Last Update08 May 25Fair value Increased 19%

Key Takeaways

- Chemours faces ongoing regulatory and legacy product risks, with volatility in margins and cash flow as it shifts toward environmentally friendly refrigerants and away from declining Freon sales.

- Growth from new products and markets may be slow to materialize, while persistent litigation and debt limit reinvestment and expose the company to further shocks.

- Chemours faces significant legal liabilities, cyclical market volatility, a concentrated product mix, delayed growth in new segments, and ongoing leverage pressures impacting its financial stability.

Catalysts

About Chemours- Provides performance chemicals in North America, the Asia Pacific, Europe, the Middle East, Africa, and Latin America.

- Although Chemours is positioned to benefit from accelerating global electrification and stricter environmental mandates driving the adoption of low-global-warming refrigerants like Opteon, the company remains highly exposed to legacy product phase-outs and regulatory risks, with ongoing transition dynamics and inventory imbalances potentially creating ongoing volatility in both revenue and net margin as the product mix shifts and Freon sales decline sharply.

- While investments in capacity expansion for Opteon feedstock and strategic agreements in emerging markets such as liquid cooling fluids for data centers could underpin multi-year top-line growth, the timing and realization of these opportunities rely heavily on complex field trials and gradual commercialization, which could delay near-term earnings impact and potentially make Chemours vulnerable if competitors' innovations outpace their own.

- Despite ongoing strategic cost out and operational savings programs expected to yield $125 million by 2025 and up to $250 million by 2027, Chemours faces headwinds from legacy ore feedstock contracts and plant downtime, suggesting that improvements in longer-term gross margins could be offset or delayed, impacting free cash flow and increasing earnings volatility.

- Although tightening of fair trade regulations in Western markets like North America and Europe offers Chemours a path to regain share and drive volume growth in TiO₂, ongoing global overcapacity—especially from Chinese suppliers—and price declines in less-regulated regions may limit overall pricing power and depress realized EBITDA, especially if regulatory progress in major markets proves inconsistent or slow.

- While Chemours is making some progress on legacy litigation and has implemented a dividend cut to preserve balance sheet flexibility, the persistence of PFAS-related liabilities and elevated net leverage at five times adjusted EBITDA remain a structural constraint; this could restrict the company’s ability to meaningfully reinvest for growth or weather further macroeconomic or regulatory shocks, ultimately capping improvements in shareholder returns.

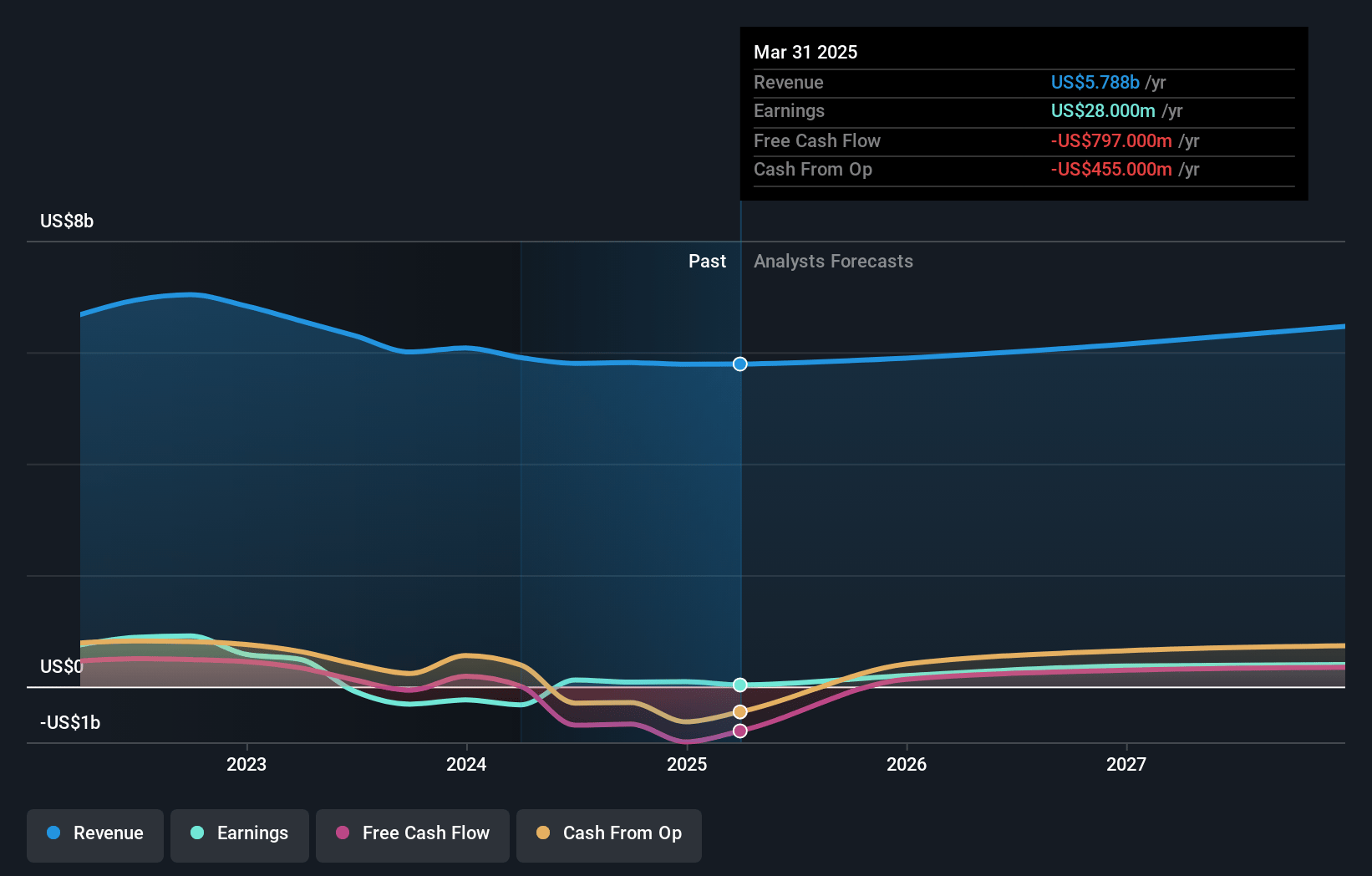

Chemours Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Chemours compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Chemours's revenue will grow by 1.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.5% today to 8.0% in 3 years time.

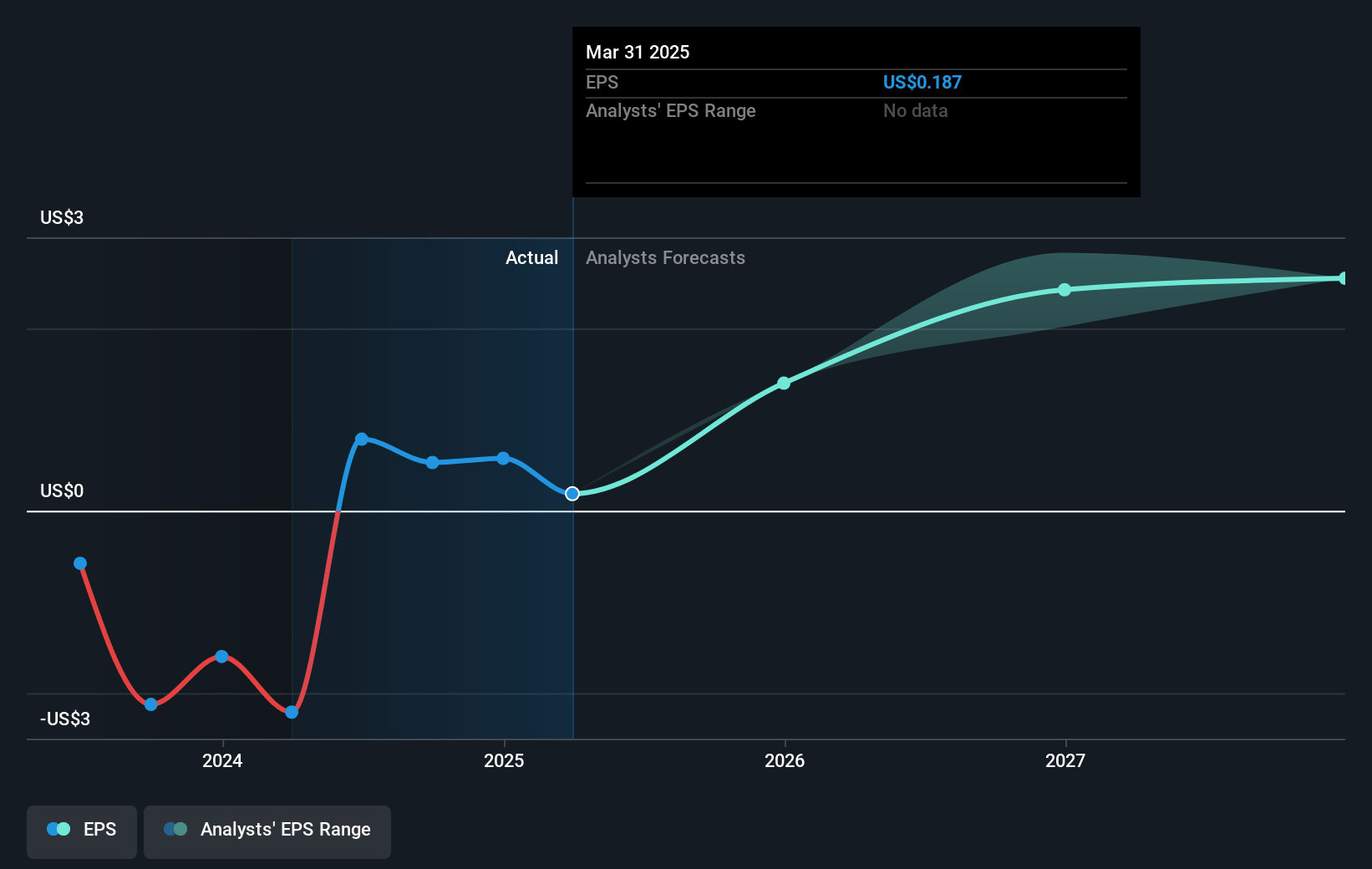

- The bearish analysts expect earnings to reach $487.0 million (and earnings per share of $3.14) by about May 2028, up from $28.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.6x on those 2028 earnings, down from 58.3x today. This future PE is lower than the current PE for the US Chemicals industry at 20.2x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Chemours Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Chemours faces ongoing legal and financial risks from legacy liabilities, particularly litigation related to PFAS (“forever chemicals”), with the company incurring higher-than-anticipated legal costs this quarter and holding $50 million in restricted cash for potential settlements, which may pressure future net margins and earnings.

- The company’s top-line growth remains vulnerable to cyclical and regional volatility in its core Titanium Technologies (TiO₂) and Advanced Performance Materials (APM) segments, as evidenced by significant pricing declines, weak demand in hydrogen and other cyclical markets, and exposure to price attrition from Chinese dumping, which impacts both revenues and EBITDA margins.

- Chemours remains heavily dependent on a concentrated product portfolio, especially TiO₂ and fluoroproducts like Opteon, making the business susceptible to demand shifts, pricing competition, and regulatory changes that could result in revenue instability and reduced profitability.

- Despite optimism for long-term growth in advanced materials and emerging markets such as immersion cooling fluids, commercialization and meaningful revenue contribution from these products are expected only toward the end of the decade, which raises concerns about the company’s ability to offset near-term weaknesses in existing lines and sustain long-term revenue growth.

- Elevated leverage, with net debt at five times adjusted EBITDA and a significant dividend cut to preserve balance sheet flexibility, highlights ongoing pressure on free cash flow and the risk that further economic downturns or delays in margin recovery could constrain Chemours’ ability to invest in growth or return capital to shareholders, directly impacting long-term financial health and shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Chemours is $13.04, which represents two standard deviations below the consensus price target of $18.7. This valuation is based on what can be assumed as the expectations of Chemours's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $22.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $487.0 million, and it would be trading on a PE ratio of 5.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $10.9, the bearish analyst price target of $13.04 is 16.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.