Last Update04 Sep 25

As both consensus revenue growth and net profit margin forecasts for Markel Group remain steady, analysts have left their price target unchanged at $1931.

What's in the News

- Repurchased 49,140 shares (0.39%) for $90.45 million in Q2 2025, completing repurchase of 194,494 shares (1.52%) for $351.23 million under the current buyback program.

- Launched "Undercover," a $200 million facility with Willis to provide tailored global cargo insurance covering geopolitical risks, minimizing coverage gaps and claims disputes.

Valuation Changes

Summary of Valuation Changes for Markel Group

- The Consensus Analyst Price Target remained effectively unchanged, at $1931.

- The Consensus Revenue Growth forecasts for Markel Group remained effectively unchanged, at 2.5% per annum.

- The Net Profit Margin for Markel Group remained effectively unchanged, at 11.10%.

Key Takeaways

- Decentralization, operational restructuring, and digital transformation aim to boost underwriting results, efficiency, and support higher long-term profitability in core specialty insurance.

- Expansion of non-insurance ventures and redeployment of freed capital improve earnings diversification, reduce volatility, and position for stable, compounded growth.

- Persistent legacy risks, operational challenges, and industry headwinds threaten profitability, revenue growth, and market position amid organizational changes and increasing competition.

Catalysts

About Markel Group- Through its subsidiaries, engages in the insurance business in the United States and internationally.

- The restructuring and re-segmentation of Markel's insurance operations, including decentralizing decision-making and aligning accountability with clear P&L ownership, is expected to drive expense efficiency and strengthen underwriting performance, likely improving overall net margins and earnings as operational improvements take hold.

- Exiting underperforming lines and moving the subscale, loss-making reinsurance business into runoff frees up capital for more profitable specialty insurance opportunities, while enabling a strategic focus on high-growth, high-demand specialty markets. This shift should enhance risk-adjusted ROE and support more stable long-term revenue and earnings growth.

- The expansion and success of Markel Ventures, marked by recurring cash flow from non-insurance businesses and recent contributions from new stable-growth units (like EPI and Valor), provide stronger earnings diversification and are expected to reduce volatility in consolidated net income and margins.

- Ongoing digital transformation-coupled with Markel's decentralization, autonomous business unit structure, and adoption of advanced analytics in risk assessment-is anticipated to result in superior risk selection, pricing accuracy, and improved loss ratios, driving better profitability and supporting future revenue expansion.

- The company's focus on allocating released capital-both from runoff businesses and growing investment income on reserves-into higher-return opportunities, including public equities and strategic acquisitions, is poised to accelerate intrinsic book value per share and long-term compounded earnings, especially as the specialty insurance and programs market expands alongside global asset growth.

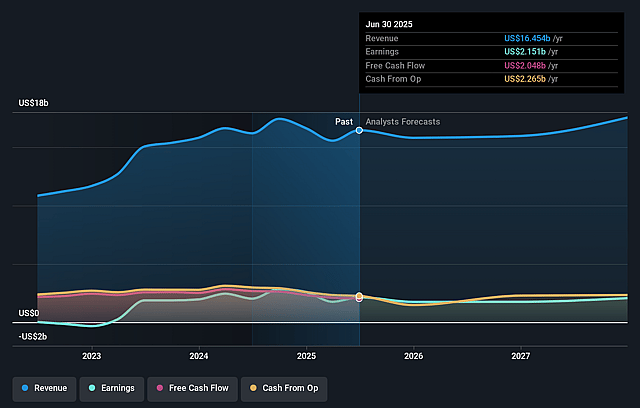

Markel Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Markel Group's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 13.1% today to 11.1% in 3 years time.

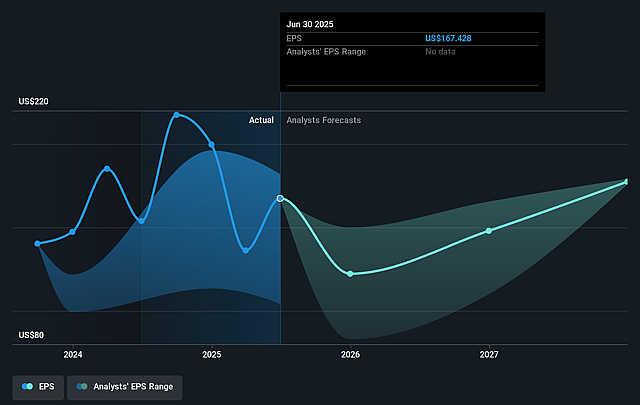

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $179.42) by about September 2028, down from $2.2 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 11.3x today. This future PE is about the same as the current PE for the US Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to decline by 1.64% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Markel Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant legacy exposure and ongoing reserve strengthening in discontinued lines (U.S. and European risk-managed D&O, Global Reinsurance, and CPI) suggest persistent risk of further adverse loss development or reserve deficiencies, which could negatively impact net earnings and combined ratios in future periods.

- The runoff and exit from the Global Reinsurance business will generate a gradual decline in gross written premiums and limit near-term revenue growth, while the full release of associated capital and earnings accretion from this move will not materialize for several years, potentially leading to a revenue and returns drag.

- Integration and management focus risks are heightened by the ongoing reorganization and decentralization of Markel Insurance and Ventures operations; if leadership cannot successfully execute, extract efficiencies, or maintain underwriting discipline, expense ratios may remain elevated, pressuring net margins and long-term profitability.

- The company remains exposed to industry-wide secular headwinds such as escalating litigation (particularly social inflation in casualty and D&O), intensifying regulatory oversight, and potential increases in capital requirements, all of which could further elevate loss costs, compliance expenses, or constrain capital available for growth and shareholder returns.

- Specialty market segments targeted by Markel may become increasingly commoditized or attract larger, better-capitalized competitors and insurtech disruptors, leading to downward pressure on pricing and market share-risking slower revenue growth and margin compression over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $1931.2 for Markel Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $17.7 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1928.85, the analyst price target of $1931.2 is 0.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.