Key Takeaways

- Selling the LNG business and slow growth in China may hinder future revenue growth.

- Regulatory challenges and clean hydrogen focus present risks to earnings and net margins.

- Strategic divestitures, project financing, and long-term agreements support Air Products' growth in clean hydrogen, earnings stability, and shareholder returns.

Catalysts

About Air Products and Chemicals- Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

- The sale of the LNG business to Honeywell means that Air Products will no longer receive revenues from this segment, potentially impacting future revenue growth negatively.

- Concerns about economic activity in China, specifically the lack of significant growth forecast for the first quarter of fiscal year 2025, could constrain revenue growth if the situation does not improve as expected.

- The expected 60% completion of the NEOM green hydrogen project by the end of 2026 might raise questions about the risk of full capacity utilization by 2027, affecting future revenue projections.

- Existing regulatory and environmental challenges, especially relating to project permits in Louisiana and World Energy, can impede timely project execution, affecting future revenue or earnings growth.

- The strategic focus on clean hydrogen carries execution risk and significant upfront costs, which may lead to pressure on net margins before substantial market adoption and consistent revenue streams from these new ventures are realized.

Air Products and Chemicals Future Earnings and Revenue Growth

Assumptions

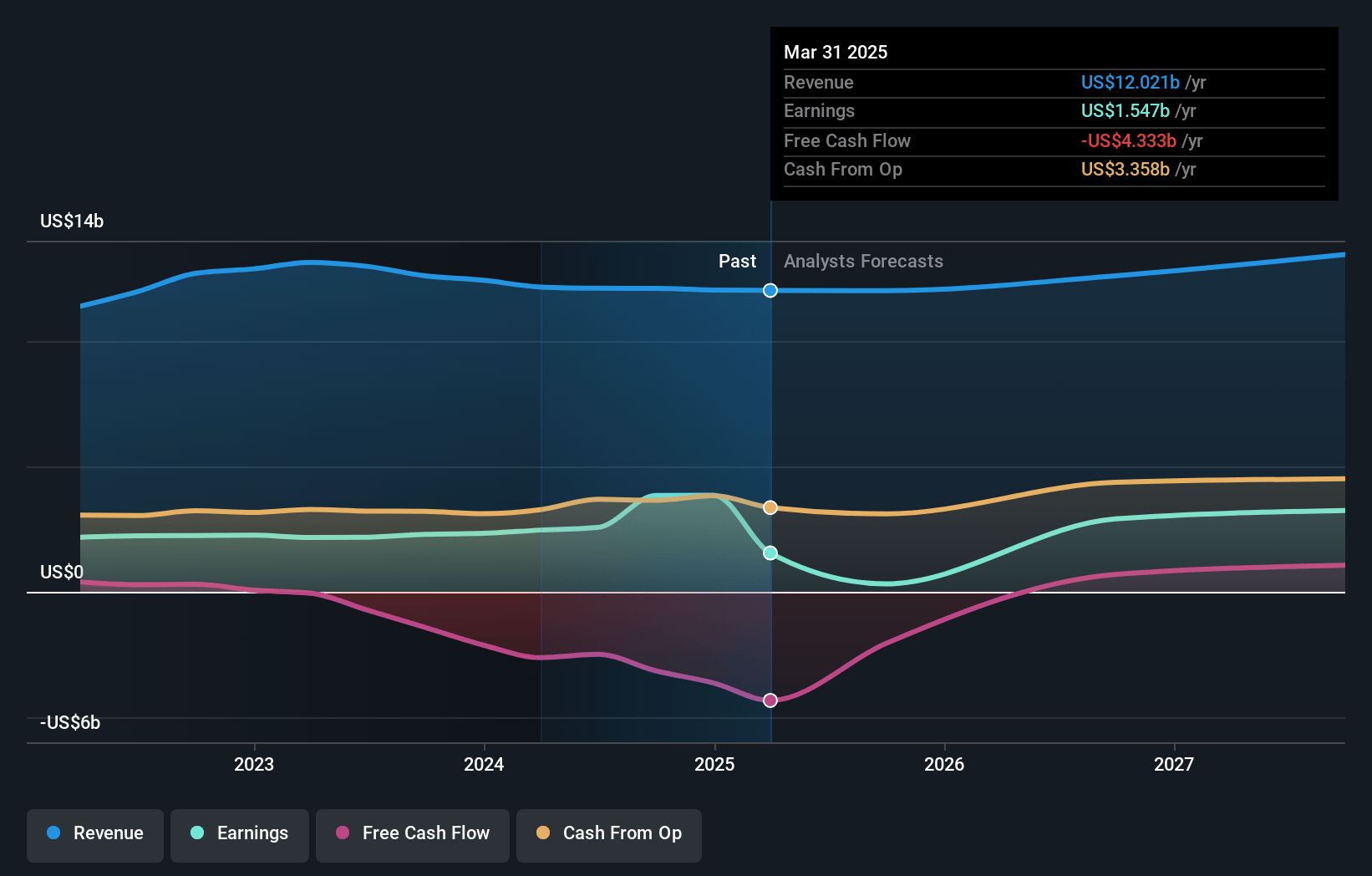

How have these above catalysts been quantified?- Analysts are assuming Air Products and Chemicals's revenue will grow by 6.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 31.8% today to 24.9% in 3 years time.

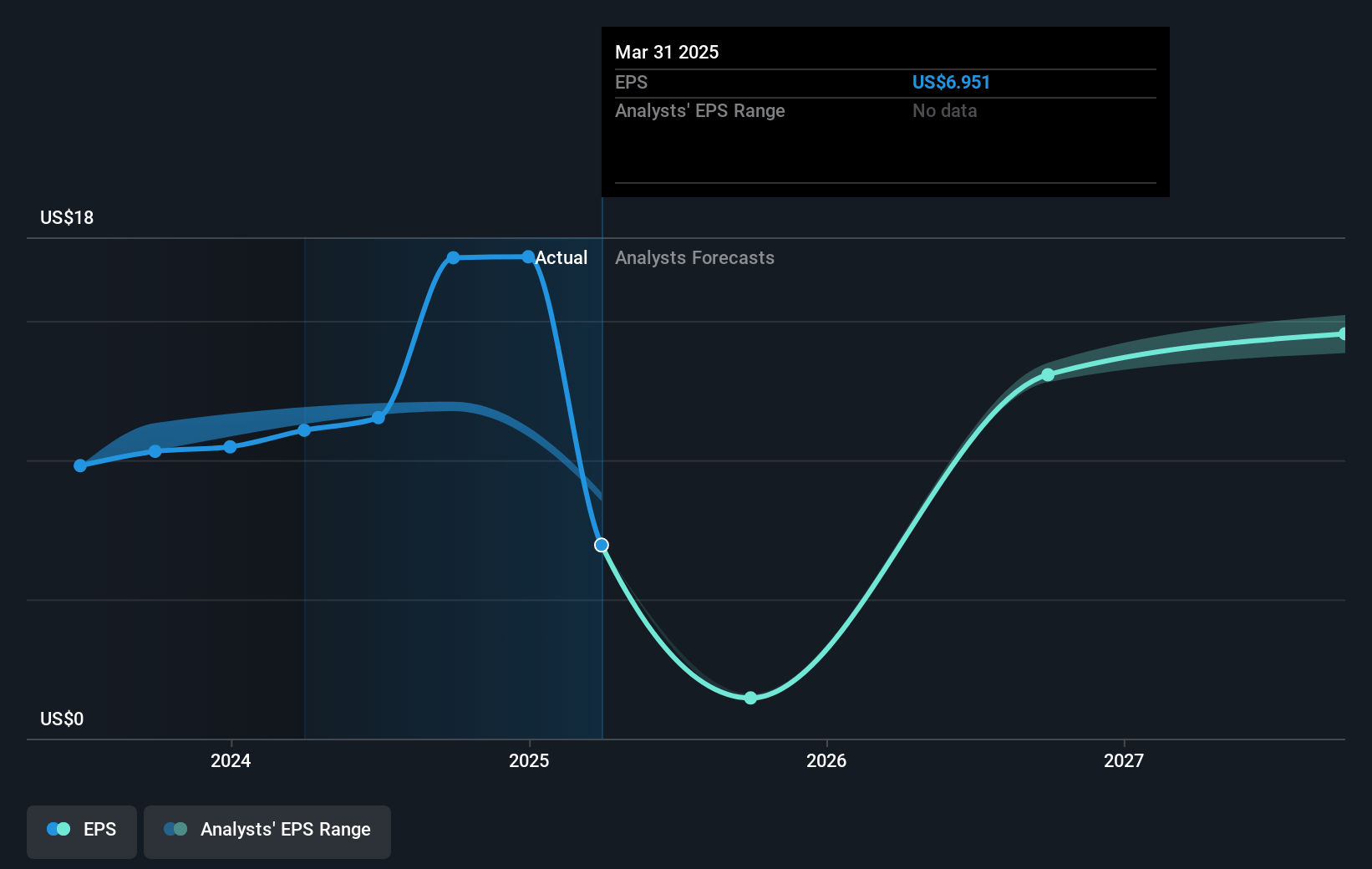

- Analysts expect earnings to reach $3.7 billion (and earnings per share of $16.34) by about January 2028, down from $3.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $3.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.1x on those 2028 earnings, up from 18.9x today. This future PE is greater than the current PE for the US Chemicals industry at 22.6x.

- Analysts expect the number of shares outstanding to grow by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

Air Products and Chemicals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Air Products achieved a 10% annual growth rate in adjusted earnings per share since 2014 and plans to continue this trajectory with EPS growth of 6% to 9% in fiscal year 2025. This strong historical performance could contribute positively to future earnings expectations.

- The divestiture of the LNG business is expected to be offset by improved margins and growth from smaller projects, indicating robust operating margin improvements of 350 basis points, which may support earnings stability and growth.

- Air Products' successful strategic moves include securing long-term supply agreements, like the one with TotalEnergies for green hydrogen, which indicates strong demand and potential revenue growth in the clean hydrogen sector.

- The company's sound financial management is evidenced by its ability to finance projects effectively, such as the NEOM green hydrogen project, which has been financed by 23 banks, mitigating financial risk and supporting potential future revenue streams.

- Air Products aims to consistently return cash to shareholders, as evidenced by 42 consecutive years of dividend growth and plans to return $1.6 billion in dividends in the current year, demonstrating strong cash flow and commitment to shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $350.71 for Air Products and Chemicals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $385.0, and the most bearish reporting a price target of just $290.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.7 billion, earnings will come to $3.7 billion, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of $327.0, the analyst's price target of $350.71 is 6.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives