Key Takeaways

- Increased silver production and reduced costs position Buenaventura for growth and improved net margins.

- Strategic asset sales and debt management enhance financial flexibility, supporting investments in high-potential projects.

- Declining copper production, high costs, and dependence on commodity prices threaten profitability and financial stability amid operational challenges.

Catalysts

About Compañía de Minas BuenaventuraA- Engages in the exploration, development, construction, and operation of mineral processing business.

- The significant increase in silver production at Uchucchacua and Yumpag, along with a reduction in all-in sustaining costs by 69% year-over-year, positions Buenaventura for greater revenue growth and potentially improved net margins.

- The San Gabriel project's progress, now at 65% overall completion, is a major catalyst for future growth, with an expected annual EBITDA of $100 million once operational. This development could have a substantial positive impact on earnings.

- The company's effective debt management, resulting in a record low leverage ratio of 0.5x, provides Buenaventura with an advantageous financial position to support future investments and growth opportunities, likely enhancing net margins.

- Strategic sale of the Chaupiloma Royalty Company for $210 million strengthens cash flow and allows reinvestment into high-potential projects like San Gabriel, directly bolstering capital for revenue-generating initiatives.

- Buenaventura's upgrade in credit rating to B1 with a positive outlook indicates improved financial health, which can lower borrowing costs and facilitate investments in growth projects, ultimately boosting net margins and earnings.

Compañía de Minas BuenaventuraA Future Earnings and Revenue Growth

Assumptions

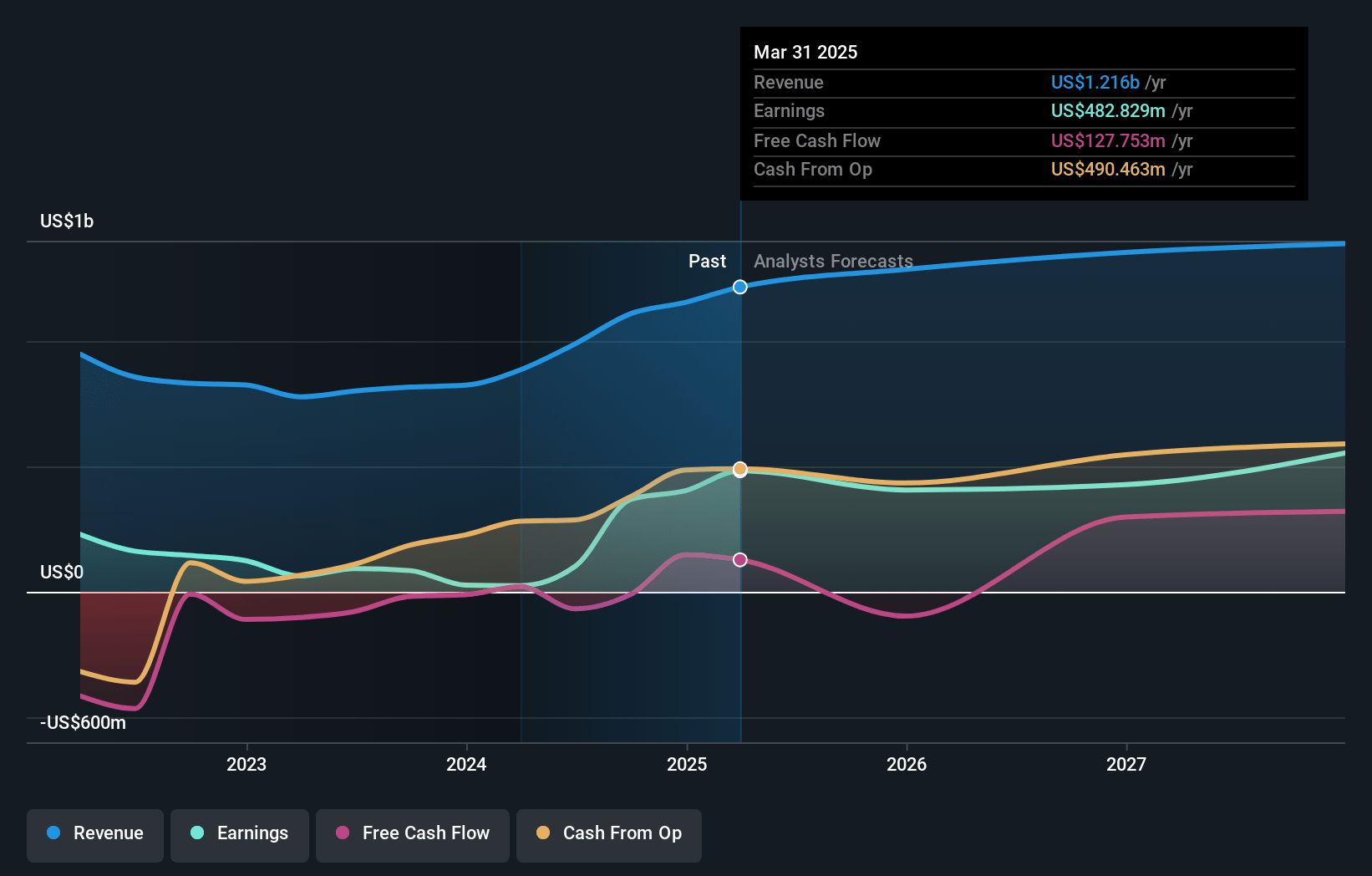

How have these above catalysts been quantified?- Analysts are assuming Compañía de Minas BuenaventuraA's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 33.2% today to 29.2% in 3 years time.

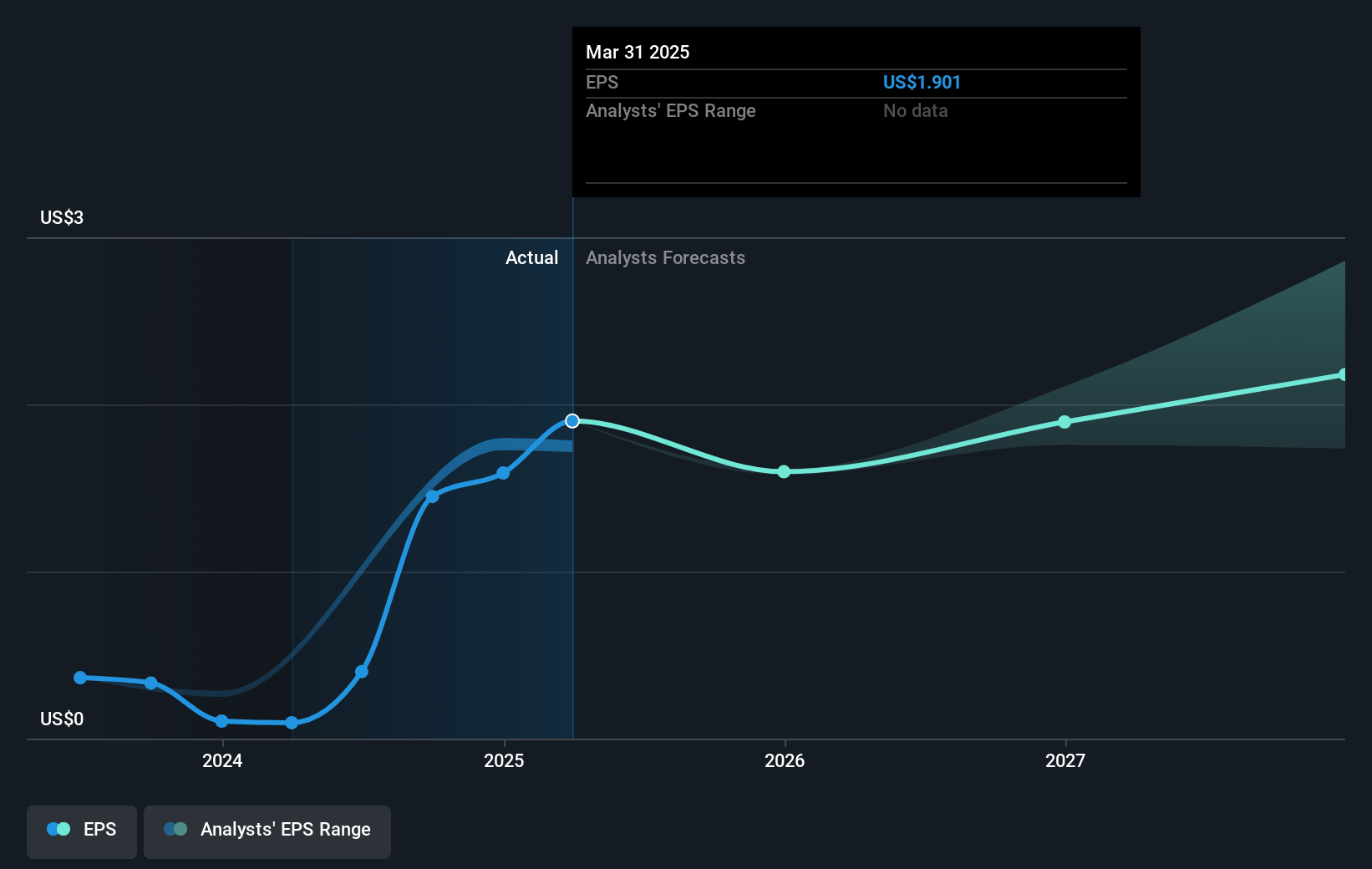

- Analysts expect earnings to reach $361.9 million (and earnings per share of $1.42) by about January 2028, down from $368.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $484.5 million in earnings, and the most bearish expecting $303 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, up from 8.6x today. This future PE is lower than the current PE for the US Metals and Mining industry at 16.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.75%, as per the Simply Wall St company report.

Compañía de Minas BuenaventuraA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Copper production decreased by 10% compared to the previous period, suggesting potential challenges in maintaining stable production, which can negatively impact revenues and earnings.

- Cost reduction efforts had to contend with increased exploration expenses and rising costs at key sites, which could pressure net margins if not controlled effectively.

- The San Gabriel project's completion risk, including potential delays or increased capital expenditure beyond the planned $650 million, could strain cash flows and affect long-term financial projections.

- Dependence on commodity prices, such as gold and silver, presents financial risk; any decline in these prices may significantly reduce revenue and EBITDA.

- High all-in sustaining costs and the challenges at certain operations, like Julcani with low productivity, pose a risk to overall cost efficiency and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.21 for Compañía de Minas BuenaventuraA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.5, and the most bearish reporting a price target of just $14.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $361.9 million, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 9.8%.

- Given the current share price of $12.4, the analyst's price target of $16.21 is 23.5% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives