diversification position it to capture share as demand accelerates for sustainable materials driven by both tightening environmental regulation and increased consumer focus on circular solutions, supporting long-term top-line and margin expansion.

- Ongoing integration of Engineered Materials and recent acquisitions is unlocking operational synergies, broadening the product portfolio, and enabling more flexible make-to-order production, all of which will contribute to improved operating margins and higher free cash flow as integration matures.

- The company maintains substantial earnings power and cash generation ability even at depressed volume levels; any macro catalysts (industrial recovery, normalization of construction cycles, onshoring of manufacturing) are likely to drive disproportionate improvements in revenue and margin due to the company's advantaged cost structure and operational flexibility.

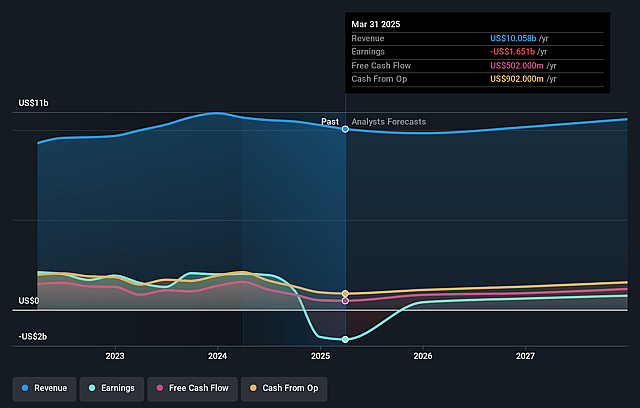

Celanese Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Celanese's revenue will decrease by 1.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -16.1% today to 7.8% in 3 years time.

- Analysts expect earnings to reach $799.9 million (and earnings per share of $7.28) by about September 2028, up from $-1.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.7x on those 2028 earnings, up from -3.1x today. This future PE is lower than the current PE for the US Chemicals industry at 25.9x.

- Analysts expect the number of shares outstanding to grow by 0.18% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Celanese Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent overcapacity and weak demand in global acetyl and engineered materials markets, particularly in Asia and Western Hemisphere, have driven volumes to historically low levels and compressed margins, which, if prolonged, could pressure revenue and earnings recovery.

- The chemical industry is experiencing low order visibility and heightened customer inventory destocking, resulting in unpredictable and potentially volatile near-term and long-term revenues.

- Cost-saving and footprint rationalization actions have been highlighted as major drivers of future profitability, but reliance on these internally controllable levers indicates ongoing structural challenges in end-market demand, making sustainable earnings growth uncertain.

- Margin compression in China, especially due to overcapacity and price declines in the Acetyl Chain, as well as increasing coal prices, could erode gross and operating margins, particularly if input costs rise faster than Celanese can offset via price or mix improvements.

- Elevated debt levels and interest expenses following recent acquisitions, coupled with dependence on asset divestitures to meet deleveraging targets, create financial risk-potentially constraining free cash flow available for reinvestment or shareholder returns if operational improvements do not materialize as planned.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.688 for Celanese based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $40.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.2 billion, earnings will come to $799.9 million, and it would be trading on a PE ratio of 10.7x, assuming you use a discount rate of 12.3%.

- Given the current share price of $44.68, the analyst price target of $54.69 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Celanese?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.