Narratives are currently in beta

Key Takeaways

- New initiatives in steel and aluminum production and coating aim to enhance revenue, earnings, and product diversification by 2025.

- Commitment to sustainability may improve net margins through cost savings and green premiums.

- Declining steel prices and increased imports could pressure revenues and margins, while operational challenges and rising expenses may strain earnings.

Catalysts

About Steel Dynamics- Operates as a steel producer and metal recycler in the United States.

- The ramp-up of four new value-add flat-rolled steel coating lines is expected to bring a full earnings benefit in 2025, adding 1.1 million tons of higher-margin product diversification, which should improve future revenue and net margins.

- The Sinton, Texas facility improvements and increased utilization rates are expected to enhance production capabilities in 2025, potentially leading to increased revenue and improved earnings.

- The strategic investment in aluminum facilities aims for EBITDA positivity by the second half of 2025, with plans to operate at 75% capacity in 2026, suggesting future revenue growth and contribution to earnings.

- The company's commitment to sustainability and carbon reduction initiatives, such as the biocarbon project, positions it advantageously against peers, potentially leading to enhanced net margins through cost savings and green premiums.

- Expected support from public funding and moderating interest rates in 2025 may drive increased demand for steel and steel fabrication products, positively impacting revenue growth.

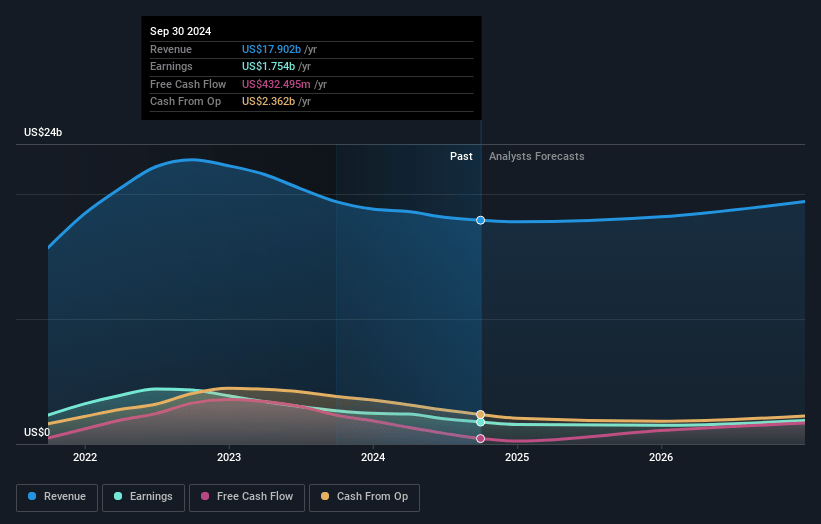

Steel Dynamics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Steel Dynamics's revenue will grow by 3.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.8% today to 10.1% in 3 years time.

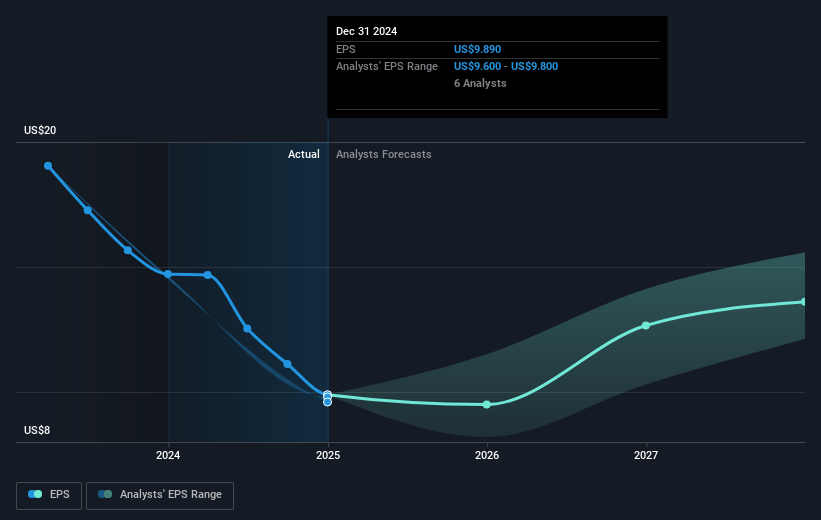

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $11.14) by about October 2027, up from $1.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.5 billion in earnings, and the most bearish expecting $1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2027 earnings, up from 11.6x today. This future PE is greater than the current PE for the US Metals and Mining industry at 14.8x.

- Analysts expect the number of shares outstanding to grow by 4.73% per year for the next 3 years.

- To value all of this in today's dollars, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Steel Dynamics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company experienced lower third quarter revenue compared to the previous quarter due to declines in realized flat-rolled steel pricing, which, if persistent, could impact future revenues.

- The steel metal spread contracted because of pricing declines that exceeded reductions in material costs, which could pressure net margins if such conditions persist.

- Sinton’s utilization challenges and slower post-maintenance ramp-up could constrain operational efficiency and profitability if not addressed, potentially affecting earnings.

- Increased steel imports have put pressure on domestic supply dynamics and steel pricing, which, if continued, could negatively impact revenue.

- Anticipated higher SG&A expenses related to aluminum investments could strain net earnings until these projects become EBITDA positive, impacting short-term financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $135.6 for Steel Dynamics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $19.5 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $131.8, the analyst's price target of $135.6 is 2.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives