Last Update 14 Dec 25

CENX: Supportive Trade Tariffs Will Drive Future Pricing Power And Upside

Analysts have raised their price target on Century Aluminum to $37 from $36, citing stronger than expected aluminum pricing driven by resilient China demand and the company’s leverage to supportive U.S. trade tariffs.

Analyst Commentary

Bullish Takeaways

- Bullish analysts highlight that recent aluminum prices have outpaced prior forecasts, supporting upward revisions to revenue and EBITDA expectations and justifying the higher price target.

- Resilient demand from China is seen as underpinning a more durable pricing backdrop, which could drive stronger volume and margin execution than previously modeled.

- The company’s meaningful leverage to 50% Section 232 tariffs on aluminum imports is viewed as a structural competitive advantage that supports premium valuation versus global peers.

- Initiation at an Overweight rating, coupled with a $37 price objective, signals confidence that earnings growth and cash flow generation can outpace the broader mining group over the medium term.

Bearish Takeaways

- Bearish analysts caution that weakness in U.S. and EU industrial activity may limit demand growth outside China, creating execution risk if domestic and European end markets remain soft.

- Reliance on favorable trade policy is viewed as a potential overhang, as any shift in Section 232 tariffs could compress margins and challenge the current valuation premium.

- Elevated expectations for aluminum pricing leave less room for error, raising the risk of multiple compression if prices normalize faster than anticipated.

- Concentration in a cyclical commodity sector leaves earnings highly sensitive to macro downturns, which could delay realization of the projected upside to the $37 target.

What's in the News

- President Trump reversed a Biden-era rule that had tightened copper smelter emissions limits, granting a two year compliance exemption. This move could ease regulatory pressure on metals producers broadly, including Century Aluminum (Reuters).

- Century Aluminum reported a significant operational disruption at its Grundartangi plant in Iceland after an electrical equipment failure, temporarily cutting production capacity to about one third and impacting key logistics partner Eimskip's transport volumes (company announcement).

- The company extended its power agreement with Santee Cooper to secure long term electricity supply for the Mt. Holly smelter through 2031. The deal underpins a planned $50 million investment to restart idle capacity, add 50,000 metric tons of output, and create over 100 new jobs by 2026 (company announcement).

- Century Aluminum disclosed that during the latest quarter it executed no additional share repurchases, while confirming completion of its long running buyback program with a total of about 7.2 million shares repurchased for $86.27 million since its 2011 authorization (company filing).

Valuation Changes

- Fair Value: Unchanged at $36.00 per share, reflecting stable long term intrinsic value assumptions.

- Discount Rate: Risen slightly from 8.57% to 8.62%, implying a modestly higher required return and risk premium.

- Revenue Growth: Effectively unchanged, ticking up marginally from 7.53% to 7.53%, indicating steady top line expectations.

- Net Profit Margin: Essentially flat, moving minimally from 19.22% to 19.22%, suggesting no meaningful change in margin outlook.

- Future P/E: Edged up slightly from 7.33x to 7.34x, signaling a small increase in the implied valuation multiple for forward earnings.

Key Takeaways

- Expansion of U.S. production and operational efficiency improvements position the company to benefit from rising demand and favorable market conditions.

- Government incentives and strong end-market trends support revenue growth, margin expansion, and enhanced financial flexibility for future initiatives.

- Heavy reliance on favorable market conditions, government support, and stable input costs exposes the company to significant operational, regulatory, and competitive risks that threaten profitability.

Catalysts

About Century Aluminum- Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

- The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production, capturing rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections-supporting future revenue growth and improved fixed cost absorption, thus enhancing net margins.

- Expected sustained tightness in global primary aluminum supply (with China near capacity caps and minimal new ex-China projects) should maintain favorable pricing levels and strong Midwest premiums, especially as U.S. demand rebounds from infrastructure and electrification trends, providing a tailwind for top-line growth and improved EBITDA.

- The company's investments in operational efficiency-evident in safety initiatives and planned capital improvements, such as the Jamalco steam turbine upgrade-support further margin expansion by lowering energy and operating costs, translating into stronger future earnings.

- Continued momentum in end-market demand (especially value-added products like billets for transportation electrification and the growing use of aluminum in clean energy and sustainable packaging) is driving higher premiums and increased shipment volumes, directly benefiting revenue visibility and margin expansion.

- Receipt of substantial U.S. manufacturing tax credits (45X credits) tied to domestic production volumes-expected to grow with the Mt. Holly restart and potential new smelter-should significantly enhance future free cash flow and net income, providing financial flexibility for additional growth initiatives.

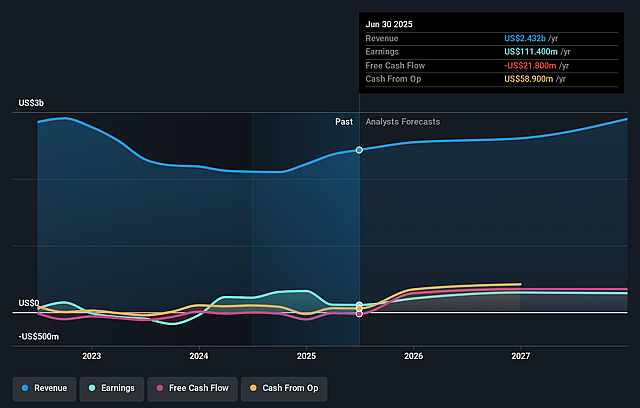

Century Aluminum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Century Aluminum's revenue will grow by 7.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 15.8% in 3 years time.

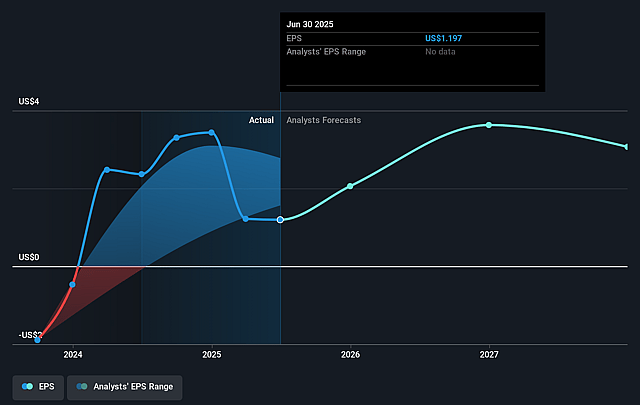

- Analysts expect earnings to reach $479.3 million (and earnings per share of $3.88) by about September 2028, up from $111.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, down from 18.2x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

Century Aluminum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Century's financial performance and positive outlook are currently heavily dependent on high U.S. Midwest aluminum premiums and the continued effectiveness of Section 232 tariffs; a future policy change-such as removal or lowering of tariffs-would likely reduce domestic premiums and demand, pressuring both revenues and net margins.

- The company's ambitious investment in expanding production capacity at Mt. Holly and planning a new smelter exposes it to significant execution risk, including potential delays or cost overruns, which could materially increase capital expenditures and reduce free cash flow and overall profitability.

- Century remains highly exposed to volatility in raw material and energy costs (like alumina, coke, power), with periods of elevated or unpredictable prices capable of sharply increasing operating expenses and compressing EBITDA margins-particularly given the energy-intensive nature of its smelting operations.

- Dependence on government incentives and industrial power contracts (e.g., with Santee Cooper at Mt. Holly) introduces uncertainty; changes to these incentives, power availability/cost, or regulatory frameworks could negatively affect long-term cost structures and erode net margins.

- Weakening premiums and sluggish demand in the European market, ongoing currency headwinds, and continued global competition from low-cost producers (especially from China and the Middle East) create long-term risks of margin compression and lower revenue growth abroad, making Century's global earnings less predictable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.0 for Century Aluminum based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $479.3 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $21.74, the analyst price target of $27.0 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Century Aluminum?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.