Last Update26 Mar 25Fair value Decreased 2.16%

Key Takeaways

- Investment in growth and car insurance expansion may pressure net margins short-term but aims for long-term revenue and profitability gains.

- AI and strategic underwriting could improve efficiency despite initial costs, while a focus on achieving positive EBITDA may strain near-term margins.

- Lemonade's focus on AI-driven efficiency, market diversification, and expansion in car and pet insurance supports growth and profitability while enhancing revenue diversity and stability.

Catalysts

About Lemonade- Provides various insurance products in the United States, Europe, and the United Kingdom.

- Lemonade plans a significant increase in growth spending for 2025 to accelerate in-force premium (IFP) growth, which is expected to impact expenses and potentially net margins negatively before efficiency gains and revenue growth catch up.

- The expansion strategy for Lemonade's car insurance product, including a focus on cross-selling to existing customers and leveraging telematics, is anticipated to require upfront investment before delivering expected revenue and profitability growth.

- Increasing operational efficiencies through AI integration and cautious underwriting in response to environmental events like the California wildfires may buffer gross loss ratios but could not immediately improve net earnings due to the associated costs.

- Lemonade's path to profitability includes focusing on achieving positive EBITDA by the end of 2025, suggesting a near-term focus on operating expense management, which could put pressure on net margins until these efficiencies are realized.

- Potential lag in car insurance market penetration due to measured market release could temporarily constrain revenue growth compared to competitors, impacting earnings until expansions are fully realized over the next few years.

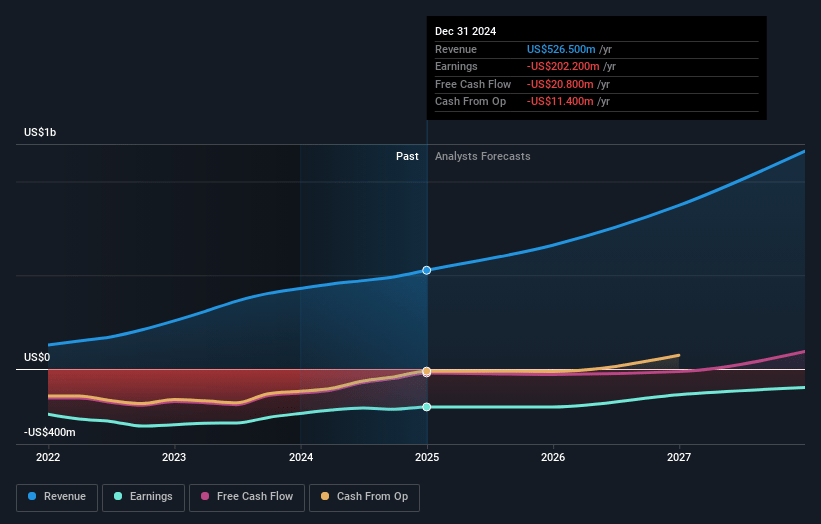

Lemonade Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lemonade's revenue will grow by 29.6% annually over the next 3 years.

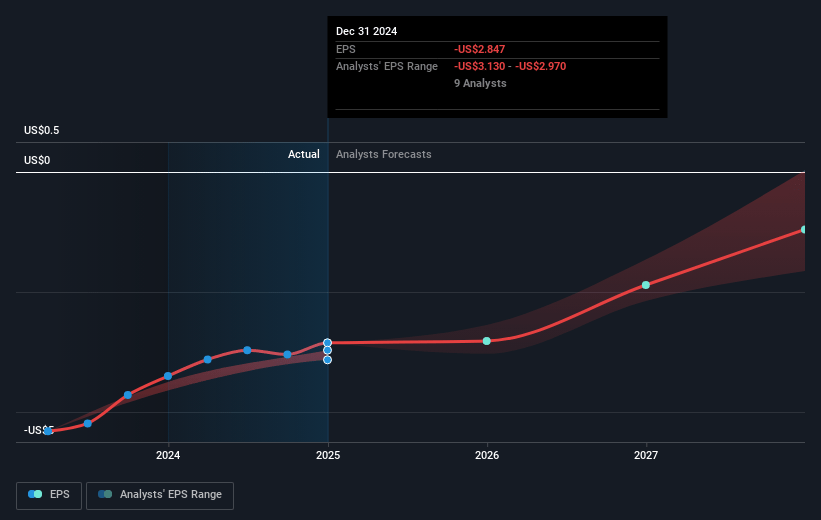

- Analysts are not forecasting that Lemonade will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Lemonade's profit margin will increase from -38.4% to the average US Insurance industry of 9.7% in 3 years.

- If Lemonade's profit margin were to converge on the industry average, you could expect earnings to reach $111.5 million (and earnings per share of $1.39) by about March 2028, up from $-202.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, up from -13.2x today. This future PE is greater than the current PE for the US Insurance industry at 14.1x.

- Analysts expect the number of shares outstanding to grow by 3.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Lemonade Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lemonade demonstrated strong adjusted free cash flow in 2024 and expects to maintain positive cash flow and improve EBITDA throughout 2025, driven by accelerating in-force premium (IFP) growth and efficient operational scaling. This supports its financial stability and potential for revenue growth and improved earnings.

- The successful reduction of the gross loss ratio to 63% in Q4 2024, alongside effective management of reinsurance during the California wildfires, showcases Lemonade's ability to enhance net margins through improved underwriting and risk mitigation strategies.

- Lemonade's strategic focus on expanding its car insurance business, leveraging advanced telematics technology for precision pricing, positions it to capture a larger market share efficiently, potentially boosting revenue and enhancing profitability long-term.

- Continued growth in the pet insurance line, along with geographic diversification, such as increasing the presence in European markets, contributes to Lemonade's revenue diversity, reducing dependency on a single market segment and enhancing growth potential.

- Lemonade's investment in AI-driven efficiency and technological development could enable sustained growth without proportional increases in operational expenses, supporting stable net margins and long-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.857 for Lemonade based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $111.5 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 6.2%.

- Given the current share price of $36.62, the analyst price target of $29.86 is 22.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.