Key Takeaways

- Organizational changes and leadership roles are expected to enhance innovation, agility, and geographic market expansion, potentially driving future revenue and earnings growth.

- Strategic compensation alignment aims to improve net margins through employee performance focused on profitable growth in high-growth markets like consumer health care and packaging.

- European market challenges, telecommunication reliance, and geopolitical uncertainties threaten Avient's financial performance through impacted supply chains and potential revenue shortfalls.

Catalysts

About Avient- Operates as a formulator of material solutions in the United States, Canada, Mexico, Europe, South America, and Asia.

- Avient's recent organizational changes, including streamlining operations under a single global leader and simplifying structures in Europe, are expected to enhance customer focus and agility, potentially driving future organic growth and impacting revenue positively.

- New leadership roles, such as Chief Technology Officer and Senior VP for new business development, align with strategies for profitable growth and scaling new businesses. This could lead to increased earnings through enhanced innovation and market penetration.

- Avient's emphasis on macro trends in key regions, such as expanding their customer base in Asia and Latin America and leveraging near-shoring trends, positions the company for future revenue growth through geographical market expansion.

- Strategic alignment of compensation structures with company goals starting next year is intended to drive desired behaviors and market success. This initiative aims to improve net margins through more focused employee performance on profitability.

- The company's ability to win market share and secure new business in high-growth areas, such as consumer health care and packaging in Latin America, suggests potential revenue and earnings increases as these markets continue to expand.

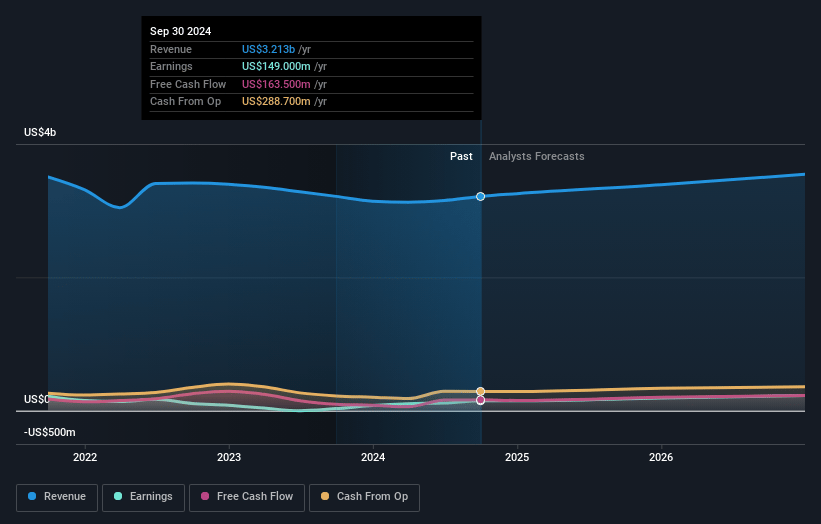

Avient Future Earnings and Revenue Growth

Assumptions

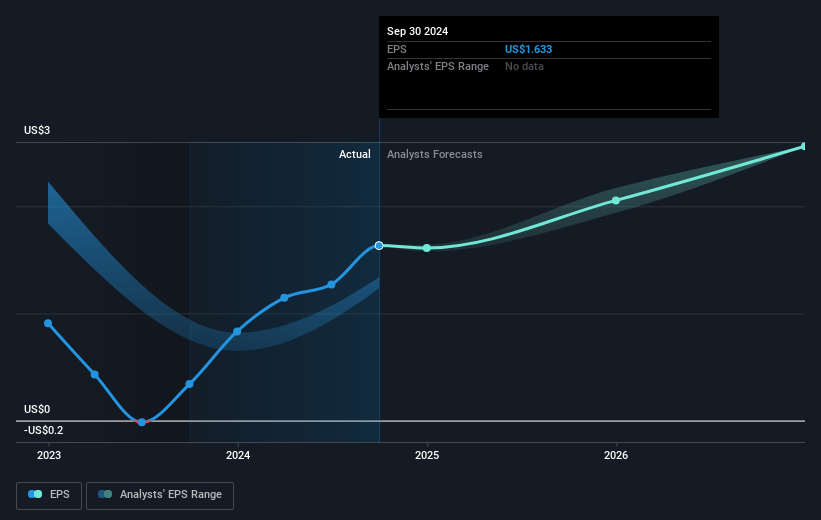

How have these above catalysts been quantified?- Analysts are assuming Avient's revenue will grow by 4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 6.8% in 3 years time.

- Analysts expect earnings to reach $247.4 million (and earnings per share of $2.72) by about January 2028, up from $149.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, down from 26.2x today. This future PE is greater than the current PE for the US Chemicals industry at 22.6x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Avient Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Eurozone economy's continued sluggishness, combined with a low manufacturing PMI, presents challenges for Avient's growth in EMEA, potentially impacting future revenues and market confidence.

- Avient's reliance on the telecommunication and transportation sectors, where demand remains weak, poses a risk of revenue shortfall and could depress overall financial performance if these sectors do not recover promptly.

- The competitive landscape in Europe, especially in the telecommunications sector where subsidized Chinese imports impact pricing, could pressure Avient's margins and revenue growth.

- Political uncertainties and trade-related challenges in Latin America pose an ongoing threat to stable revenue streams, which could disrupt supply chains and impact earnings.

- Risks associated with the delayed flow of BEAD funding in the U.S. for telecom infrastructure projects might affect Avient’s Fiber-Line business performance, potentially impacting future revenue streams in this segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.2 for Avient based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.6 billion, earnings will come to $247.4 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $42.77, the analyst's price target of $56.2 is 23.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives