Key Takeaways

- Strategic cost reductions and efficiency improvements are set to enhance margins and cash flow, positioning Alpha for financial flexibility and growth.

- Anticipated mine development and market rebound could significantly boost production and revenue as demand stabilizes in key sectors.

- Soft market conditions and operational challenges have reduced revenues and profitability, with potential decreases in production and earnings due to market and environmental pressures.

Catalysts

About Alpha Metallurgical Resources- A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

- Alpha Metallurgical Resources is expecting to reduce costs significantly in 2025 through a combination of reduced purchase coal costs, improved pricing on supplies and maintenance, and reduced sales-related expenses. These actions could enhance net margins.

- The company is developing the Kingston Wildcat mine, anticipating significant production starting in 2026. This new Low-Vol mine has the potential to contribute additional revenue as market demand stabilizes.

- Despite difficult market conditions, Alpha is maintaining a strong liquidity position with no long-term debt, enabling continued investment in projects and providing financial flexibility for future earnings growth.

- Alpha's efforts in sourcing and operational efficiency have helped reduce sustaining CapEx, potentially leading to improved cash flow and earnings as they capitalize on internal capabilities.

- While currently navigating oversupply in the High-Vol coal market, Alpha is positioned to take advantage of any potential rebound in steel demand in 2025 and beyond, which could drive revenue growth.

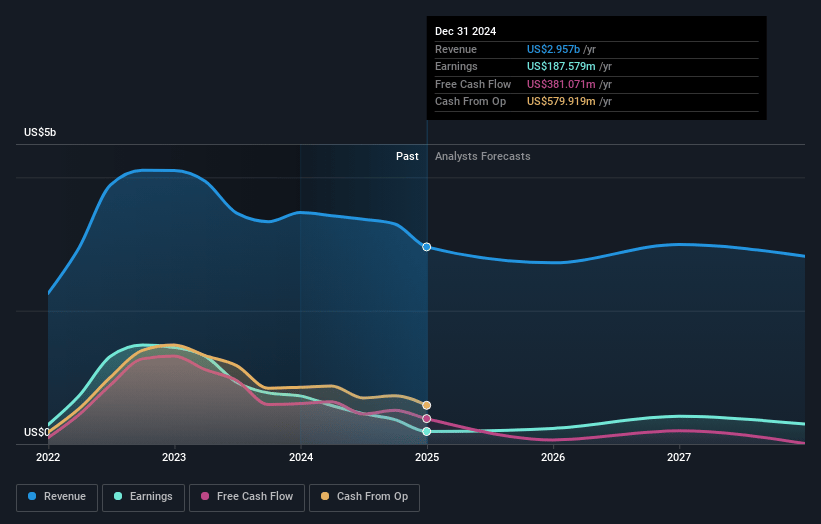

Alpha Metallurgical Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alpha Metallurgical Resources's revenue will decrease by -6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 11.1% today to 13.7% in 3 years time.

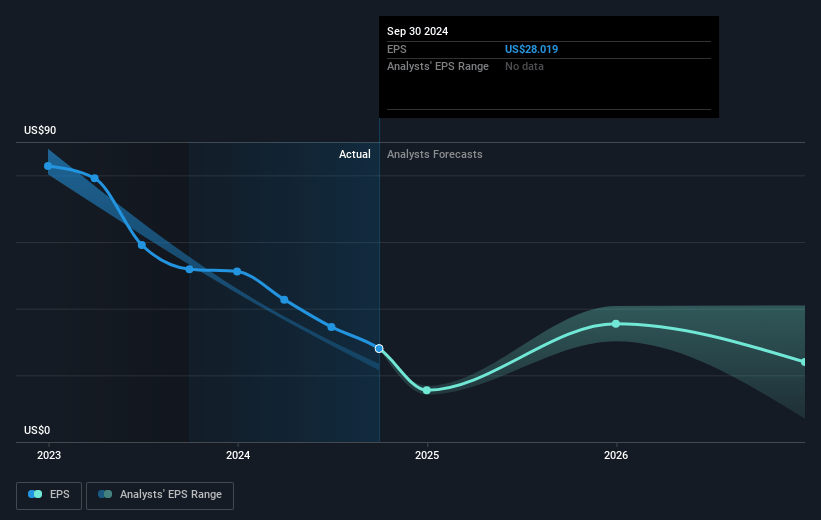

- Analysts expect earnings to reach $369.8 million (and earnings per share of $28.72) by about January 2028, up from $365.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $536.3 million in earnings, and the most bearish expecting $86.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.2x on those 2028 earnings, up from 6.6x today. This future PE is lower than the current PE for the US Metals and Mining industry at 16.5x.

- Analysts expect the number of shares outstanding to decline by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.01%, as per the Simply Wall St company report.

Alpha Metallurgical Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Decreased coal pricing and soft market conditions negatively impacted results, leading to reduced revenues and pressures on net margins.

- Difficult geology and weather-related issues have increased costs, potentially reducing earnings.

- Idling the Checkmate Powellton Mine due to unfavorable market conditions could decrease production and revenues.

- A projected decline in steel demand might continue to reduce met coal prices, affecting revenue and net margins.

- Oversupply in the High-Vol market may apply downward pressure on prices, impacting revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $332.0 for Alpha Metallurgical Resources based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $369.8 million, and it would be trading on a PE ratio of 13.2x, assuming you use a discount rate of 7.0%.

- Given the current share price of $184.53, the analyst's price target of $332.0 is 44.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives